Answered step by step

Verified Expert Solution

Question

1 Approved Answer

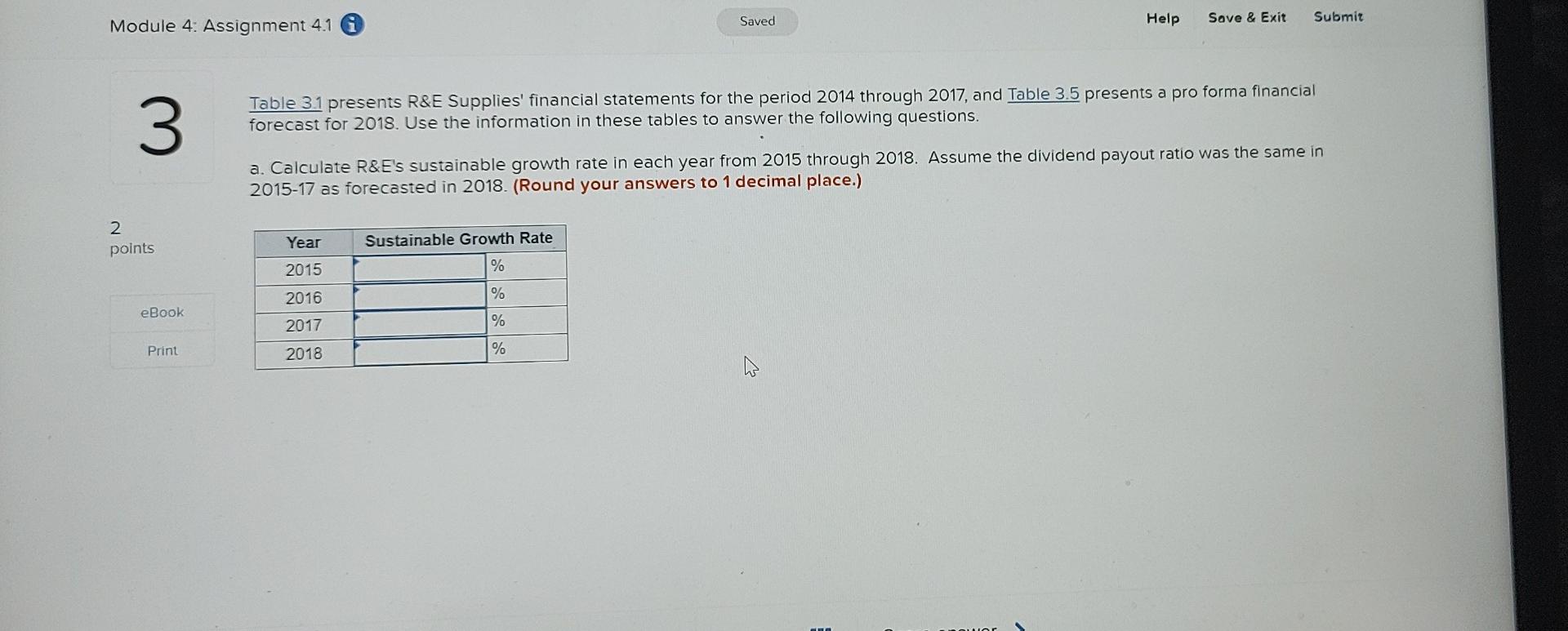

Saved Help Save & Exit Submit Module 4: Assignment 4.1 3 Table 3.1 presents R&E Supplies' financial statements for the period 2014 through 2017, and

