Says answers are wrong. Need some help getting to the correct figures.

Says answers are wrong. Need some help getting to the correct figures.

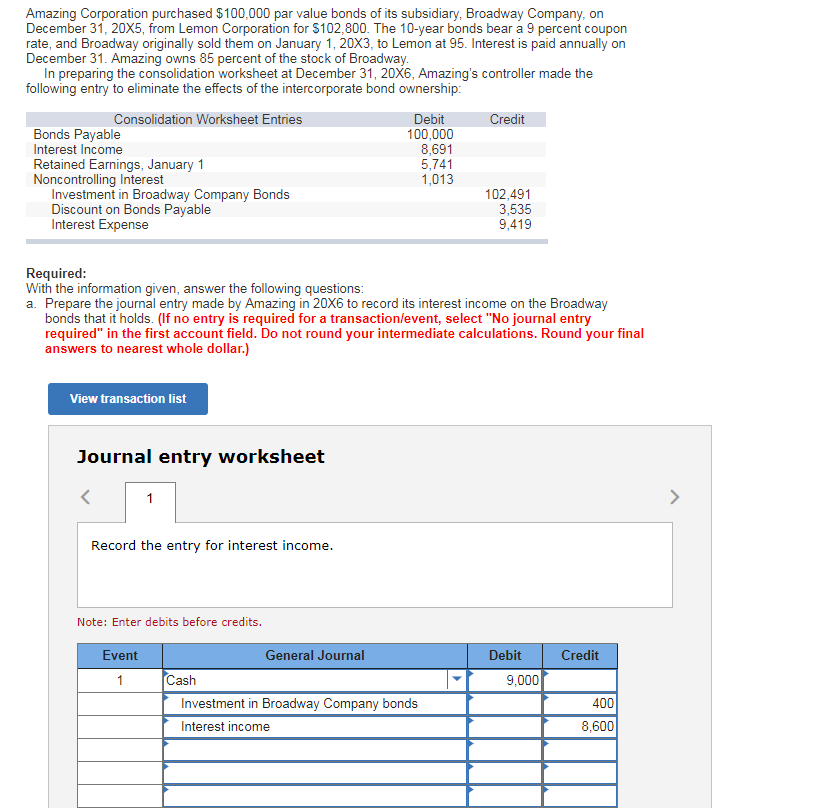

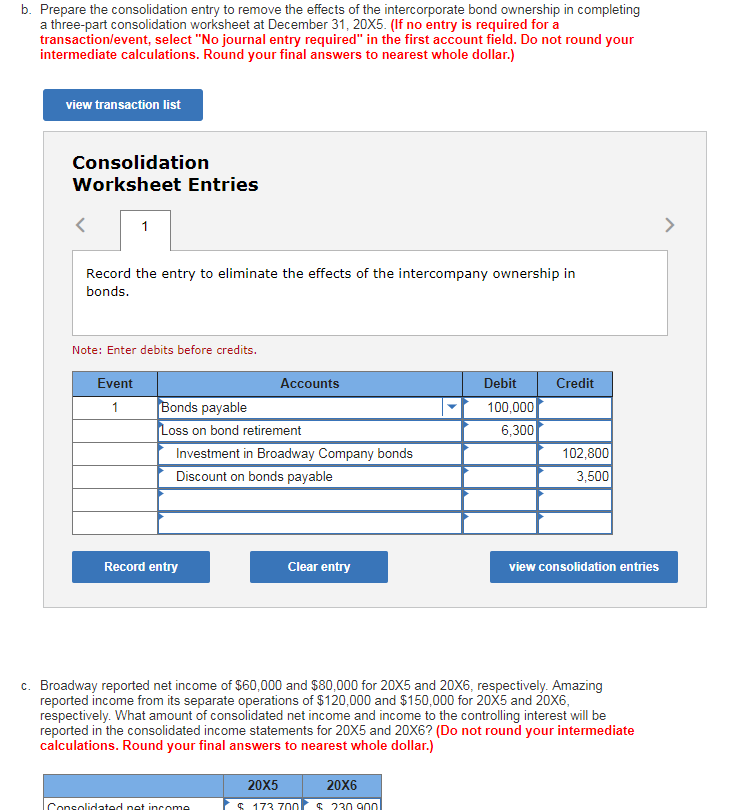

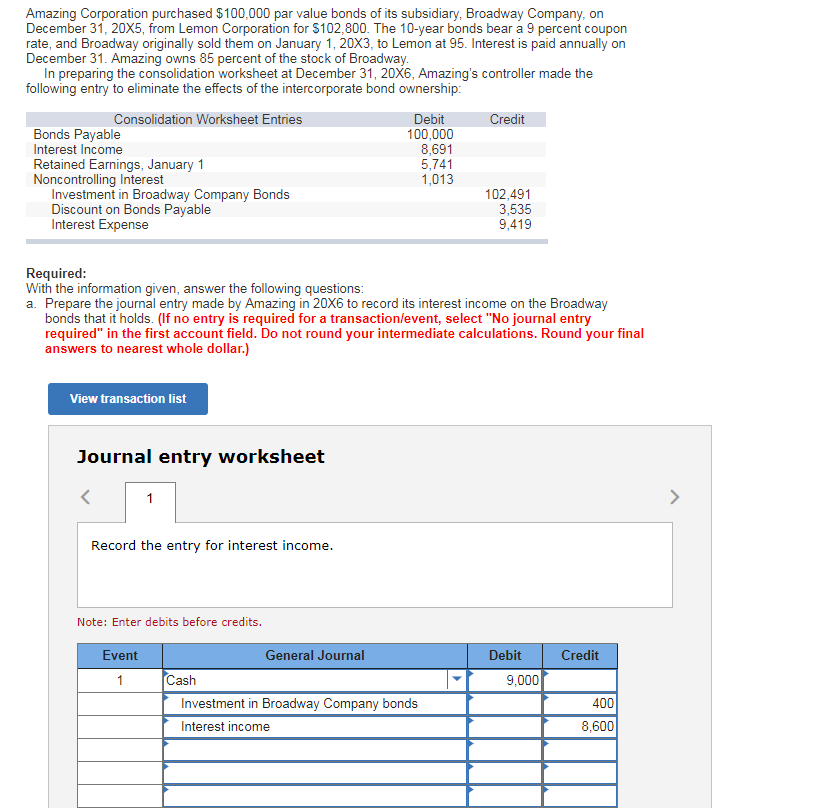

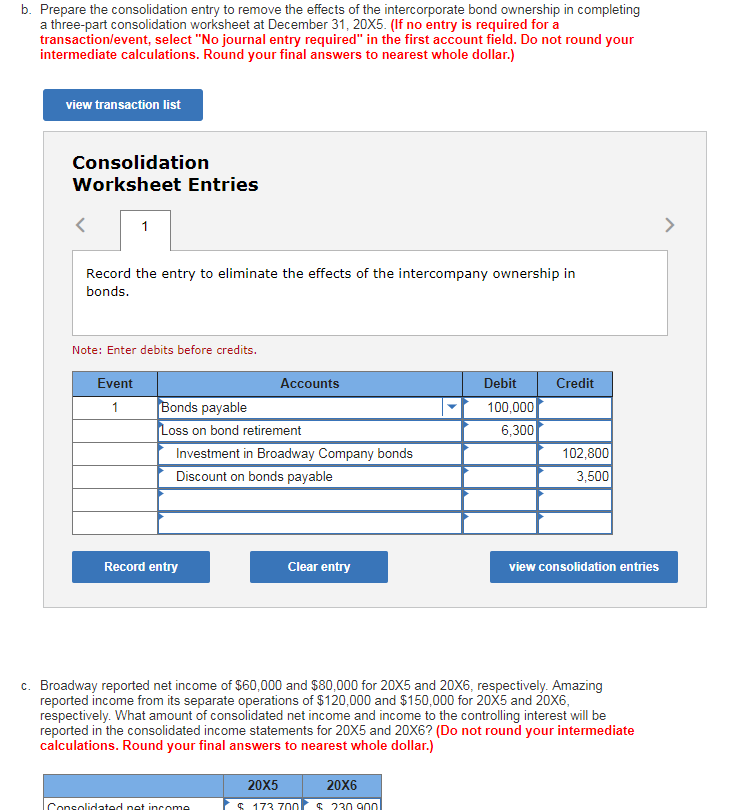

Amazing Corporation purchased $100,000 par value bonds of its subsidiary, Broadway Company, on December 31, 20X5, from Lemon Corporation for $102,800. The 10-year bonds bear a 9 percent couporn rate, and Broadway originally sold them on January 1, 20X3, to Lemon at 95. Interest is paid annually on December 31. Amazing owns 85 percent of the stock of Broadway. In preparing the consolidation worksheet at December 31, 20x6, Amazing's controller made the following entry to eliminate the effects of the intercorporate bond ownership Debit 100,000 8,691 5,741 1,013 Consolidation Worksheet Entries Bonds Payable Interest Income Retained Earnings, January 1 Noncontrolling Interest Investment in Broadway Company Bonds Discount on Bonds Payable Interest Expense 102,491 3,535 9,419 Required With the information given, answer the following questions a. Prepare the journal entry made by Amazing in 20X6 to record its interest income on the Broadway bonds that it holds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations. Round your final answers to nearest whole dollar.) View transaction list Journal entry worksheet Record the entry for interest income Note: Enter debits before credits Event General Journal Debit Credit Cash 9,000 400 Investment in Broadway Company bonds Interest income 8,600 b. Prepare the consolidation entry to remove the effects of the intercorporate bond ownership in completing a three-part consolidation worksheet at December 31, 20X5. