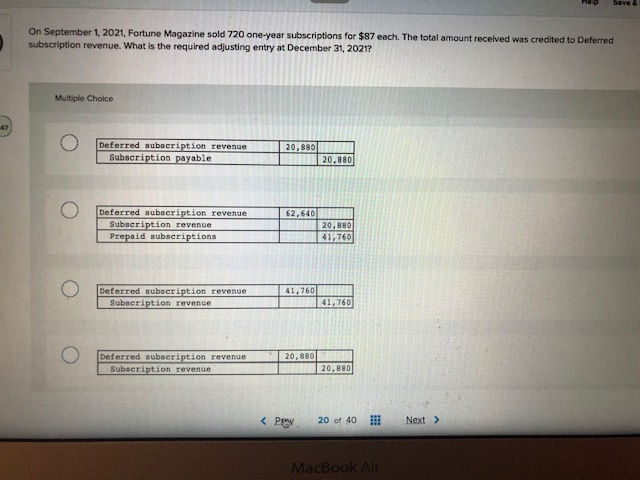

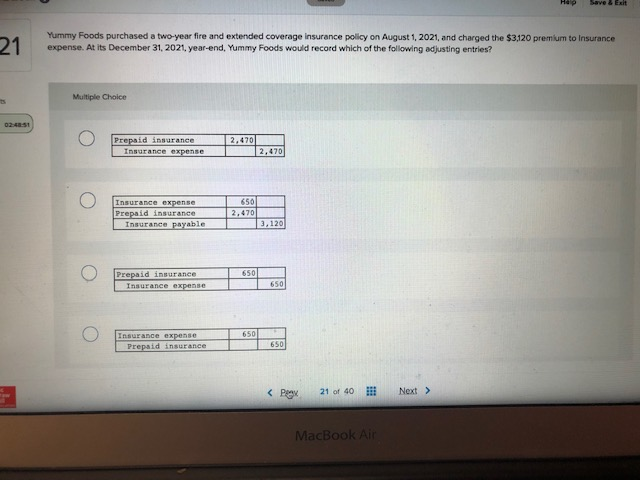

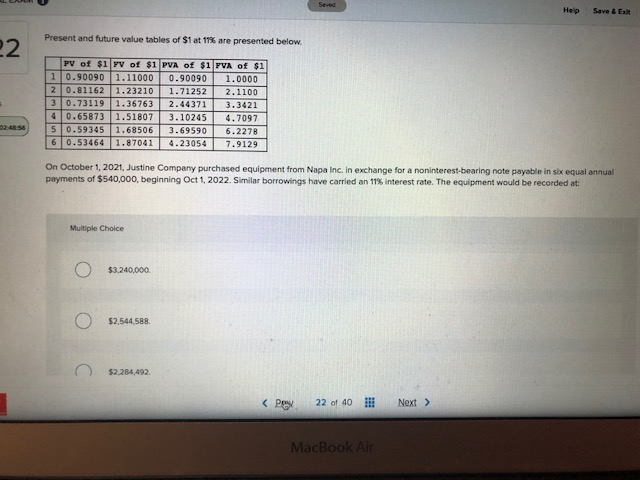

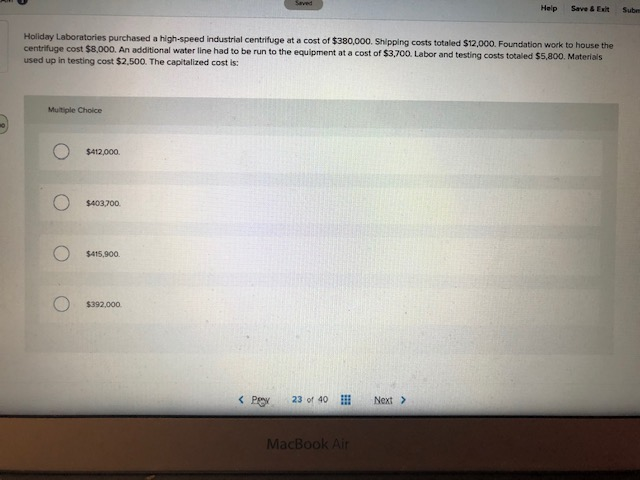

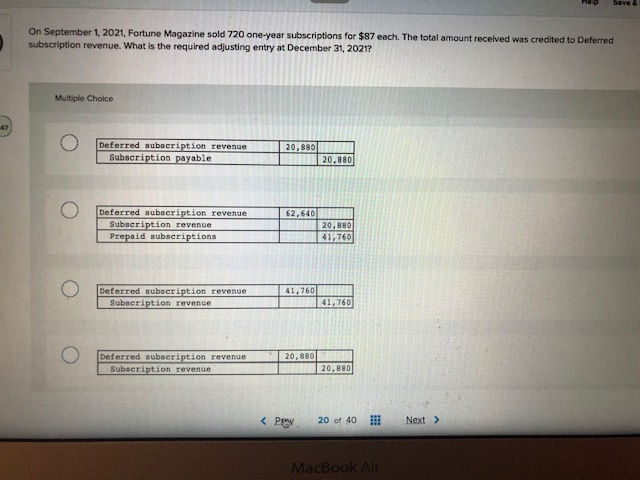

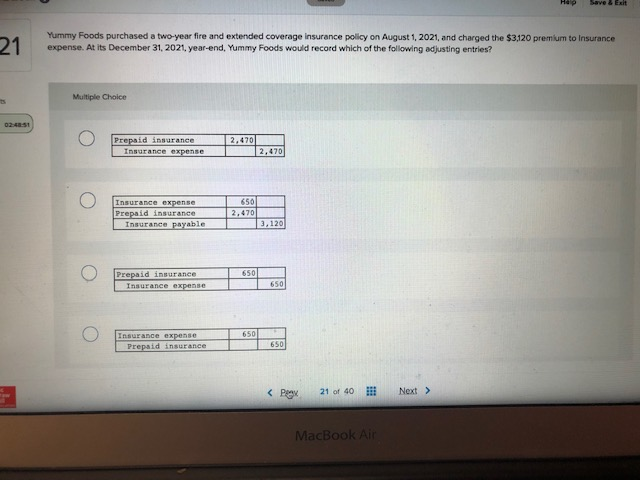

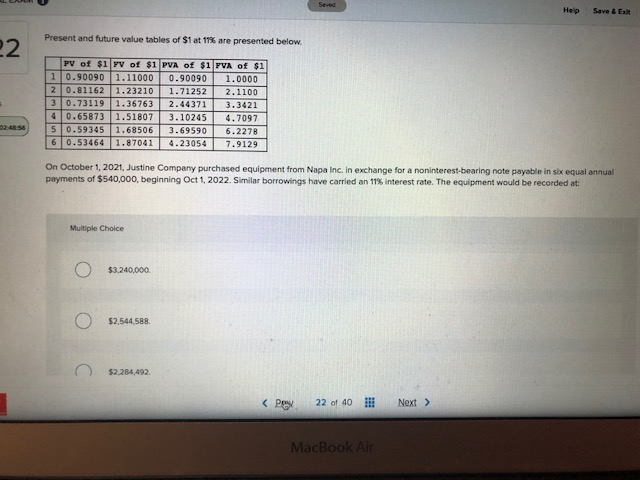

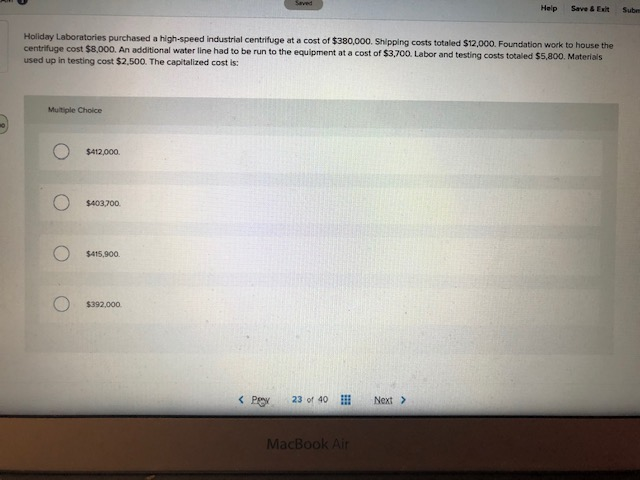

Save & On September 1, 2021, Fortune Magazine sold 720 one-year subscriptions for $87 each. The total amount received was credited to Deferred subscription revenue. What is the required adjusting entry at December 31, 2021? Multiple Choice 20,880 Deferred subscription revenue Subscription payable 20.880 62,640 Deferred subscription revenue Subscription revenue Prepaid subscriptions 20,880 41,760 41.760 Deferred subscription revenue Subscription revenue 41,760 Deferred subscription revenue Subscription revenue 20,880 20,880 MacBook Air Hep 21 Yummy Foods purchased a two-year fire and extended coverage Insurance policy on August 1, 2021, and charged the $3,120 premium to Insurance expense. At its December 31, 2021, year-end, Yummy Foods would record which of the following adjusting entries? Multiple Choice 2.470 Prepaid insurance Insurance expense 2,470 Insurance expense Prepaid insurance