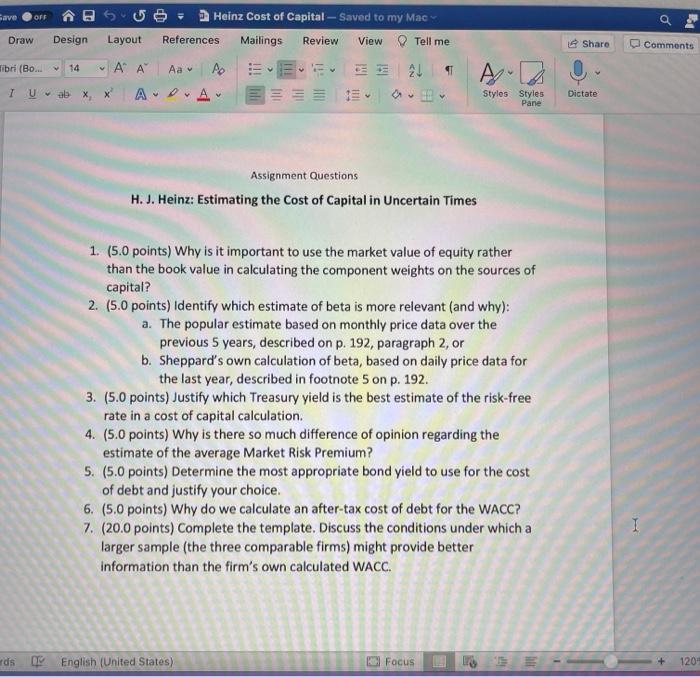

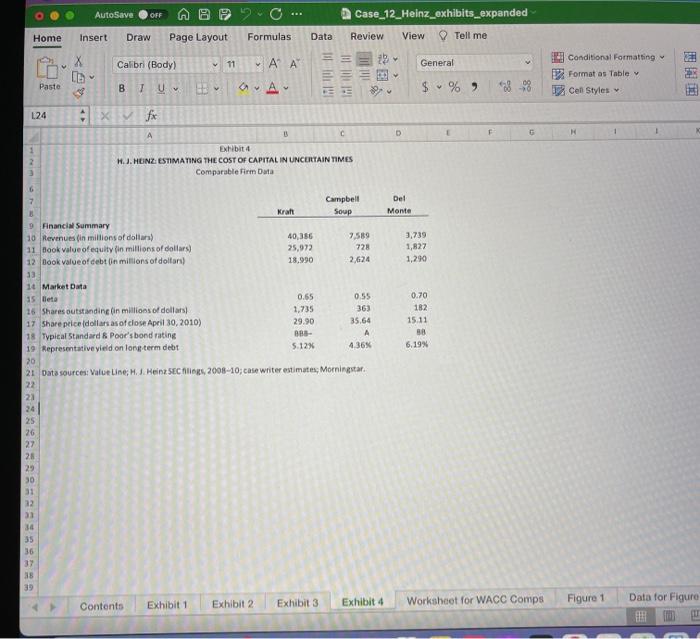

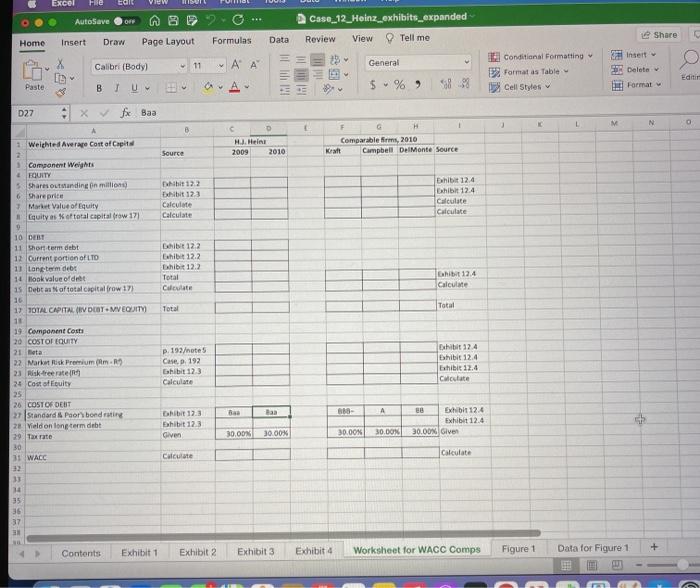

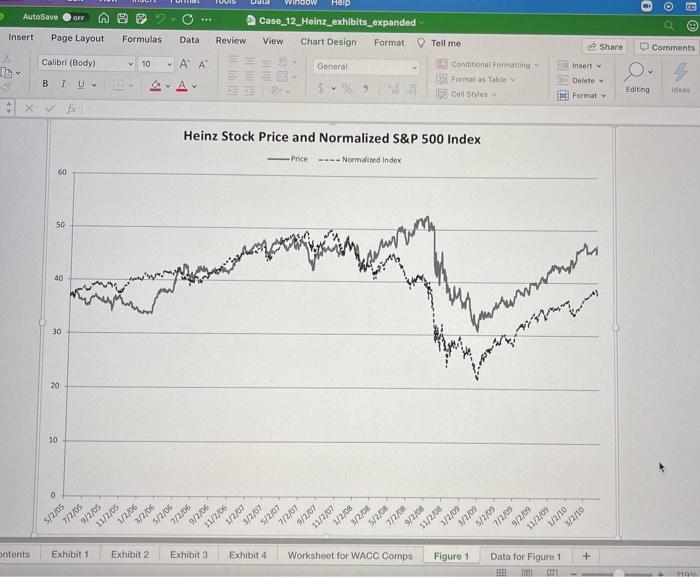

Save OFF a Heinz Cost of Capital - Saved to my Mac References Mailings Review View Tell me Draw Design Layout Share Comments libri (Bo... 14 ~A A A A A y A 1 U ab X X ADA V Styles Styles Pane Dictate Assignment Questions H. J. Heinz: Estimating the Cost of Capital in Uncertain Times 1. (5.0 points) Why is it important to use the market value of equity rather than the book value in calculating the component weights on the sources of capital? 2. (5.0 points) Identify which estimate of beta is more relevant (and why): a. The popular estimate based on monthly price data over the previous 5 years, described on p. 192, paragraph 2, or b. Sheppard's own calculation of beta, based on daily price data for the last year, described in footnote 5 on p. 192. 3. (5.0 points) Justify which Treasury yield is the best estimate of the risk-free rate in a cost of capital calculation. 4. (5.0 points) Why is there so much difference of opinion regarding the estimate of the average Market Risk Premium? 5. (5.0 points) Determine the most appropriate bond yield to use for the cost of debt and justify your choice. 6. (5.0 points) Why do we calculate an after-tax cost of debt for the WACC? 7. (20.0 points) Complete the template. Discuss the conditions under which a larger sample (the three comparable firms) might provide better information than the firm's own calculated WACC. ds English (United States) Focus 120 Excel AutoSave OFF Case_12_Heinz_exhibits_expanded Review View Tell me Home Insert Draw Page Layout Formulas Data Calibri = 11 X General Conditional Forma Format as Table Cell Styles Paste B I v A $ % ) 127 x D E H 2010 10,494,983 6.700,677 3,794,305 2.235,073 1.559,228 250,574 (18,200) 1,290.454 1 Exhibit 1 H.J. HEINZ ESTIMATING THE COST OF CAPITAL IN UNCERTAIN TIMES 3 Income Statement 4 (numbers in thousands except per share amounts: fiscal year ends in April) 5 6 2008 2009 7 Revenue 9,885,556 10,011,331 8 Costs of goods sold 6.233.420 6.442.075 9 Gross proft 3,652,136 3,569,256 10 11 SG&A expense 2,081 801 2,066,810 