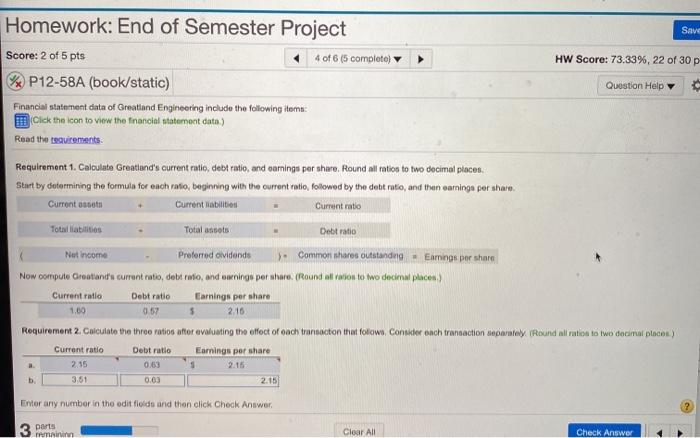

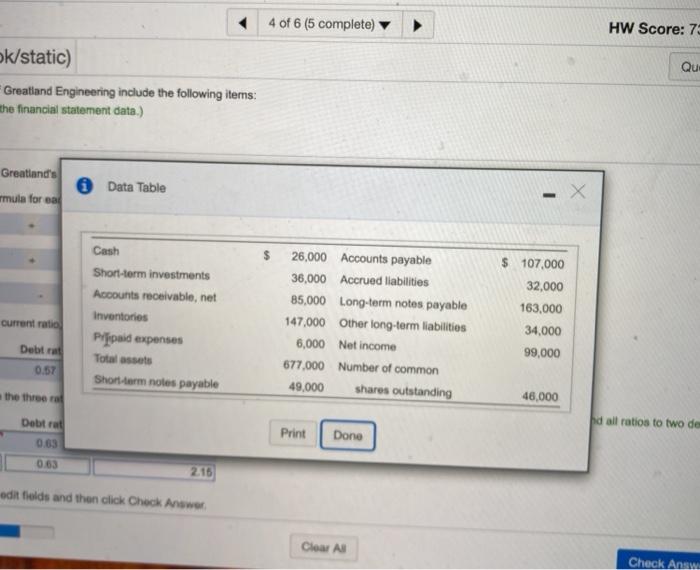

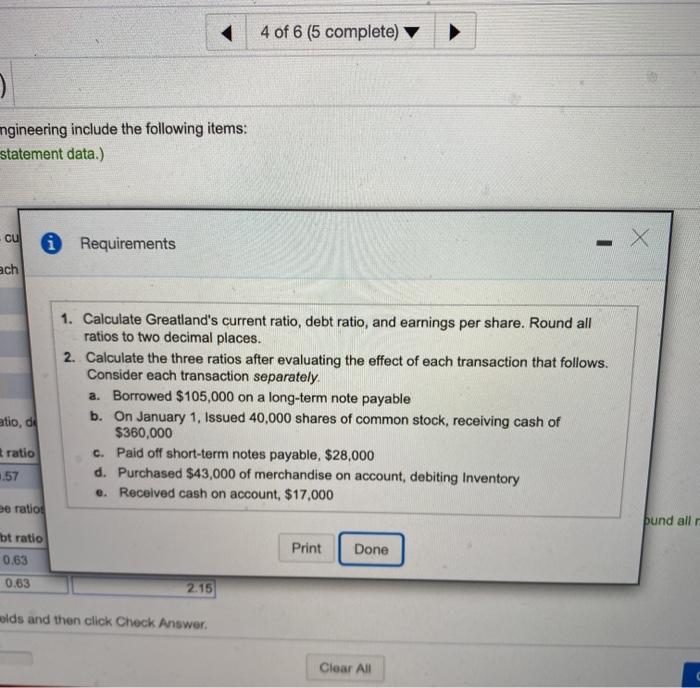

Save HW Score: 73.33%, 22 of 30 p Question Help Homework: End of Semester Project Score: 2 of 5 pts 4 of 6 (5 complete) P12-58A (book/static) Financial statement data of Greatland Engineering include the following items: Click the icon to view the financial statement data.) Read the requirements Requirement 1. Calculate Greatland's current ratio, debt ratio, and earnings per shuro Round all ration to two decimal places Start by determining the formula for each ratio, beginning with the current ratio, followed by the debt ratio, and then earnings per share. Current scots Current liabilities Current ratio Total abilities Total assets Debt ratio Not income Preferred dividends ). Common shares outstanding - Emines per share Now compute Croatiand'u current ratio, debt ratio, and earnings per share. (Round al valon to two decimal places Current ratio Debt ratio Earnings per share 1.00 0.57 2.16 Requirement 2. Calculate the three ratios after evaluating the effect of och transaction that follows. Consider och transaction separately Round all ration to two decimal places) Current ratio Debt ratio Earnings per share 2.15 0.63 b. 3.51 0.63 2.15 Entor any number in the odit fields and then click Check Answer 3 parts Tunin Clear All Check Answer 4 of 6 (5 complete) HW Score: 73 Qu ok/static) Greatland Engineering include the following items: the financial statement data.) Greatland's mula for a 0 Data Table - Cash Short-term investments Accounts receivable, net Inventories Pripaid expenses Total assets Short-term notes payable current ratio 26,000 Accounts payable 36,000 Accrued liabilities 85,000 Long-term notes payable 147,000 Other long-term liabilities 6,000 Net income 677,000 Number of common 49,000 shares outstanding $ 107,000 32,000 163,000 34.000 99,000 Debra 0.57 the three rol 46,000 hd all ratios to two de Print Done Dobra 0.63 0.63 216 odit fields and then click Check Answer Clear A Check Answ 4 of 6 (5 complete) 5. mgineering include the following items: statement data) cu Requirements - ach 1. Calculate Greatland's current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places. 2. Calculate the three ratios after evaluating the effect of each transaction that follows. Consider each transaction separately. a. Borrowed $105,000 on a long-term note payable b. On January 1, Issued 40,000 shares of common stock, receiving cash of $360,000 c. Paid off short-term notes payable, $28,000 d. Purchased $43,000 of merchandise on account, debiting Inventory e. Received cash on account, $17.000 atio, o ratio .57 De ratio und all Print Done bt ratio 0.63 0.63 2.15 olds and then click Check Answer. Clear All