-

Say, the couple have decided that they will pay for the college cost as they go. Explain pay as they go and withdraw funds from the brokerage accounts and Roth IRAs. How it might work?

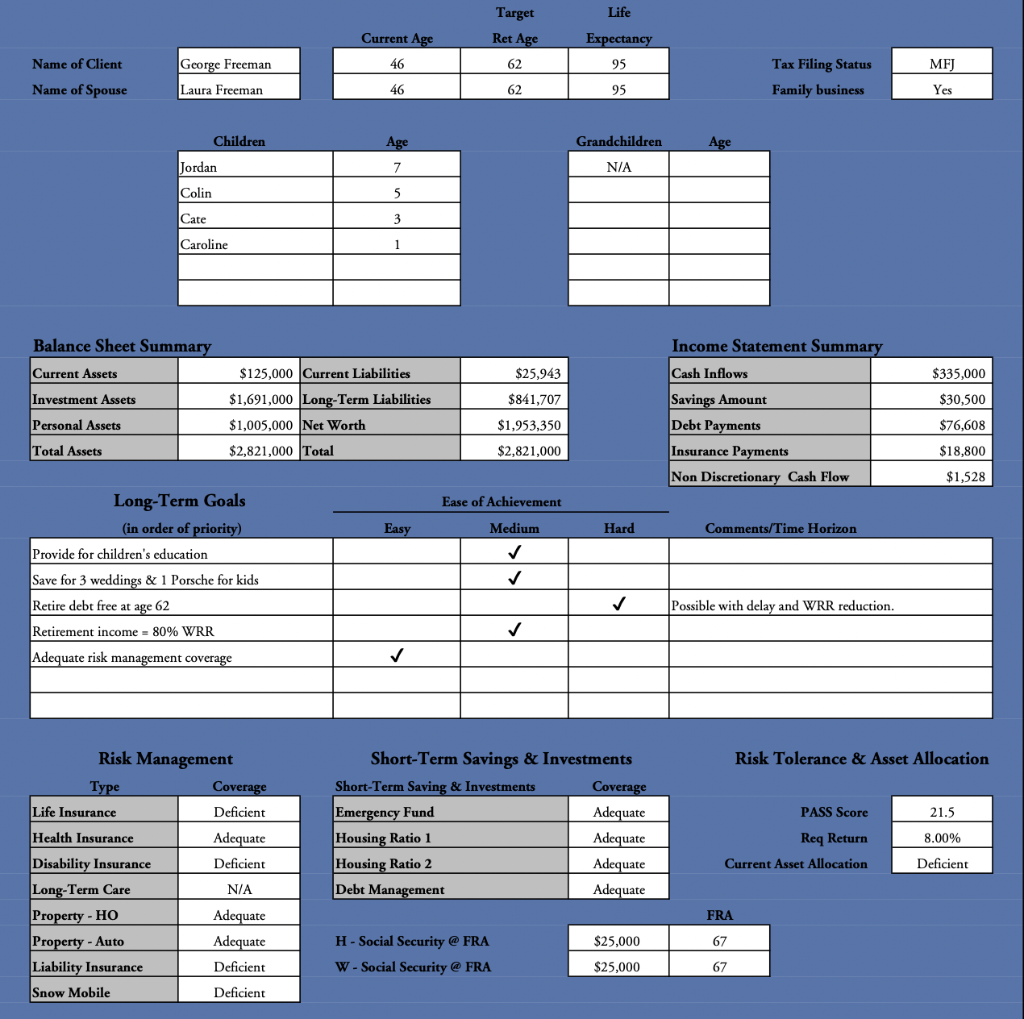

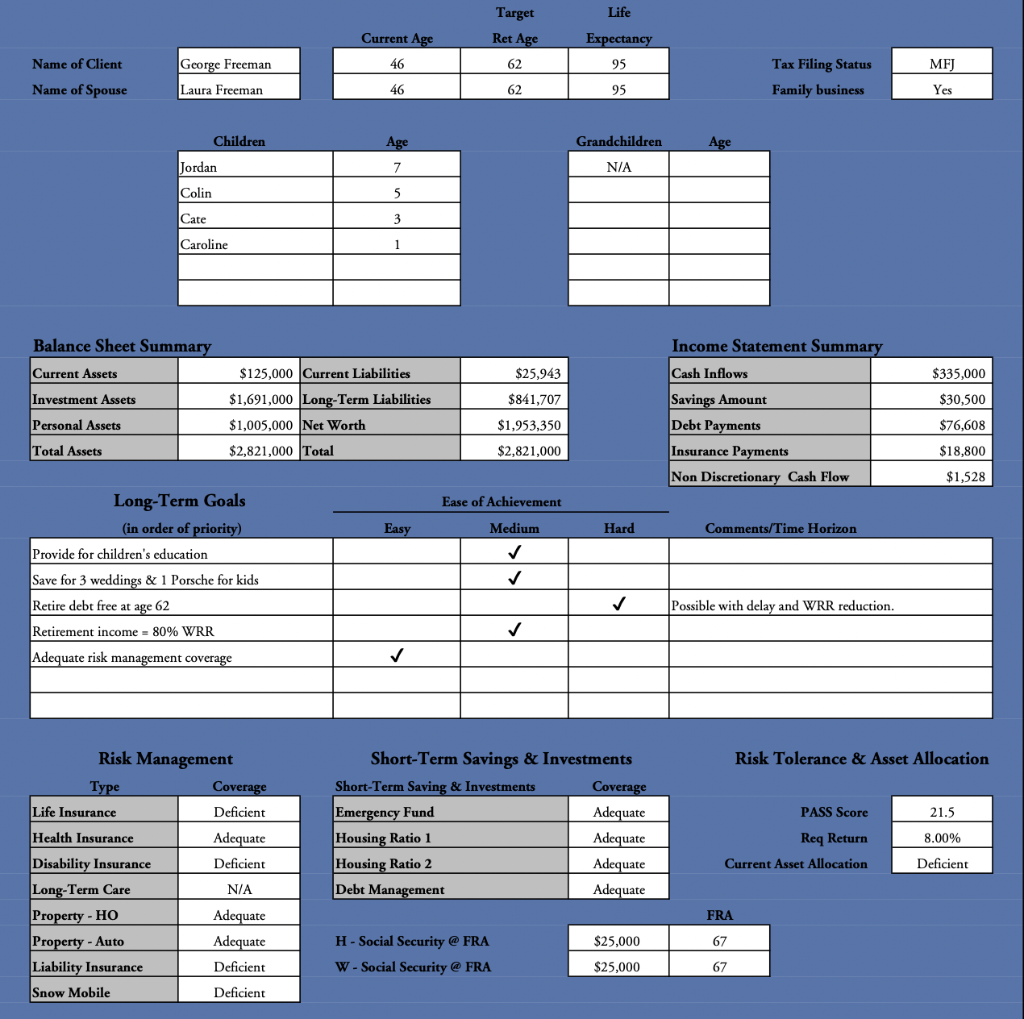

Target Life Current Age Ret Age Expectancy Name of Client 46 62 95 George Freeman Laura Freeman Tax Filing Status Family business MFJ Yes Name of Spouse 46 62 95 Age Grandchildren Age Children Jordan 7 N/A Colin 5 Cate 3 Caroline 1 Balance Sheet Summary Income Statement Summary Current Assets $25,943 Cash Inflows $335,000 Investment Assets $125,000 Current Liabilities $1,691,000 Long-Term Liabilities $1,005,000 Net Worth $841,707 $30,500 Personal Assets $1,953,350 $76,608 Savings Amount Debt Payments Insurance Payments Non Discretionary Cash Flow Total Assets $2,821,000 Total $2,821,000 $18,800 $1,528 Ease of Achievement Easy Hard Comments/Time Horizon Medium Long-Term Goals (in order of priority) Provide for children's education Save for 3 weddings & 1 Porsche for kids Retire debt free at age 62 Retirement income = 80% WRR Adequate risk management coverage Possible with delay and WRR reduction. Risk Tolerance & Asset Allocation 21.5 Short-Term Savings & Investments Short-Term Saving & Investments Coverage Emergency Fund Adequate Housing Ratio 1 Adequate Housing Ratio 2 Adequate Debt Management Adequate PASS Score Req Return Current Asset Allocation 8.00% Risk Management Type Coverage Life Insurance Deficient Health Insurance Adequate Disability Insurance Deficient Long-Term Care N/A Property - HO Adequate Property - Auto Adequate