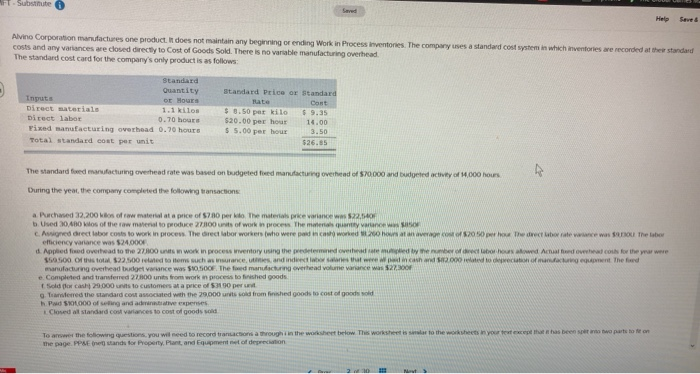

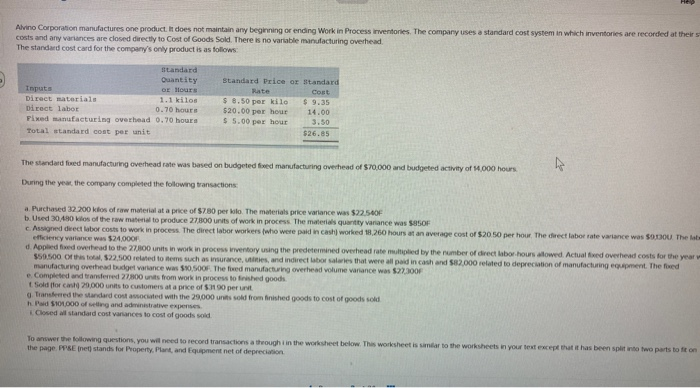

Saved Help Alvino Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at the standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead The standard cost card for the company's only product is as follows: Standard Quantity Inputs or Hours Direct materials 1.1 kilos Direct labor 0.70 hours Fixed manufacturing overhead 0.70 hours Total standard cont per unit Standard Price or Standard Rate Cost $ 3.50 per kilo $ 9.35 $20.00 per hour 14.00 $ 5.00 per hour 3.50 $26.95 The standard feed manufacturing overhead rate was based on budgeted fred manufacturing overhead of 570.000 and budgeted activity of 1,000 hours During the year, the company completed the following transactions a. Purchased 32,200 hos of water at a price of $7.00 per kilo The materials prevence 22.00 b Used 2040 os of the raw material to produce 2700 units of work in proces. The maternity news c. Assigned Grect labor costs to work in process. The direct labor workers who were perd cash worked how at av 20 50 hou e decorate wance was the labor efficiency variance was $24.000 d. Applied food overhead to the 27,800 w work in process inventory using the predetermined overed by emberboroud Achardove col for the year were 55000ths to $22.500 related to items such as insurance, time and indeed that were in cash and 12.000 led to comment. The fed manufacturing overhead budget wunce was $10.500F. The manufacturing overhead volume variance was $27.00 e. Completed and transferred 27.000 units from work in process to finished goods sold for cash 20,000 is to customers at a price of 531 90 per wered the standard counted with the 29.000 units sold from fished goods to cost of good hPod 500,000 of selling and administrative expenses Closed a standard cost variances to cost of goods sold To answer the following questions, you will need to record transactions through in the worksheet below this worksheet is to the worksheets in your teeth has been a part of the page. Prestands for Property, Plant and Equipment of depreciation HEP Alvino Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows: standard Quantity Inputs Dr Hours Direct materials 1.1 kilos Direct labor 0.70 hours Fixed manufacturing overhead 0.70 hours Total standard cost per unit Standard Price or standard Rate Cost $ 8.50 per kilo $ 9.35 $20.00 per hour 14.00 $ 5.00 per hour 3.50 $26.85 The standard fed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $70,000 and budgeted activity of 14,000 hours During the year, the company completed the following transactions a. Purchased 32.200 kilos of raw material at a price of $780 per kilo. The materials price variance was $22.540F b. Used 30480 kilos of the raw material to produce 27.000 units of work in process. The material quantity variance was SOF c. Assigned direct labor costs to work in process. The direct labor workers who were paid in cash worked 18,260 hours at an average cost of $20.50 per hour The direct labor rate variance was $obou The late efficiency variance was $24.000F d. Applied fed overhead to the 27.800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor hours allowed. Actual fred overhead costs for the year $50.500 of this total 522.500 related to items such as insurance, tities, and indirect laboratories that were all paid in cash and 582.000 related to depreciation of manufacturing equipment. The foed manufacturing overhead budget variance was $90.500F The feed manufacturing overhead volume variance was $27.300F e Completed and transferred 27,800 units from work in process to finished goods. Sold for cash 20,000 units to customers at a price of 5.11 90 per unit Transferred the standard cost asociated with the 29.000 units sold from finished goods to cost of goods sold P101000 of setting and administrative expenses Closed all standard cost variances to cost of goods sold To answer the following questions, you will need to record transactions a thought in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts tot on the page PPE net stands for Property. Plan and Equipment net of depreciation