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations. Round your final answers to nearest whole dollar.) view transaction list Consolidation Worksheet Entries Record the entry to eliminate the effects of the intercompany ownership in bonds Note: Enter debits before credits Event Accounts Debit Credit onds payable 100,000 oss on bond retirement 6,300 Investment in Broadway Company bonds 102,800 Discount on bonds payabl 3,500 Record entry Clear entry view consolidation entries c. Broadway reported net income of $60,000 and $80,000 for 20x5 and 20X6, respectively. Amazing reported income from its separate operations of $120,000 and $150,000 for 20X5 and 20X6 respectively. What amount of consolidated net income and income to the controlling interest will be reported in the consolidated income statements for 20X5 and 20X6? (Do not round your intermediate calculations. Round your final answers to nearest whole dollar.) 20X5 20X6 173 7001 230 90n Amazing Corporation purchased $100,000 par value bonds of its subsidiary, Broadway Company, on December 31, 20X5, from Lemon Corporation for $102,800. The 10-year bonds bear a 9 percent couporn rate, and Broadway originally sold them on January 1, 20X3, to Lemon at 95. Interest is paid annually on December 31. Amazing owns 85 percent of the stock of Broadway. In preparing the consolidation worksheet at December 31, 20x6, Amazing's controller made the following entry to eliminate the effects of the intercorporate bond ownership Debit 100,000 8,691 5,741 1,013 Consolidation Worksheet Entries Bonds Payable Interest Income Retained Earnings, January 1 Noncontrolling Interest Investment in Broadway Company Bonds Discount on Bonds Payable Interest Expense 102,491 3,535 9,419 Required With the