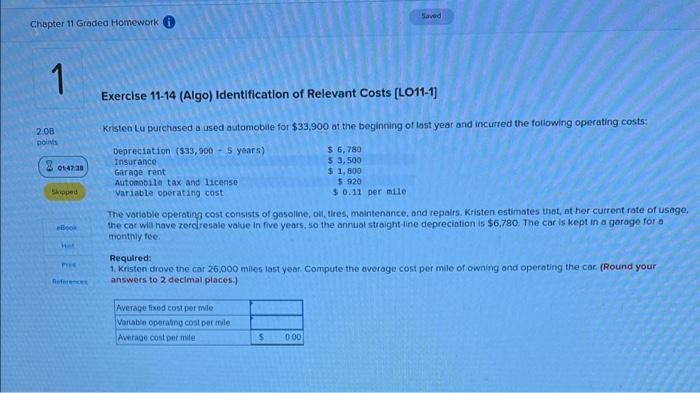

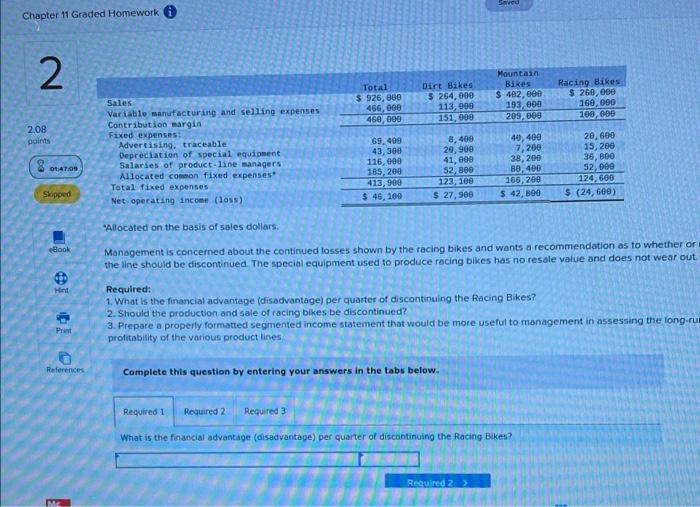

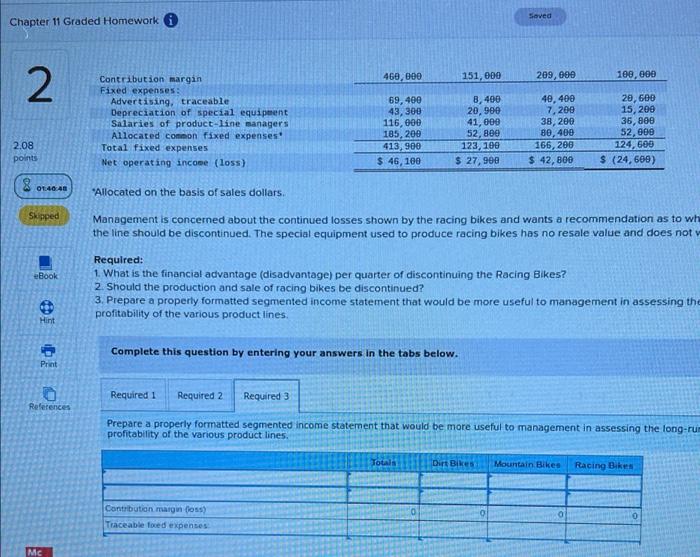

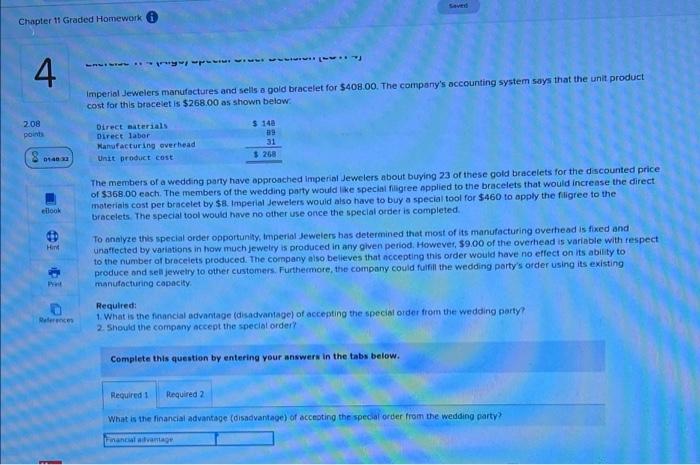

Saved Chapter 11 Gradea Homework 1 1 Exercise 11-14 (Algo) Identification of Relevant Costs [LO11-1) 20B polis Kristen Lu purchased a used automobile for $33,900 at the beginning of last year and incurred the following operating costs 014738 Depreciation (33,900 - 5 years) Insurance Garage rent Automobile tax and license Variable operating cost $ 6,780 5 3,500 $ 1,800 5920 $ 0.11 per mile Shipped Boo The votioble operating cost consists of gasoline, oll, tires, maintenance, and repairs. Kristen estimates that other current rate of usage, the car will have zerelresale value in five years, so the annual straight line depreciation is $6.780. The car is kept in a gorage for a monthly fee Required: 1. Kristen drove the car 26,000 miles last year. Compute the average cost per mile of owning and operating the car (Round your answers to 2 decimal places.) Average fixed cost per me Variable operating cost permite Average cost per mile $ 0.00 saved Chapter 11 Graded Homework 2 Total $ 926,000 466,000 460,000 Dirt Bikes $ 264,000 113, 900 151,000 Mountain Bikes $ 402,600 193,000 209,00 Racing Bikes $ 260,000 160,000 100,000 2.08 points Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product line managers Allocated common fixed expenses Total fixed expenses Net operating income (loss) 8 01.47.08 69, 409 43,300 116,000 185,200 413,900 $ 46, 100 8, 400 20,900 41,000 52,800 123, 100 $ 27,900 40,400 7,200 38,200 80,400 166,200 $ 42, BOO 20,600 15, 200 35,800 52,000 124, 600 $ (24,600) Slipped "Allocated on the basis of sales dollars. Book Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out. Hint Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 3. Prepare a property formatted segmented income statement that would be more useful to management in assessing the long-rum profitability of the various product lines Pent References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the financial advantage (disadvantage) per quarter of discontinu the Racing Bikes? Required 23 Seved Chapter 11 Graded Homework 468,000 151,000 209,000 2 100,000 Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product line managers Allocated common