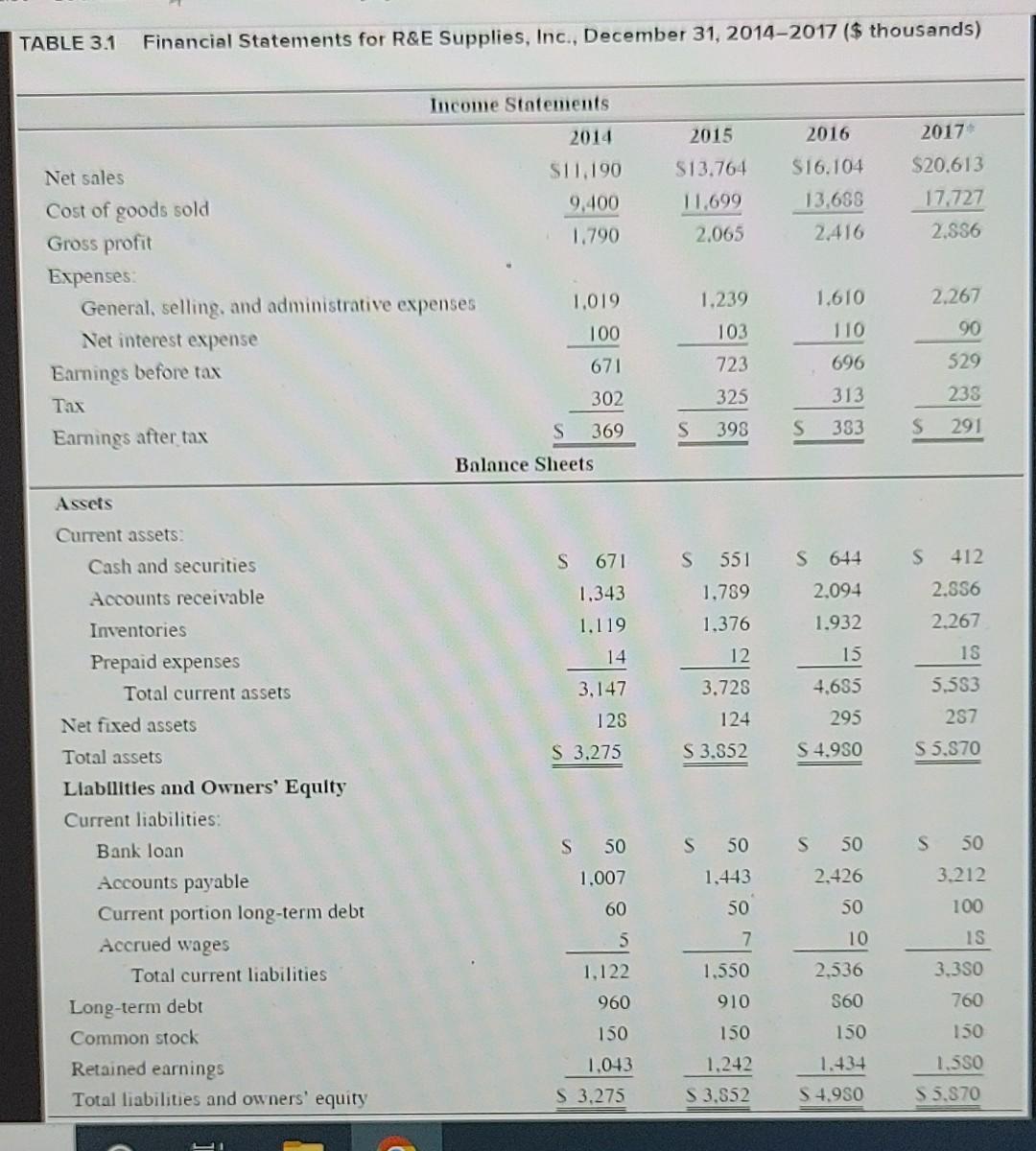

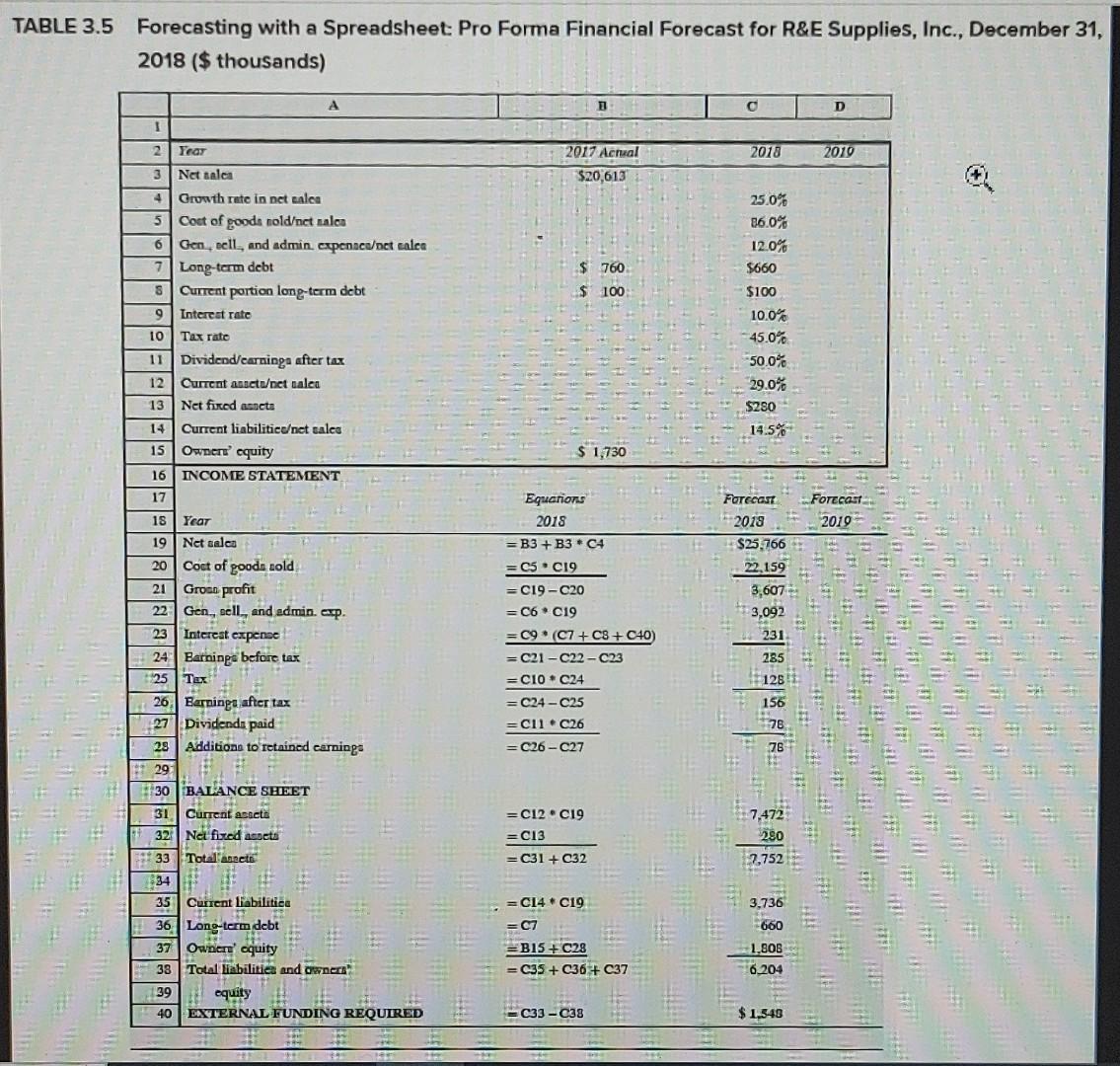

Saved Help Save & Exit Submit Module 4: Assignment 4.1 3 Table 3.1 presents R&E Supplies' financial statements for the period 2014 through 2017, and Table 3.5 presents a pro forma financial forecast for 2018. Use the information in these tables to answer the following questions. a. Calculate R& Els sustainable growth rate in each year from 2015 through 2018. Assume the dividend payout ratio was the same in 2015-17 as forecasted in 2018. (Round your answers to 1 decimal place.) 2 points Sustainable Growth Rate Year 2015 % 2016 % eBook 2017 % Print 2018 % A TABLE 3.1 Financial Statements for R&E Supplies, Inc., December 31, 2014-2017 ($ thousands) 2016 2015 513.764 11.699 2.065 S16.104 13,6SS 2.416 2017 $20.613 17.727 2.556 Income Statements 2014 Net sales S11.190 Cost of goods sold 9,400 Gross profit 1.790 Expenses General, selling, and administrative expenses 1,019 Net interest expense 100 Earnings before tax 671 Tax 302 Earnings after tax S 369 Balance Sheets 1.610 1.239 103 2.267 90 110 723 696 529 235 325 313 S 398 S 383 S 291 Assets Current assets. S 644 S 412 S 551 1.789 1.376 2,094 2.556 2.267 S 671 1.343 1.119 14 3,147 12S S 3,275 Cash and securities Accounts receivable Inventories Prepaid expenses Total current assets Net fixed assets Total assets Llabilities and Owners' Equity Current liabilities: IS 12 3.728 1.932 15 4.635 295 S 4.950 124 5.553 287 S 5.870 S 3.552 Bank loan S 50 S 50 1.007 1,443 S 50 2,426 50 60 SO S 50 3.212 100 IS 3.350 5 7 10 1.122 2.536 Accounts