information given, answer the following questions a. Prepare the journal entry made by Amazing in 20X6 to record its interest income on the Broadway bonds that it holds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations. Round your final answers to nearest whole dollar.) View transaction list Journal entry worksheet Record the entry for interest income Note: Enter debits before credits Event General Journal Debit Credit Cash 9,000 400 Investment in Broadway Company bonds Interest income 8,600 b. Prepare the consolidation entry to remove the effects of the intercorporate bond ownership in completing a three-part consolidation worksheet at December 31, 20X5. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations. Round your final answers to nearest whole dollar.) view transaction list Consolidation Worksheet Entries Record the entry to eliminate the effects of the intercompany ownership in bonds Note: Enter debits before credits Event Accounts Debit Credit onds payable 100,000 oss on bond retirement 6,300 Investment in Broadway Company bonds 102,800 Discount on bonds payabl 3,500 Record entry Clear entry view consolidation entries c. Broadway reported net income of $60,000 and $80,000 for 20x5 and 20X6, respectively. Amazing reported income from its separate operations of $120,000 and $150,000 for 20X5 and 20X6 respectively. What amount of consolidated net income and income to the controlling interest will be reported in the consolidated income statements for 20X5 and 20X6? (Do not round your intermediate calculations. Round your final answers to nearest whole dollar.) 20X5 20X6 173 7001 230 90n

Says answers are wrong. Need some help getting to the correct figures.

Says answers are wrong. Need some help getting to the correct figures.