Liability Insurance Deficient Snow Mobile Deficient Deficient FRA $25,000 67 H - Social Security @ FRA W - Social Security @ FRA $25,000 67 Target Life Current Age Ret Age Expectancy Name of Client 46 62 95 George Freeman Laura Freeman Tax Filing Status Family business MFJ Yes Name of Spouse 46 62 95 Age Grandchildren Age Children Jordan 7 N/A Colin 5 Cate 3 Caroline 1 Balance Sheet Summary Income Statement Summary Current Assets $25,943 Cash Inflows $335,000 Investment Assets $125,000 Current Liabilities $1,691,000 Long-Term Liabilities $1,005,000 Net Worth $841,707 $30,500 Personal Assets $1,953,350 $76,608 Savings Amount Debt Payments Insurance Payments Non Discretionary Cash Flow Total Assets $2,821,000 Total $2,821,000 $18,800 $1,528 Ease of Achievement Easy Hard Comments/Time Horizon Medium Long-Term Goals (in order of priority) Provide for children's education Save for 3 weddings & 1 Porsche for kids Retire debt free at age 62 Retirement income = 80% WRR Adequate risk management coverage Possible with delay and WRR reduction. Risk Tolerance & Asset Allocation 21.5 Short-Term Savings & Investments Short-Term Saving & Investments Coverage Emergency Fund Adequate Housing Ratio 1 Adequate Housing Ratio 2 Adequate Debt Management Adequate PASS Score Req Return Current Asset Allocation 8.00% Risk Management Type Coverage Life Insurance Deficient Health Insurance Adequate Disability Insurance Deficient Long-Term Care N/A Property - HO Adequate Property - Auto Adequate Liability Insurance Deficient Snow Mobile Deficient Deficient FRA $25,000 67 H - Social Security @ FRA W - Social Security @ FRA $25,000 67