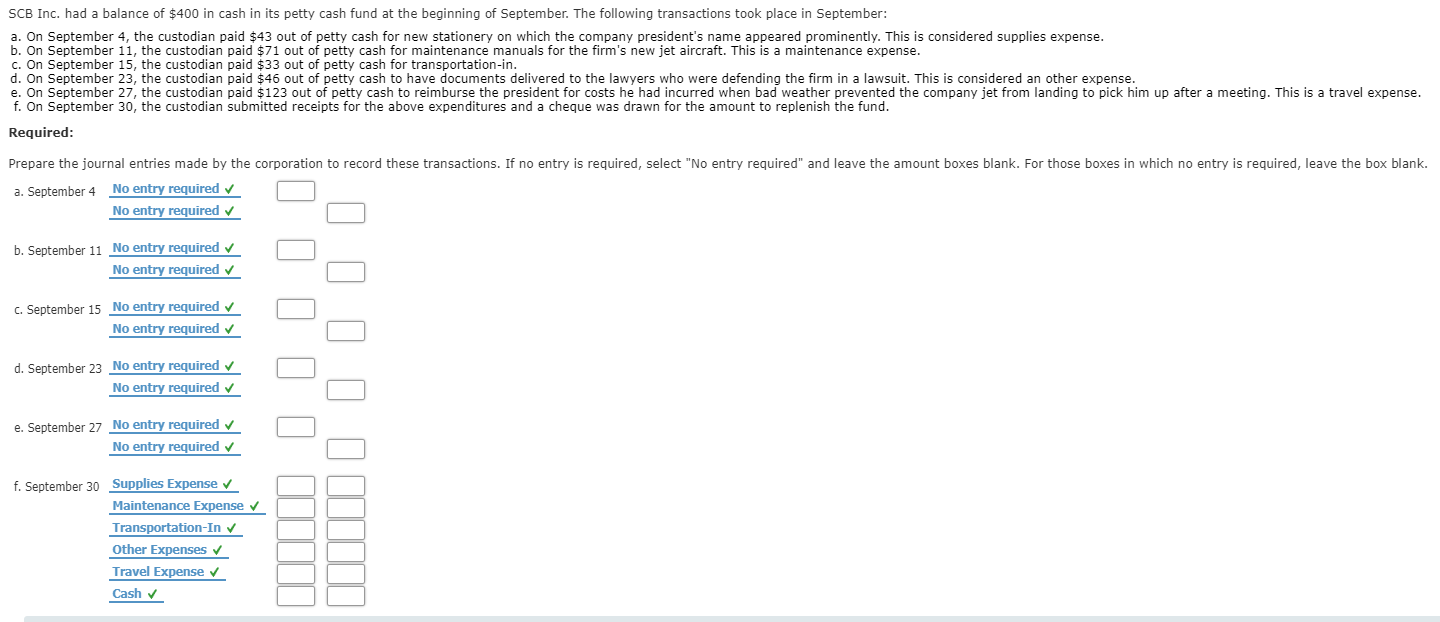

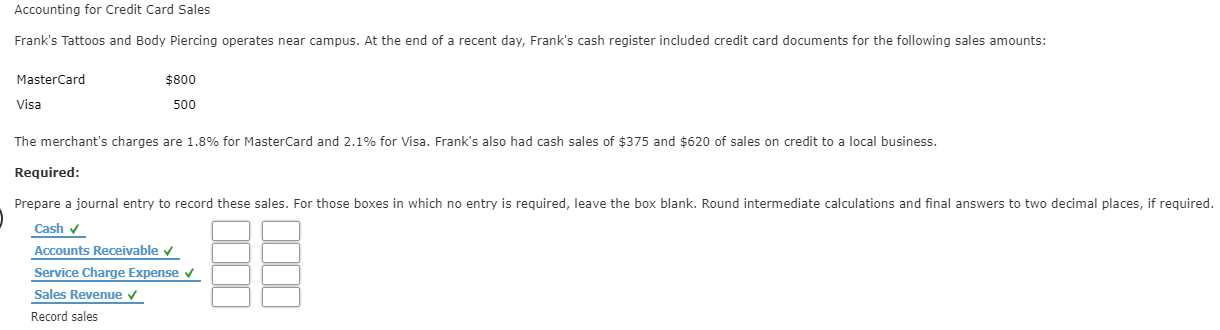

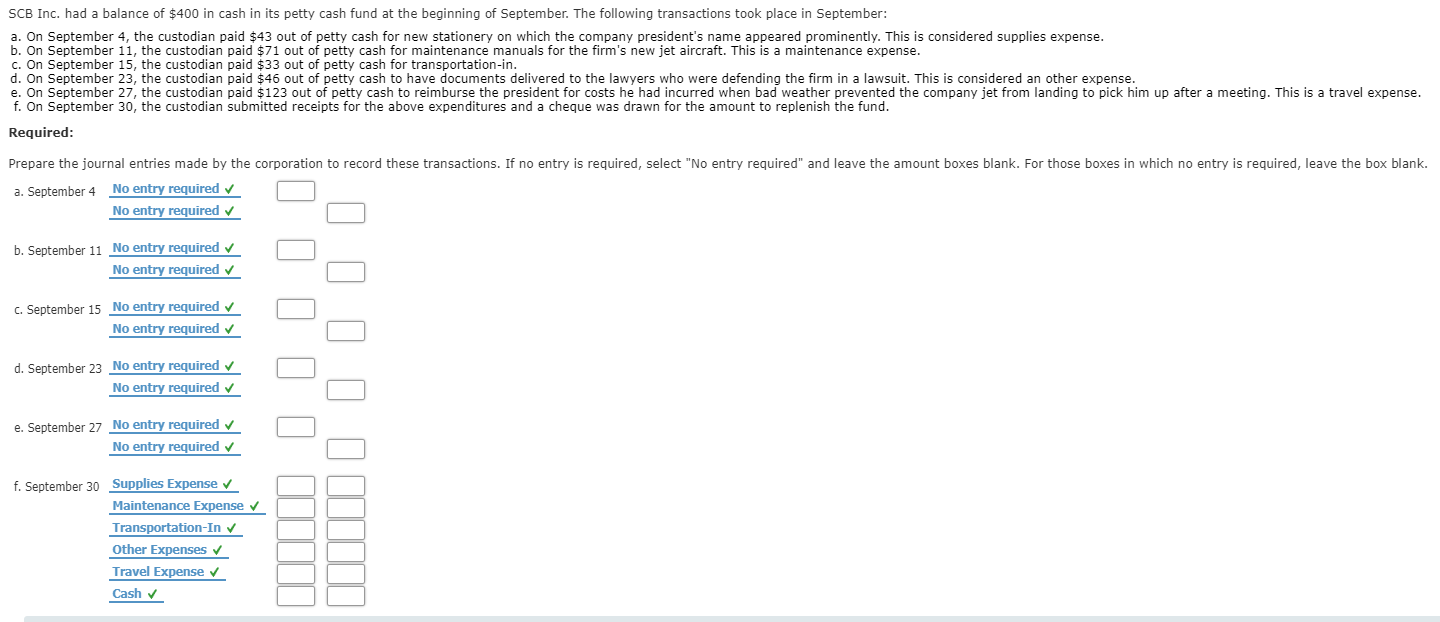

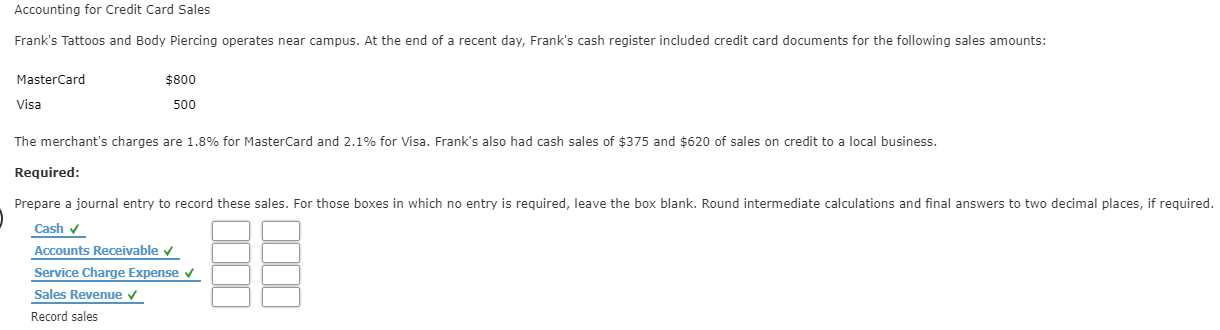

SCB Inc. had a balance of $400 in cash in its petty cash fund at the beginning of September. The following transactions took place in September: a. On September 4, the custodian paid $43 out of petty cash for new stationery on which the company president's name appeared prominently. This is considered supplies expense. b. On September 11, the custodian paid $71 out of petty cash for maintenance manuals for the firm's new jet aircraft. This is a maintenance expense. c. On September 15, the custodian paid $33 out of petty cash for transportation-in. d. On September 23, the custodian paid $46 out of petty cash to have documents delivered to the lawyers who were defending the firm in a lawsuit. This is considered an other expense. e. On September 27, the custodian paid $123 out of petty cash to reimburse the president for costs he had incurred when bad weather prevented the company jet from landing to pick him up after a meeting. This is a travel expense. f. On September 30, the custodian submitted receipts for the above expenditures and a cheque was drawn for the amount to replenish the fund. Required: Prepare the journal entries made by the corporation to record these transactions. If no entry is required, select "No entry required" and leave the amount boxes blank. For those boxes in which no entry is required, leave the box blank. a. September 4 No entry required No entry required b. September 11 No entry required No entry required C. September 15 No entry required No entry required I III d. September 23 No entry required No entry required e. September 27 No entry required No entry required f. September 30 Supplies Expense Maintenance Expense Transportation-In Other Expenses Travel Expense Cash HII Accounting for Credit Card Sales Frank's Tattoos and Body Piercing operates near campus. At the end of a recent day, Frank's cash register included credit card documents for the following sales amounts: MasterCard Visa $800 500 The merchant's charges are 1.8% for MasterCard and 2.1% for Visa. Frank's also had cash sales of $375 and $620 of sales on credit to a local business. Required: Prepare a journal entry to record these sales. For those boxes in which no entry is required, leave the box blank. Round intermediate calculations and final answers to two decimal places, if required. Cash V Accounts Receivable Service Charge Expense Sales Revenue Record sales