Answered step by step

Verified Expert Solution

Question

1 Approved Answer

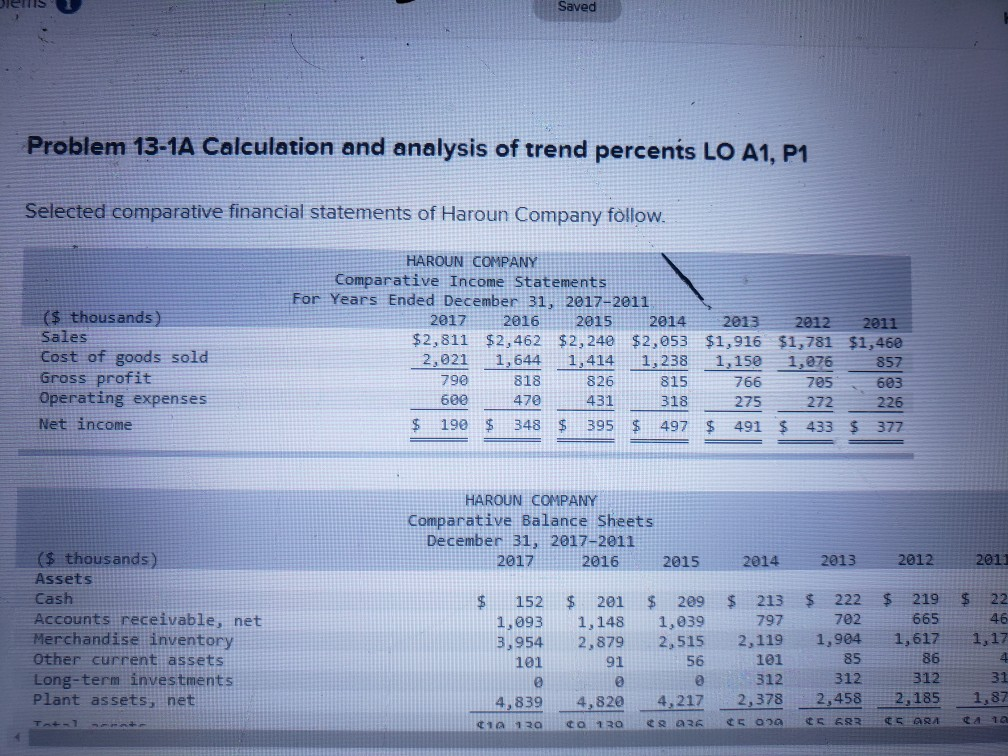

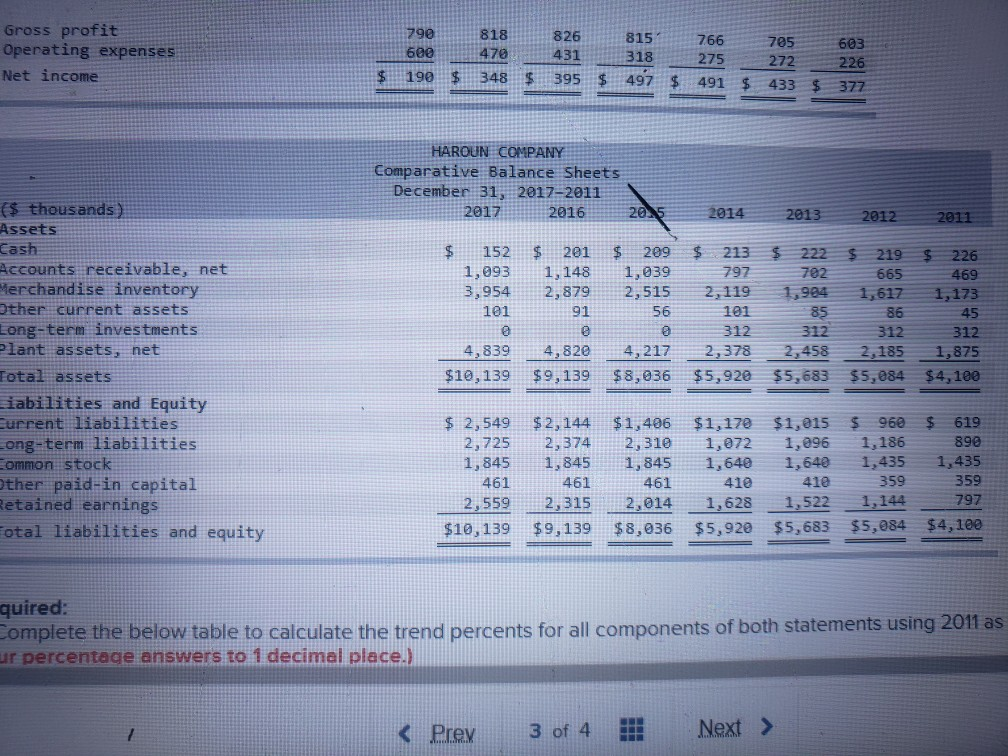

Saved Problem 13-1A Calculation and analysis of trend percents LO A1, P1 Selected comparative financial statements of Haroun Company follow. ($ thousands Sales Cost of

