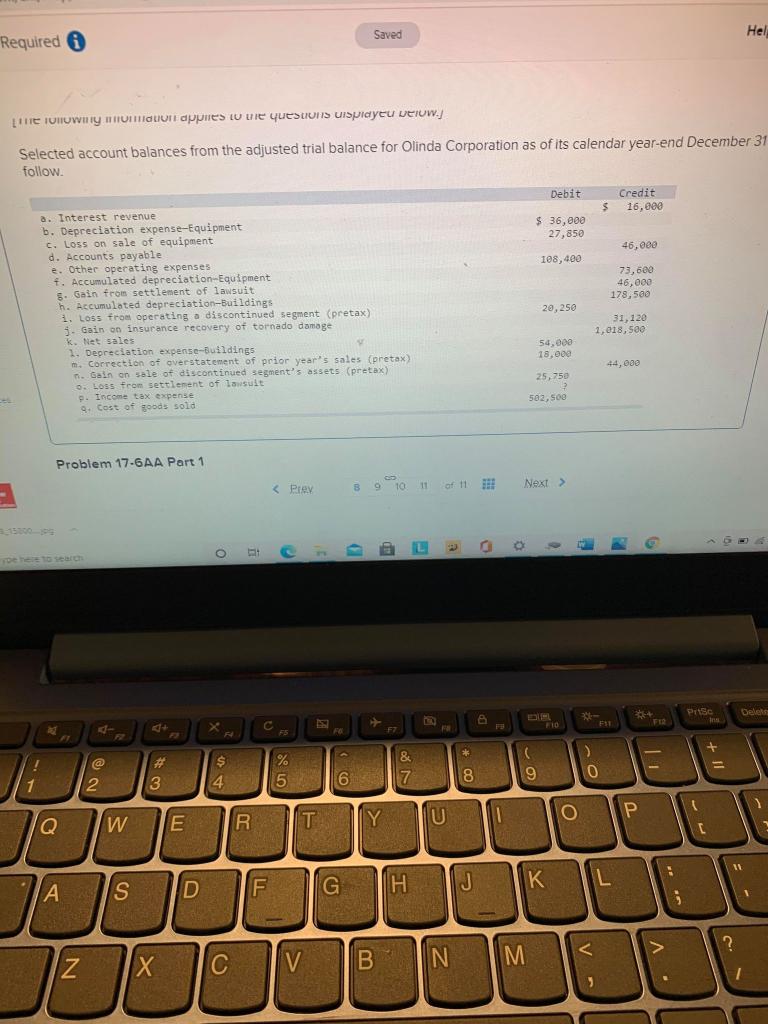

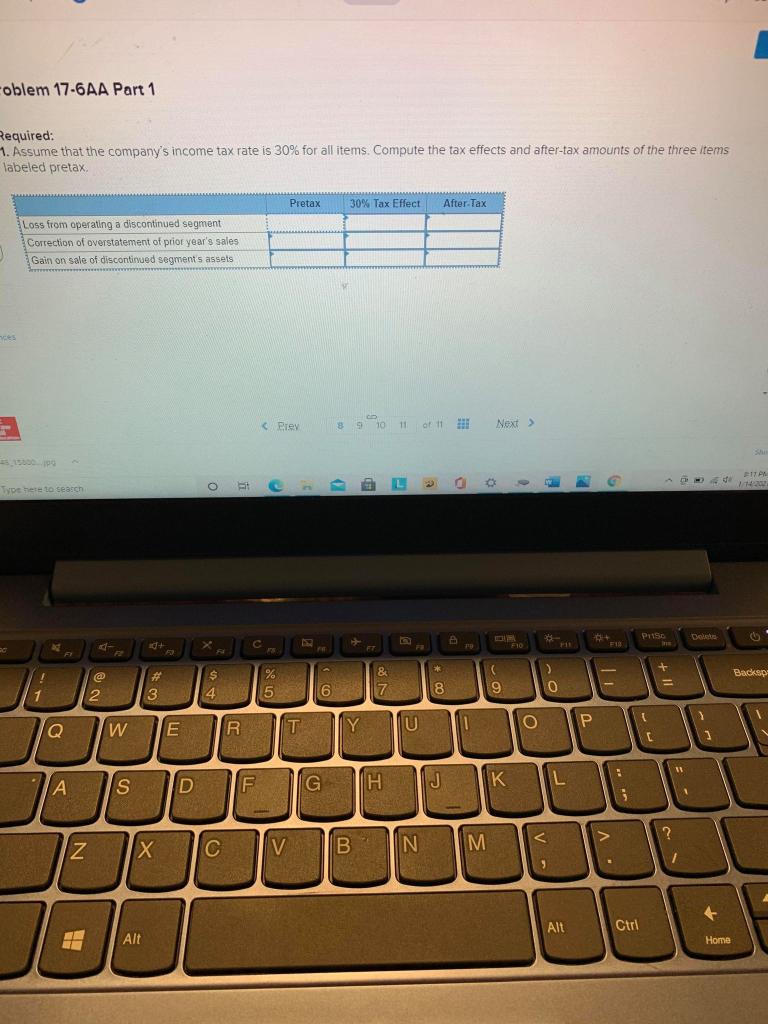

Saved Hel Required 0 THE TONOWNIE UITGLIUTI apues tu uit questions UiSpidyeu veuw. Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow Debit Credit 16,000 $ $36,000 27,850 46.ee 108,400 73,600 46,000 178,56 20,250 a. Interest revenue b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts payable e. Other operating expenses 1. Accumulated depreciation Equipment 8. Gain from settlement of lawsuit h. Accumulated depreciation-Buildings 1. Loss from operating a discontinued segment pretax) 5. Gain on insurance recovery of tornado damage k. Net sales 1. Depreciation expense-Buildings m. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segments assets (pretax) o. Loss from settlement of lawsuit 9. Income tax expense 9. Cost of goods sold 31,120 1,018,500 54.000 18.000 44,000 25,750 502, 500 Problem 17-6AA Part 1 Pic Delen FEE F F * a ! 1 + " $ 4 & 7 % 5 ( ( 9 0 8 2 3 6 O 1 Q U W E Y R T 11 D H J K IL AN S F ? N IX M V B IN va V oblem 17-6AA Part 1 Required: 1. Assume that the company's income tax rate is 30% for all items. Compute the tax effects and after-tax amounts of the three items labeled pretax Pretax 30% Tax Effect After Tax Loss from operating a discontinued segment Correction of overstatement of prior year's sales Gain on sale of discontinued segments assets PITA Type here to search Puso + - FB 20 TE F10 + $ % 5 Backsp ) o & 6 7 2 3 1 4 8 9 1 w Q O R T IY Y U S A.COM F D G H J K K IL D 1 ? Z C V B N M / 3 + Alt Ctrl HI Alt Home Saved Hel Required 0 THE TONOWNIE UITGLIUTI apues tu uit questions UiSpidyeu veuw. Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow Debit Credit 16,000 $ $36,000 27,850 46.ee 108,400 73,600 46,000 178,56 20,250 a. Interest revenue b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts payable e. Other operating expenses 1. Accumulated depreciation Equipment 8. Gain from settlement of lawsuit h. Accumulated depreciation-Buildings 1. Loss from operating a discontinued segment pretax) 5. Gain on insurance recovery of tornado damage k. Net sales 1. Depreciation expense-Buildings m. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segments assets (pretax) o. Loss from settlement of lawsuit 9. Income tax expense 9. Cost of goods sold 31,120 1,018,500 54.000 18.000 44,000 25,750 502, 500 Problem 17-6AA Part 1 Pic Delen FEE F F * a ! 1 + " $ 4 & 7 % 5 ( ( 9 0 8 2 3 6 O 1 Q U W E Y R T 11 D H J K IL AN S F ? N IX M V B IN va V oblem 17-6AA Part 1 Required: 1. Assume that the company's income tax rate is 30% for all items. Compute the tax effects and after-tax amounts of the three items labeled pretax Pretax 30% Tax Effect After Tax Loss from operating a discontinued segment Correction of overstatement of prior year's sales Gain on sale of discontinued segments assets PITA Type here to search Puso + - FB 20 TE F10 + $ % 5 Backsp ) o & 6 7 2 3 1 4 8 9 1 w Q O R T IY Y U S A.COM F D G H J K K IL D 1 ? Z C V B N M / 3 + Alt Ctrl HI Alt Home