Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Save Homework: Chapter 14 Homework 4 of 8 (5 complete) HW Score: 70%. 7 of 10 pt Score: 0 of 3 pts E14-21 (similar to)

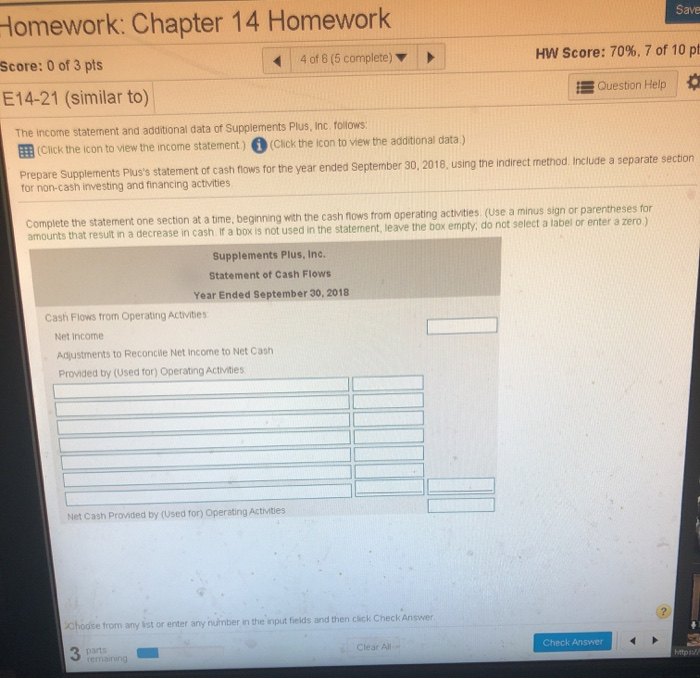

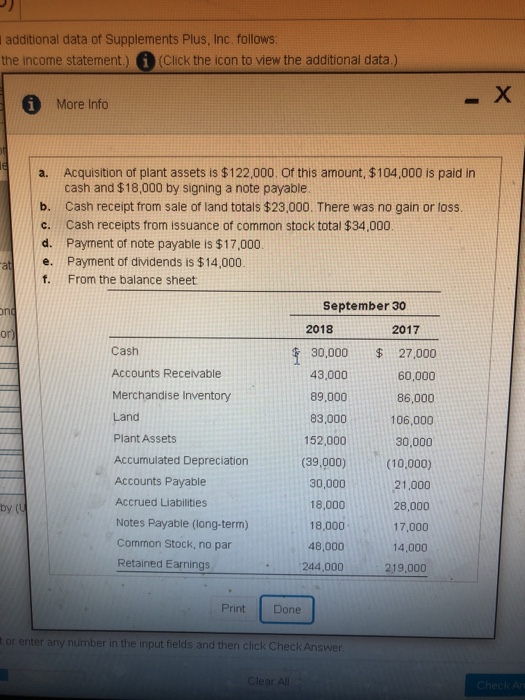

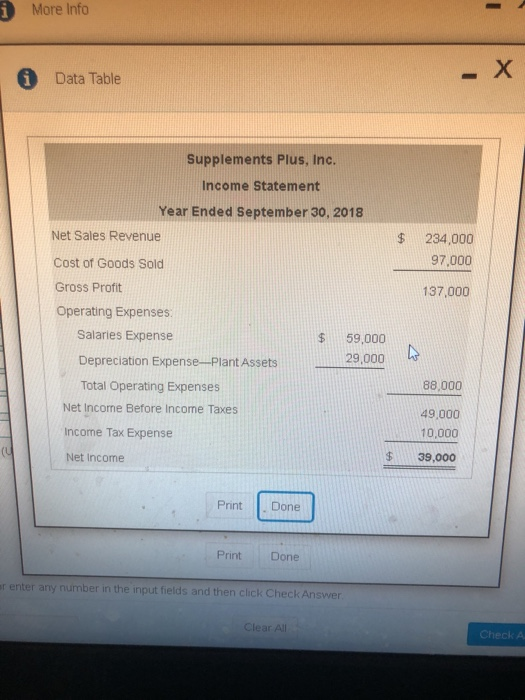

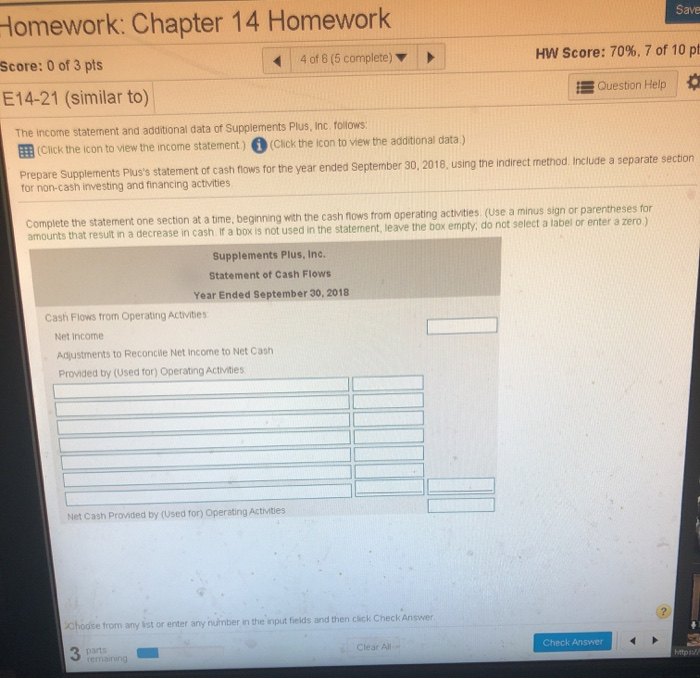

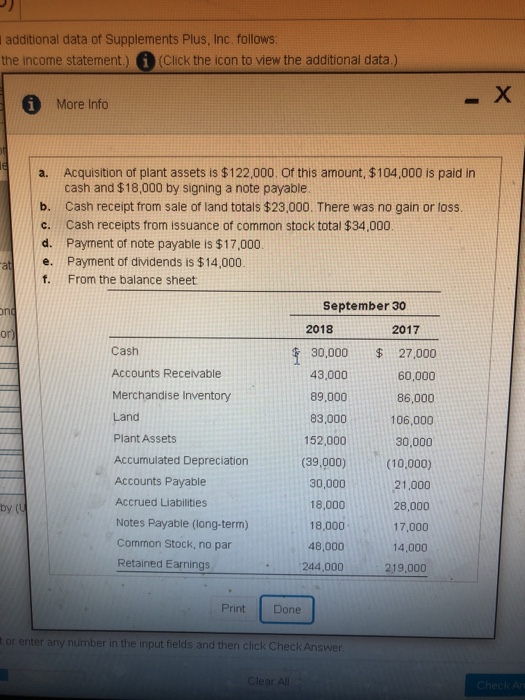

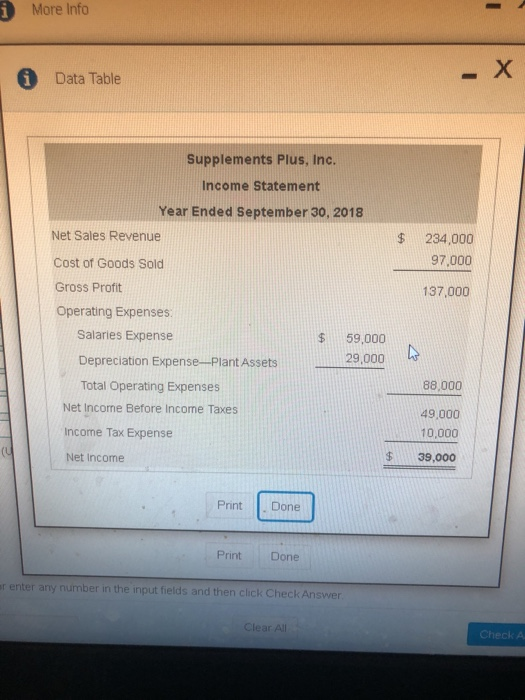

Save Homework: Chapter 14 Homework 4 of 8 (5 complete) HW Score: 70%. 7 of 10 pt Score: 0 of 3 pts E14-21 (similar to) Question Help The income statement and additional data of Supplements Plus, Inc follows: Click the icon to view the income statement) (Click the icon to view the additional data.) Prepare Supplements Plus's statement of cash flows for the year ended September 30, 2018, using the Indirect method. Include a separate section for non-cash investing and financing activities Complete the statement one section at a time, beginning with the cash flows from operating activities (Use a minus sign or parentheses for amounts that result in a decrease in cash. If a box is not used in the statement, leave the box empty, do not select a label or enter a zero ) Supplements Plus, Inc. Statement of Cash Flows Year Ended September 30, 2018 Cash Flows from Operating Activities Net income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for Operating Activities Net Cash Provided by (Used for) Operating Activities Choose from any est or enter any number in the input fields and then click Check Answer Clear All Check Answer 3 parts remaining additional data of Supplements Plus, Inc. follows: the income statement.) i (Click the icon to view the additional data.) More Info 1 a. C. at Ong on) Acquisition of plant assets is $122,000. Of this amount, $104,000 is paid in cash and $18,000 by signing a note payable b. Cash receipt from sale of land totals $23,000. There was no