12 Operating income 1,570,335 1.502.446 13 14 Interest expense 323,289 275,485 15 Other income (expense) (16,283) 92.922 16 Income before taxes 1.230,763 1.319,883 17 18 Income taxes 372,587 375,483 19 Net income after takes 858,176 944,400 20 21 Adjustments to net income (13,251) 21,328) 22 Net income 844.925 923,072 23 24 Diluted EPS 2.61 2.89 25. Dividends per share 152 1.66 26 27 Data source: H. J. Heinz SEC filings, 2008-10. 28 29 30 31 32 33 34 35 36 37 358,514 931.940 157.048) 864,892 2.71 1.68 C Contents Exhibit 1 Exhibit 2 Exhibit 3 Exhibit 4 Worksheet for WACC Comps Figure 1 Dat AutoSave OFF Home Insert Draw Page Layout Formulas Case_12_Heinz_exhibits_expanded Data Review View Tell me 22 General $ % ) X Calibri (Body) 11 ' a.A 12 Conditional Formatting Format as Table Cell Styles Paste BIU L24 x fx C D F G 1 2 Exhibit 2 H. 1. HEINZ ESTIMATING THE COST OF CAPITAL IN UNCERTAIN TIMES Balance Sheet (numbers in thousands of dollars except per share amounts; iscal year ends in April) 5 2008 617,687 1,161,481 1,378,216 168,182 3,325,566 2009 373,145 1,171,797 1,237,613 162,466 2,945,021 2010 483,253 1,045,338 1,249,127 273,407 3,051,125 2,104,713 5,134,764 10,565,043 Cash 9 Net receivables 10 Inventories 11 Other current assets 12 Total current assets 13 14 Net fixed assets 15 Other noncurrent assets 16 Total assets 17 18 Accounts payable 19 Short-term debt 20 Current portion of long-term debt 21 Other current liabilities 22 Total current liabilities 23 24 Long-term debt 25 Other noncurrent liabilities 1,978,302 4,740,861 9.664,184 2,091,796 4932,790 10,075,711 1.247,479 124,290 328.418 969,873 2,670,060 1,113,307 61,297 4,141 883.901 2,067.846 1,129,514 43,853 15,167 986,825 2,175,359 4,730,946 1,276,217 6,007,163 5,076,186 1.246,047 6.322,233 4,559,152 1,392,704 5,951,856 1,887,820 10,565,043 1.279,105 9,564,184 1.948,496 10,075,711 27 28 Equity 29 Total liabilities and equity 30 31 Shares outstanding in millions of dollars) 32 33 Data source: H. J. Heinz SEC filings, 2008-10. 34 35 311.45 314.86 317.69 37 Contents Exhibit 1 Exhibit 2 Exhibit 3 Exhibit 4 Worksheet for WACC Comps Figure 1 Data for Figure 1 Excel File Edit View Insert Format Tools AutoSave OFF