Answered step by step

Verified Expert Solution

Question

1 Approved Answer

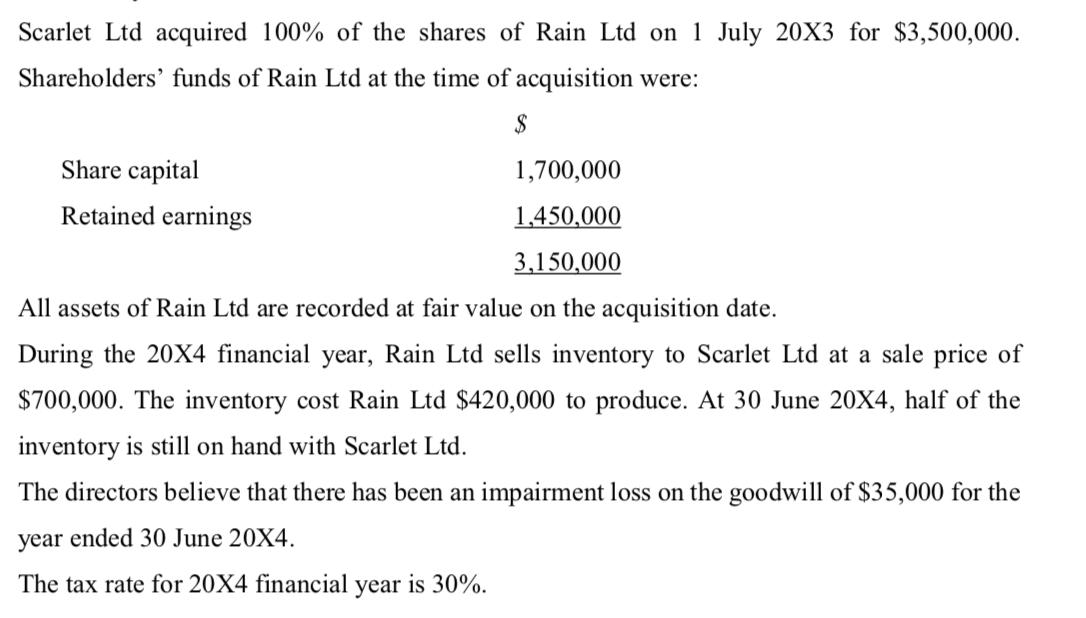

Scarlet Ltd acquired 100% of the shares of Rain Ltd on 1 July 20X3 for $3,500,000. Shareholders' funds of Rain Ltd at the time

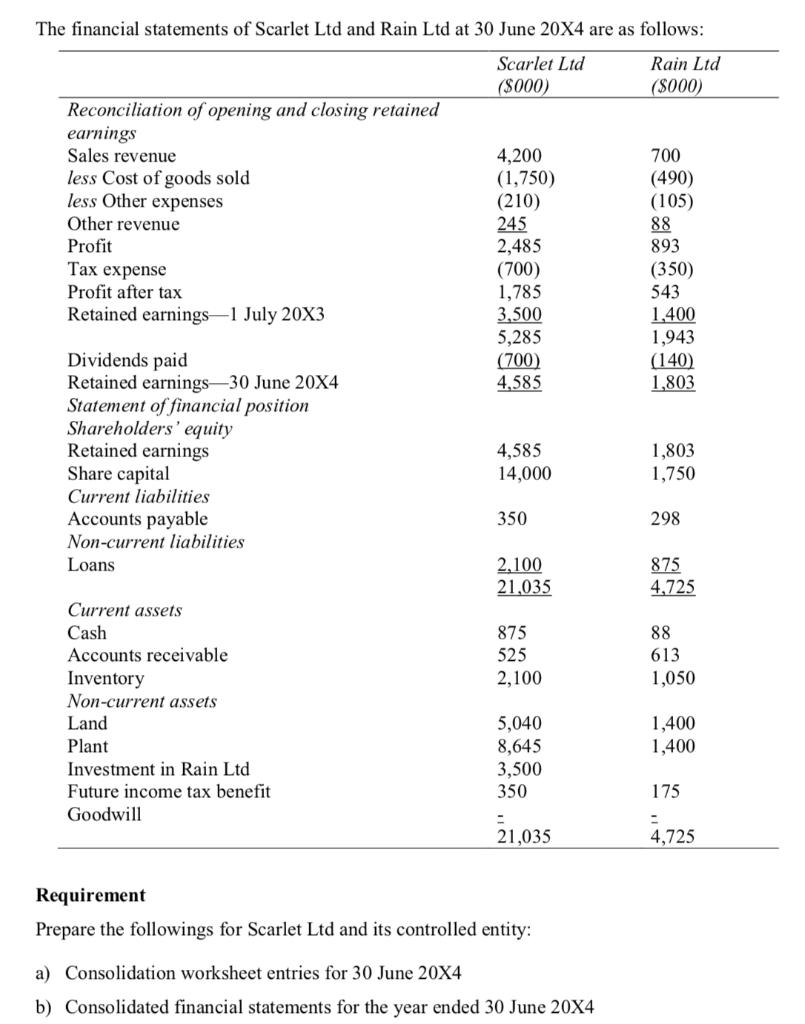

Scarlet Ltd acquired 100% of the shares of Rain Ltd on 1 July 20X3 for $3,500,000. Shareholders' funds of Rain Ltd at the time of acquisition were: $ Share capital Retained earnings 1,700,000 1,450,000 3,150,000 All assets of Rain Ltd are recorded at fair value on the acquisition date. During the 20X4 financial year, Rain Ltd sells inventory to Scarlet Ltd at a sale price of $700,000. The inventory cost Rain Ltd $420,000 to produce. At 30 June 20X4, half of the inventory is still on hand with Scarlet Ltd. The directors believe that there has been an impairment loss on the goodwill of $35,000 for the year ended 30 June 20X4. The tax rate for 20X4 financial year is 30%. The financial statements of Scarlet Ltd and Rain Ltd at 30 June 20X4 are as follows: Scarlet Ltd ($000) Rain Ltd ($000) Reconciliation of opening and closing retained earnings Sales revenue less Cost of goods sold less Other expenses Other revenue Profit Tax expense Profit after tax Retained earnings-1 July 20X3 Dividends paid Retained earnings-30 June 20X4 Statement of financial position Shareholders' equity Retained earnings Share capital Current liabilities Accounts payable Non-current liabilities Loans Current assets Cash Accounts receivable Inventory Non-current assets Land Plant Investment in Rain Ltd Future income tax benefit Goodwill 4,200 (1,750) (210) 245 2,485 (700) 1,785 3,500 5,285 (700) 4,585 4,585 14,000 350 2,100 21,035 875 525 2,100 5,040 8,645 3,500 350 21,035 Requirement Prepare the followings for Scarlet Ltd and its controlled entity: a) Consolidation worksheet entries for 30 June 20X4 b) Consolidated financial statements for the year ended 30 June 20X4 700 (490) (105) 88 893 (350) 543 1,400 1,943 (140) 1,803 1,803 1,750 298 875 4,725 88 613 1,050 1,400 1,400 175 = 4,725

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a Consolidation Worksheet Entries for 30 June 20X4 Scarlet Ltd Rain Ltd Noncurrent assets Land 3500 350 Plant 350 175 Investment in Rain Ltd 3500 Future Income Tax Benefit 875 Goodwill 4725 Current As...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started