gain or loss Cash receipts from issuance of common stock total $34,000. d. Payment of note payable is $17,000 e. Payment of dividends is $14,000 f. From the balance sheet September 30 2018 2017 Cash $ 30,000 $ 27,000 Accounts Receivable 43,000 60,000 Merchandise Inventory 89,000 86,000 Land 83,000 106,000 Plant Assets 152,000 30,000 Accumulated Depreciation (39,000) (10,000) Accounts Payable 30,000 21,000 Accrued Liabilities 18,000 28,000 Notes Payable (long-term) 18,000 17,000 Common Stock, no par 48,000 14,000 Retained Earnings 244,000 219,000 by co Print Done tor enter any numb in the input fields and then click Check Answer Clear All Check Ar i More Info - i Data Table - X Supplements Plus, Inc. Income Statement Year Ended September 30, 2018 Net Sales Revenue 234,000 97,000 Cost of Goods Sold Gross Profit 137,000 59,000 29,000 w Operating Expenses Salaries Expense Depreciation Expense_Plant Assets Total Operating Expenses Net Income Before Income Taxes Income Tax Expense 88,000 49,000 10,000 39,000 Net Income $ Print Done Print Done ar enter any number in the input fields and then click Check Answer Clear All Check A

Save Homework: Chapter 14 Homework 4 of 8 (5 complete) HW Score: 70%. 7 of 10 pt Score: 0 of 3 pts E14-21 (similar to) Question Help The income statement and additional data of Supplements Plus, Inc follows: Click the icon to view the income statement) (Click the icon to view the additional data.) Prepare Supplements Plus's statement of cash flows for the year ended September 30, 2018, using the Indirect method. Include a separate section for non-cash investing and financing activities Complete the statement one section at a time, beginning with the cash flows from operating activities (Use a minus sign or parentheses for amounts that result in a decrease in cash. If a box is not used in the statement, leave the box empty, do not select a label or enter a zero ) Supplements Plus, Inc. Statement of Cash Flows Year Ended September 30, 2018 Cash Flows from Operating Activities Net income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for Operating Activities Net Cash Provided by (Used for) Operating Activities Choose from any est or enter any number in the input fields and then click Check Answer Clear All Check Answer 3 parts remaining additional data of Supplements Plus, Inc. follows: the income statement.) i (Click the icon to view the additional data.) More Info 1 a. C. at Ong on) Acquisition of plant assets is $122,000. Of this amount, $104,000 is paid in cash and $18,000 by signing a note payable b. Cash receipt from sale of land totals $23,000. There was no gain or loss Cash receipts from issuance of common stock total $34,000. d. Payment of note payable is $17,000 e. Payment of dividends is $14,000 f. From the balance sheet September 30 2018 2017 Cash $ 30,000 $ 27,000 Accounts Receivable 43,000 60,000 Merchandise Inventory 89,000 86,000 Land 83,000 106,000 Plant Assets 152,000 30,000 Accumulated Depreciation (39,000) (10,000) Accounts Payable 30,000 21,000 Accrued Liabilities 18,000 28,000 Notes Payable (long-term) 18,000 17,000 Common Stock, no par 48,000 14,000 Retained Earnings 244,000 219,000 by co Print Done tor enter any numb in the input fields and then click Check Answer Clear All Check Ar i More Info - i Data Table - X Supplements Plus, Inc. Income Statement Year Ended September 30, 2018 Net Sales Revenue 234,000 97,000 Cost of Goods Sold Gross Profit 137,000 59,000 29,000 w Operating Expenses Salaries Expense Depreciation Expense_Plant Assets Total Operating Expenses Net Income Before Income Taxes Income Tax Expense 88,000 49,000 10,000 39,000 Net Income $ Print Done Print Done ar enter any number in the input fields and then click Check Answer Clear All Check A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started