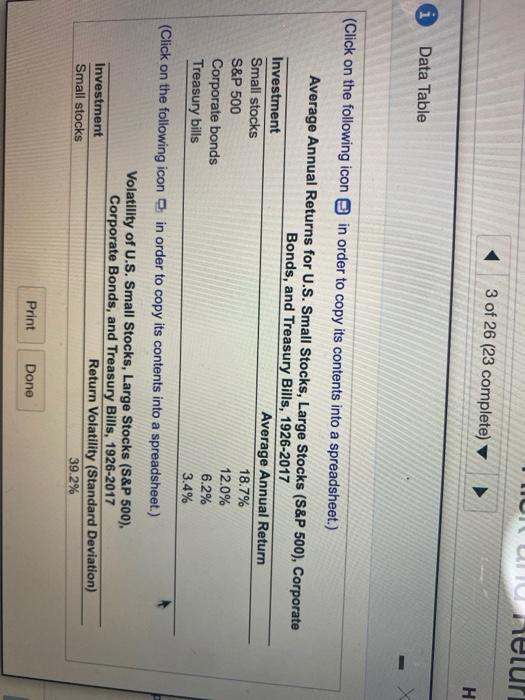

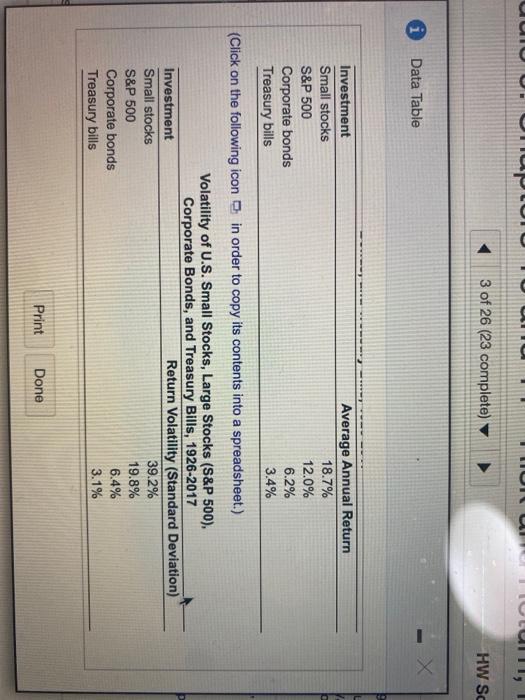

Save Homework: Module 9: Chapters 10 and 11 - Risk and Return, Po Score: 0 of 1 pt 3 of 20 (23 complete X P10-8 (similar to) HW Score: 82.05%, 21.33 of 26 pts Question Assume than historical returns and future returns are independently and identically distributed and drawn from the same distribution . Calculate the confidence intervals for the expected arvual return of four different treatments included in the table (the time period pas 7 years . Assume that the values in the tables are the the expected return and volatility,mated without ero) and that thereums are normally distributed. For each imate the probability that an investor will not lose more than 4% in the next year in Forech inwestment, you can use the function normal mearviolto complete proibita normally distributed variable with a given mean and volatility will send where in this case - Then subtracta probability from 100to find the protect the an we will not loe more than 4%) c. Do wl the probabilities you calculated in part (b) make sense so explain. If not, can you identity the reason Cattulate the confidence intervals for the expected annowrotum de tour offerent resiveria bcluded in the name we indushes, so the time pernod were w Lower Bound Upper Bound Round to two decimal places) Confidence interval for all stocks is se Enter your answer in the edit fields and then click Check Answer CAR bracy parts remaining Urneluri 3 of 26 (23 complete) H i Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Average Annual Returns for U.S. Small Stocks, Large Stocks (S&P 500), Corporate Bonds, and Treasury Bills, 1926-2017 Investment Average Annual Return Small stocks 18.7% S&P 500 12.0% Corporate bonds 6.2% Treasury bills 3.4% (Click on the following icon in order to copy its contents into a spreadsheet.) Investment Small stocks Volatility of U.S. Small Stocks, Large Stocks (S&P 500), Corporate Bonds, and Treasury Bills, 1926-2017 Return Volatility (Standard Deviation) 39.2% Print Done IU HUIUI IULUI, 3 of 26 (23 complete) HW SC i Data Table Investment Small stocks S&P 500 Corporate bonds Treasury bills Average Annual Return 18.7% 12.0% 6.2% 3.4% (Click on the following icon in order to copy its contents into a spreadsheet.) Volatility of U.S. Small Stocks, Large Stocks (S&P 500). Corporate Bonds, and Treasury Bills, 1926-2017 Investment Return Volatility (Standard Deviation) Small stocks 39.2% S&P 500 19.8% Corporate bonds 6.4% Treasury bills 3.1% Print Done