fixed expenses Total fixed expenses Net operating income (loss) 69,400 43,300 116,000 185,200 413,900 $ 46, 100 8,490 20,900 41,000 52,800 123, 100 $ 27,900 40,400 7,200 38,200 80,400 166, 200 $ 42,800 20,600 15, 200 35,800 52,000 124, 600 $ (24,600) 2.08 points 8 01:40:40 "Allocated on the basis of sales dollars. Skipped Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to wh the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not eBook Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the profitability of the various product lines. Hint Complete this question by entering your answe nswers in the tabs below. Print Required 1 Required 2 Required 3 References Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-rum profitability of the various product lines. Total Dirt Bikes Mountain Bike Racing Bikes Contribution margin (los) Traceable foed expenses MC Chapter 11 Graded Homework ... ---- 4 Imperial Jewelers manufactures and sells a gold bracelet for $408.00. The company's accounting system says that the unit product cost for this bracelet is $268.00 as shown below $ 148 208 points Direct baterials Direct labor Manufacturing overhead Unit product cost 31 $ 260 0140 The members of a wedding party have approached Imperial Jewelers about buying 23 of these gold bracelets for the discounted price of $368.00 each. The members of the wedding party would like special niligree applied to the bracelets that would increase the direct materials cost per bracelet by $8. Imperial Jewelers would also have to buy a special tool for $460 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed ellook Hint To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $9.00 of the overhead is variable with respect to the number of bracelets produced. The company also believes that accepting this order would have no effect on its ability to produce and sell jewelry to other customers. Furthermore, the company could fill the wedding party's order using its existing manufacturing capacity Required: 1. What is the financial advantage (disadvantage of accepting the special order from the wedding party 2. Should the company accept the special order? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the financial advantage (disadvantage) of accepting the special order from the wedding party Financial advantage