Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Saved Toronto Inc. needed to conserve cash, so instead of a cash dividend the board of directors declared a 10% common share dividend on June

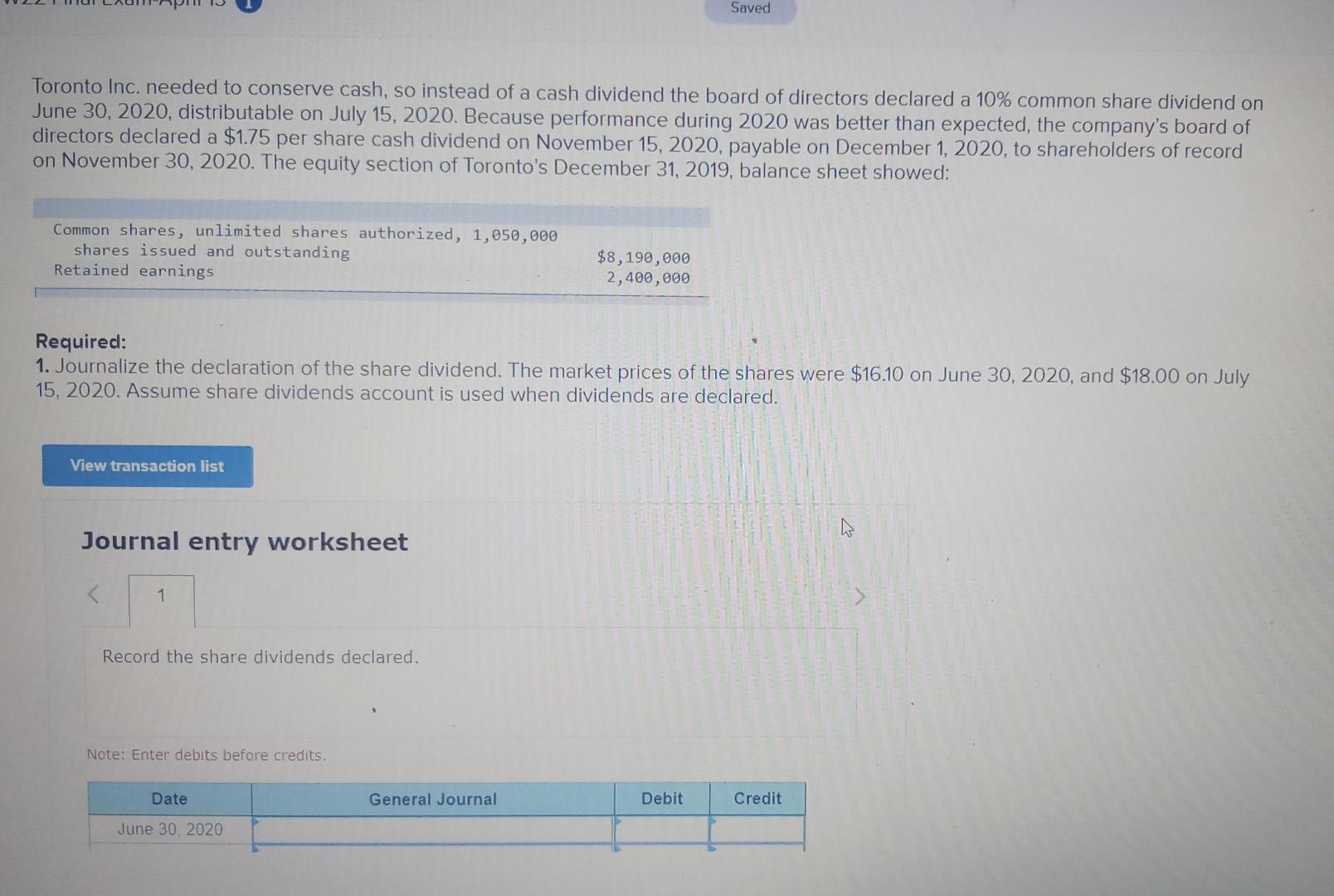

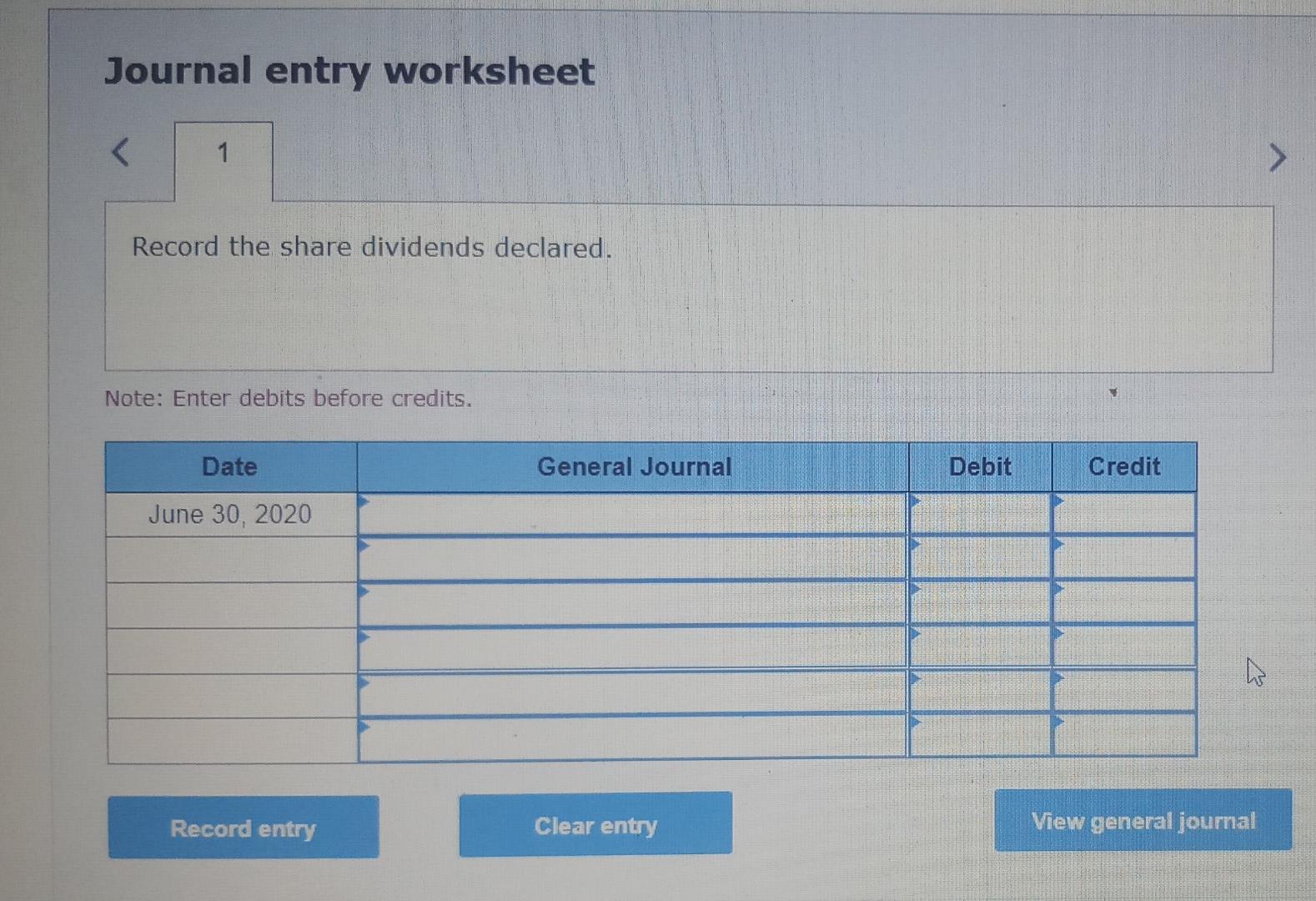

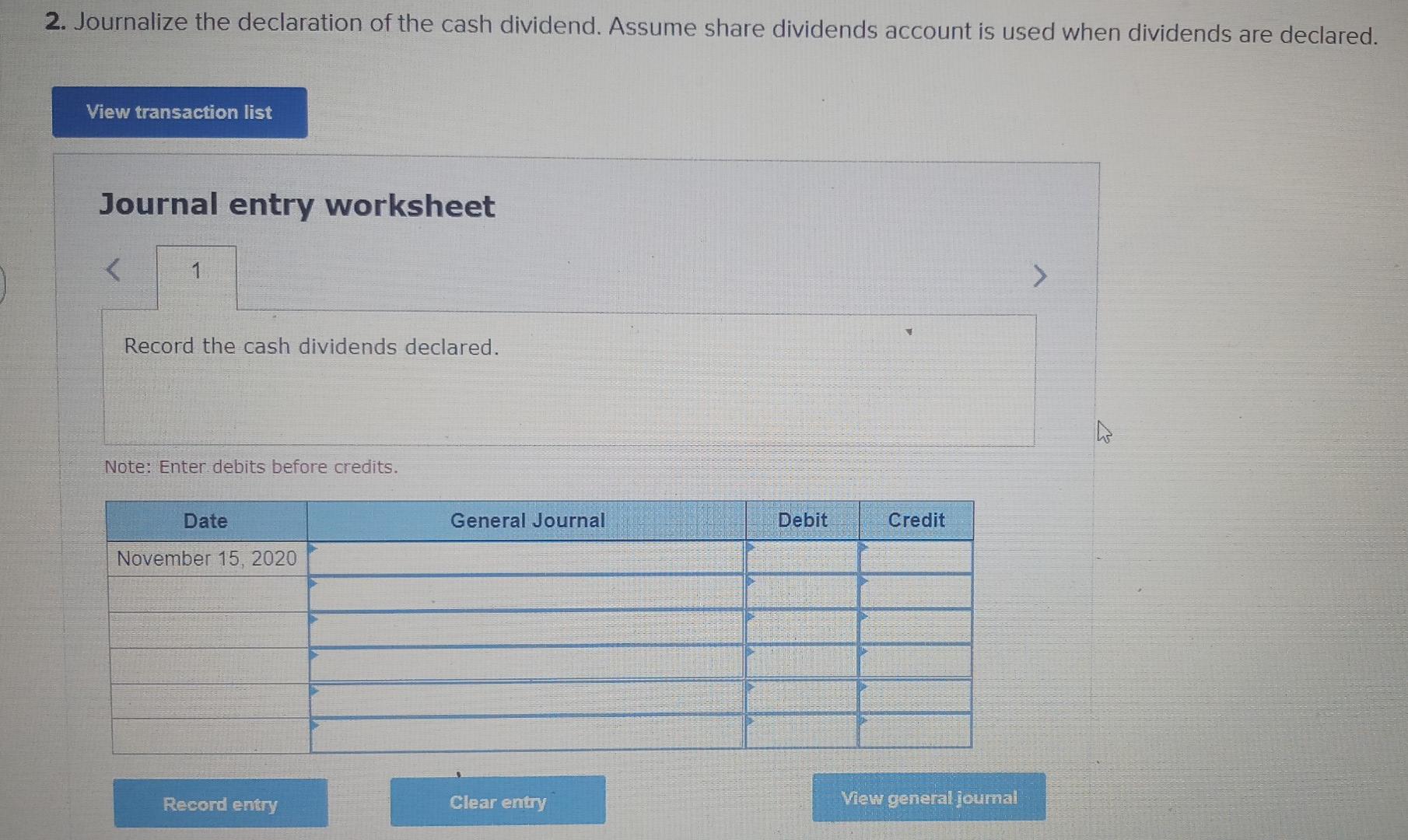

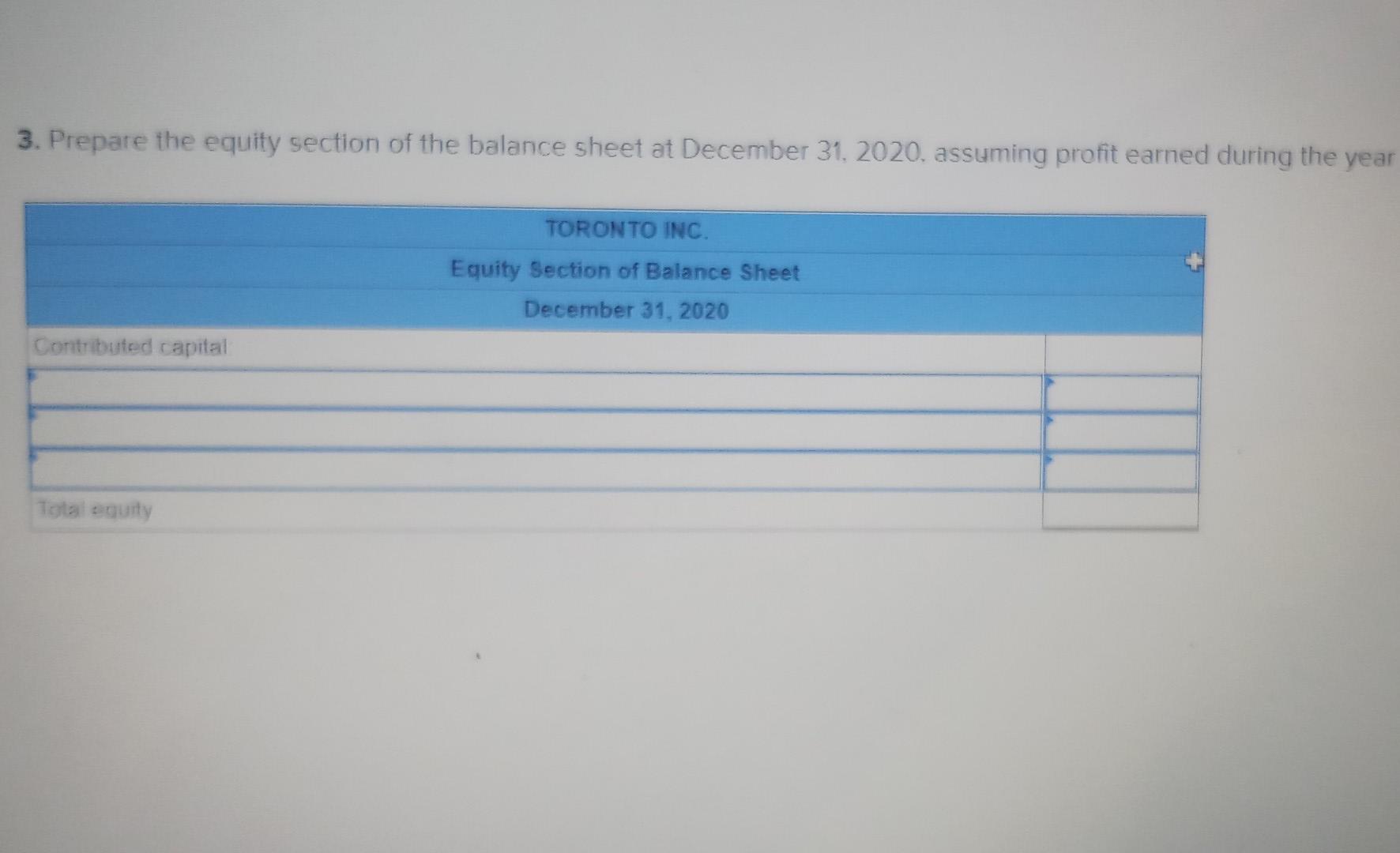

Saved Toronto Inc. needed to conserve cash, so instead of a cash dividend the board of directors declared a 10% common share dividend on June 30, 2020, distributable on July 15, 2020. Because performance during 2020 was better than expected, the company's board of directors declared a $1.75 per share cash dividend on November 15, 2020, payable on December 1, 2020, to shareholders of record on November 30, 2020. The equity section of Toronto's December 31, 2019, balance sheet showed: Common shares, unlimited shares authorized, 1,050,000 shares issued and outstanding Retained earnings $8,190,000 2,400,000 Required: 1. Journalize the declaration of the share dividend. The market prices of the shares were $16.10 on June 30, 2020, and $18.00 on July 15, 2020. Assume share dividends account is used when dividends are declared. View transaction list Journal entry worksheet Record the share dividends declared. Note: Enter debits before credits. Date General Journal Debit Credit June 30, 2020 Record entry Clear entry View general journal 2. Journalize the declaration of the cash dividend. Assume share dividends account is used when dividends are declared. View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started