Insurance payable 650 2,4701 3,120 650 Prepaid insurance Insurance expense 650 650 Insurance expense Prepaid insurance 6 SO MacBook Air Srved Help Save & E Present and future value tables of $1 at 11% are presented below. 22 PV of $1 YV of $1 PVA of $1 PVA of $1 10.90090 1.11000 0.90090 1.0000 2 0.81162 1.23210 1.71252 2.1100 30.73119 1.36763 2.44371 3.3421 40.65873 1.51807 3.10245 4.7097 50.59345 1.68506 3.69590 6.2278 60.53464 1.87041 4.23054 7.9129 On October 1, 2021, Justine Company purchased equipment from Napa Inc. in exchange for a noninterest-bearing note payable in six equal annual payments of $540,000, beginning Oct 1, 2022. Similar borrowings have carried an 11% Interest rate. The equipment would be recorded at: Multiple Choice $3.240,000 $2,544,588 $2.284,492 MacBook Air Saved Help Save 6 Exit Sub Holiday Laboratories purchased a high-speed industrial centrifuge at a cost of $380,000. Shipping costs totaled $12,000. Foundation work to house the centrifuge cost $8,000. An additional water line had to be run to the equipment at a cost of $3,700. Labor and testing costs totaled $5,800. Materials used up in testing cost $2,500. The capitalized cost is: Multiple Choice $412,000 $403,700 O $415,900 $392.000 O MacBook Air