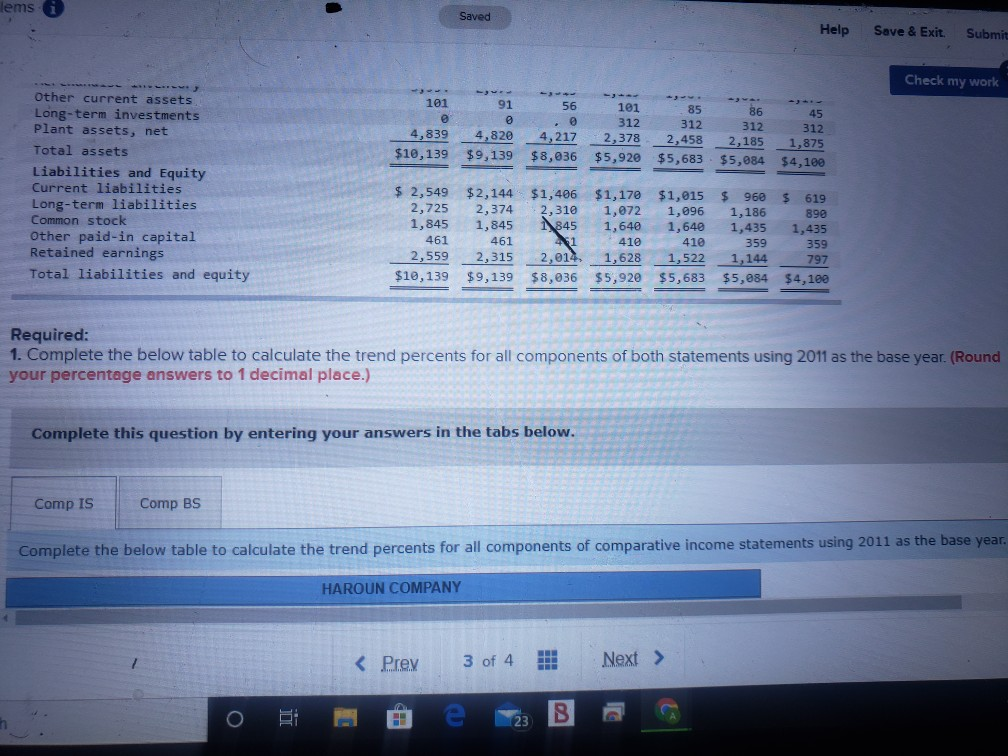

Saved Problem 13-1A Calculation and analysis of trend percents LO A1, P1 Selected comparative financial statements of Haroun Company follow. ($ thousands Sales Cost of goods sold Gross profit Operating expenses Net income HAROUN COMPANY Comparative Income Statements For Years Ended December 31, 2017-2011 2017 2016 2015 2014 2013 2012 2011 $2,811 $2,462 $2,240 $2,053 $1,916 $1,781 $1,460 2,021 1,644 1,414 1,238 1,150 1,076 857 790 818 826 815 766 705 603 6ee 470 318 275 272 226 $ 190$ 348 $ 395 $ 497 $ 491 $ 433 $ 377 431 HAROUN COMPANY Comparative Balance Sheets December 31, 2017-2011 2017 2016 2015 2014 2013 2012 2011 $ $ ($ thousands) Assets Cash Accounts receivable, net Merchandise inventory Other current assets Long-term investments Plant assets, net 152 1,093 3,954 101 $ 201 1,148 2,879 91 $ 209 1,039 2,515 56 @ 4,217 $ 213 797 2,119 101 312 2,378 05 Oba $ 222 702 1,904 85 312 2,458 $ 219 665 1,617 86 312 2,185 22 46 1,17 4 31 1,87 4,839 4,820 Tu-1 ti 120 co 120 236 410 ER2 SARA Gross profit Operating expenses Net income 790 818 826 600 470 431 $ 190 $ 348 $ 395 $ 815 766 705 603 318 275 272 226 497 $ 491 $ 433 $ 377 HAROUN COMPANY Comparative Balance Sheets December 31, 2017-2011 2017 2016 20 2014 2013 2012 2011 $ $ 797 152 1,093 3,954 101 ($ thousands ) Assets Cash Accounts receivable, net Merchandise inventory Other current assets Long-term investments Plant assets, net Total assets Fiabilities and Equity Eurrent liabilities cong-term liabilities Common stock Other paid-in capital Retained earnings Fotal liabilities and equity $ 201 209 $ 213 $ 222 $ 219 $ 226 1,148 1,039 702 665 469 2,879 2,515 2,119 1,984 1,617 1,173 91 56 101 85 86 45 @ 0 312 312 312 312 4,820 4,217 2,378 2,458 2,185 1,875 $9,139 $8,036 $5,920 $5,683 $5,884 $4,100 4,839 $10,139 $ 2,549 2,725 1,845 461 2,559 $10,139 $ 2,144 2,374 1,845 461 2,315 $9,139 $1,406 2,310 1,845 461 2,014 $ 8,036 $1,170 1,072 1,640 410 1,628 $5,920 $1,015 $ 960 $ 619 1,096 1,186 890 1,640 1,435 1,435 410 359 359 1,522 1,144 797 $5,683 $5,084 $4,100 quired: Complete the below table to calculate the trend percents for all components of both statements using 2011 as ur percentage answers to 1 decimal place.) lems Saved Help Save & Exit. Submit Check my work 101 91 4,839 4,820 $10,139 $9,139 56 101 85 86 45 312 312 312 312 2,378 2,458 2,185 1,875 $8,036 $5,920 $5,683 $5,084 $4,100 4,217 Other current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Long-term liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity 2,310 1845 $ 2,549 $2,144 $1,406 $1,170 $1,015 $ 960 $ 619 2,725 2,374 1,072 1,096 1,186 1,845 890 1,845 1,640 1,640 1,435 1,435 461 461 41 410 410 359 359 2,559 2,315 2,014. 1,628 1,144 797 $10,139 $9,139 $8,036 $5,920 $5,683 $5,084 $4,100 1,522 Required: 1. Complete the below table to calculate the trend percents for all components of both statements using 2011 as the base year. (Round your percentage answers to 1 decimal place.) Complete this question by entering your answers in the tabs below. Comp IS Comp BS Complete the below table to calculate the trend percents for all components of comparative income statements using 2011 as the base year. HAROUN COMPANY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started