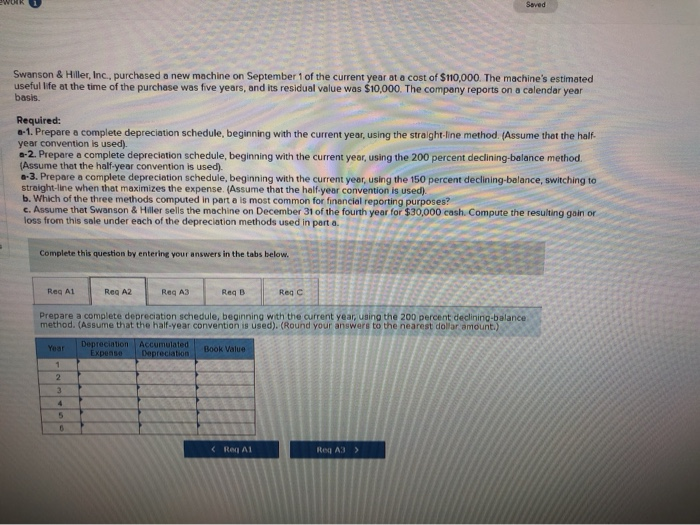

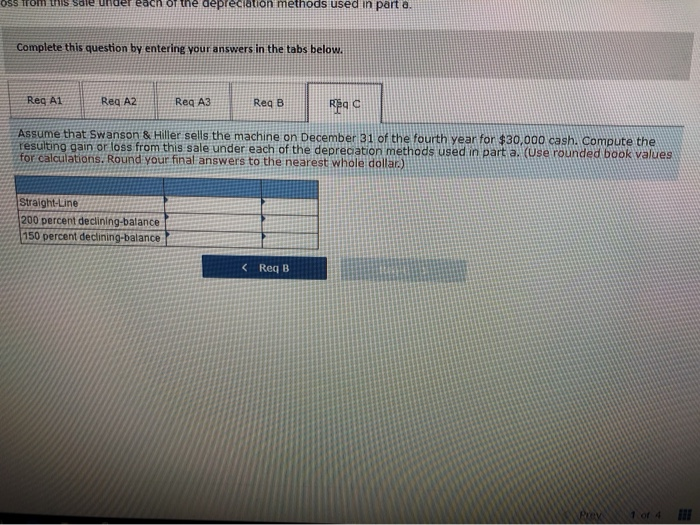

Saved Swanson & Hiller, Inc., purchased a new machine on September 1 of the current year at a cost of $110,000. The machine's estimated useful life at the time of the purchase was five years, and its residual value was $10,000. The company reports on a calendar year basis. Required: a-1. Prepare a complete depreciation schedule, beginning with the current year, using the straight-line method (Assume that the half- year convention is used). a-2. Prepare a complete depreciation schedule, beginning with the current year, using the 200 percent declining-balance method. (Assume that the half-year convention is used). a-3. Prepare a complete depreciation schedule, beginning with the current year, using the 150 percent declining-balance, switching to straight-line when that maximizes the expense. (Assume that the half-year convention is used). b. Which of the three methods computed in part a is most common for finencial reporting purposes? c. Assume thet Swanson & Hiller sells the machine on December 31 of the fourth year for $30,000 cash. Compute the resulting gain or loss from this sale under each of the depreciation methods used in part a. Complete this question by entering your answers in the tabs below. Req A1 Reg A2 Req A3 Req B Reg C Prepare a complete depreciation schedule, beginning with the current year, using the 200 percent declining-balance method. (Assume that the half-year convention is used). (Round your answere to the nearest dollar amount.) Depreciation Expense Accumulated Depreciation Year Book Value 3 5

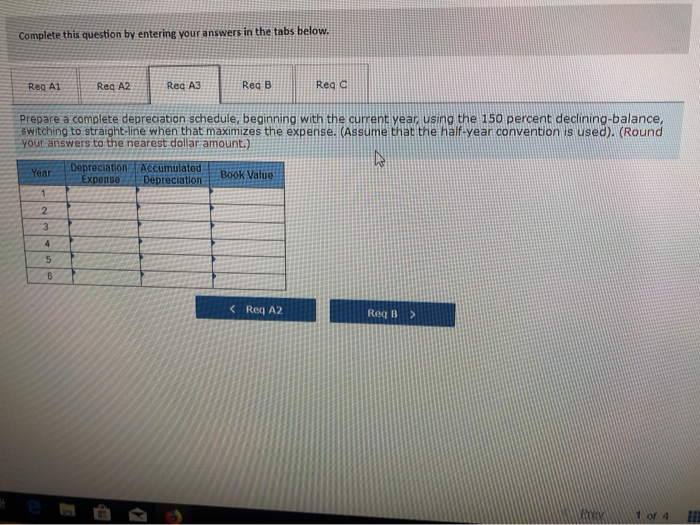

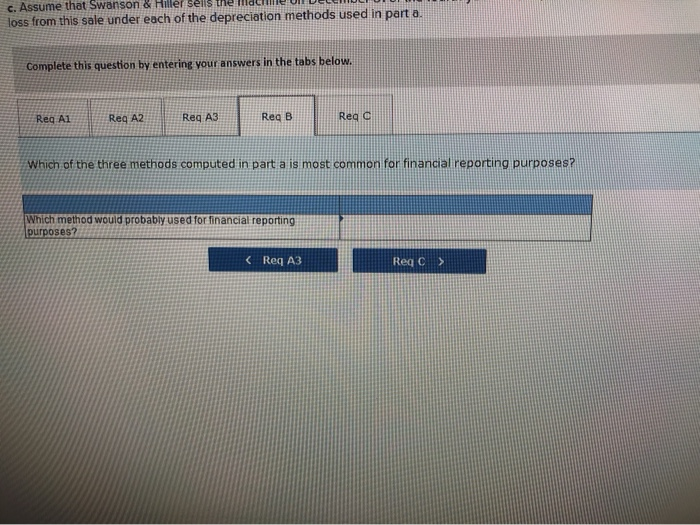

Complete this question by entering your answers in the tabs below. Req C Rea B Req A2 Req A3 Req A1 Prepare a complete depreciation schedule, beginning with the current year, using the 150 percent declining-balance, switching to straight-line when that maximizes the expense. (Assume that the half-year convention is used). (Round your answers to the nearest dollar amount.) Accumulated Depreciation Depreciation Expense Year Book Value 1 2 4 5 Req A2 Req B Prev 1 of 4 c. Assume that Swanson &Hiller sellS loss from this sale under each of the depreciation methods used in part a Complete this question by entering your answers in the tabs below. Req B Req C Req A3 Reg A1 Req A2 Which of the three methods computed in part a is most common for financial reporting purposes? Which method would probably used for financial reporting ses?