payable Current portion long-term debt Accrued wages Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and owners' equity 1.550 910 960 S60 760 150 150 150 150 1,043 S 3,275 1.242 S 3.852 1.434 S 4.950 1.550 S 5.870 TABLE 3.5 Forecasting with a Spreadsheet: Pro Forma Financial Forecast for R&E Supplies, Inc., December 31, 2018 ($ thousands) A D 1 2 Year 2018 2019 2017 Actual $20,613 25.0% 86.0% 12.0% $660 $ 760 $ 100 $100 3 Net talca 4 Growth rate in net sales 5 Cost of goods noldet nalca 6 Gen, ell, and admin. cxpenacuct sales 7 Long-term debt 8 Current portion long-term debt 9 Interest rate 10 Tax rate 11 Dividend/earninga after tax 12 Current assctoet salea 13 Net fixed assets 14 Current liabiliticact sales 15 Owner' equity 16 INCOME STATEMENT 10.0% 45.0% -50.0% 29.0% S250 14.5% $ 1,730 17 -Forecast 2019 Equations 2018 =B3 + B3 * C4 =C3 C19 Forecast 2018 $25.766 22.159 3,607 3,092 231 =C19-20 =C6C19 =C9 (C7 + C8 + C40) =C21-22-023 285 = C10 24 =C24-25 =C11.026 =C26-27 18 Year 19 Net salca 20 Cost of goods sold 21 Grose profit 22 Gen., sell, and admin. exp. 23 Interest expense 24 Earnings before tax 25 Tex 26 Berning after tax 27 Dividenda paid 28 Addition to retained earnings ** 29 *30 BALANCE SHEET 31 Current assets 32 Nei fixed assets 34 33 Total secto $34 35 Current liabilities 36 Long-term debt 37 Owner' equity 38 Total liabilities and owners 39 40 EXTERNAL FUNDING REQUIRED =C12C19 =C13 290 2,752 =C31 +32 = C14C19 =C7 =B15 + C28 =C35 + C36 + C37 3,736 660 1.805 6.204 equity C33-C38 $1.548

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started