Question

Scenario #1: Grants Emporium You work for Dynamo Consulting Inc., a business consultancy, helping small to medium business owners make better financial decisions. W.T. runs

Scenario #1: Grants Emporium

Scenario #1: Grants Emporium

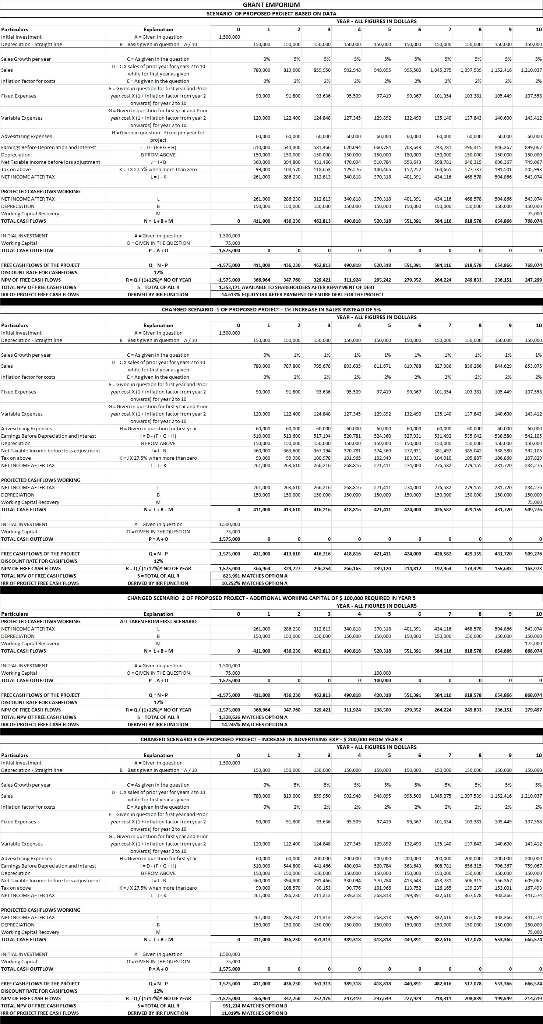

You work for Dynamo Consulting Inc., a business consultancy, helping small to medium business owners make better financial decisions. W.T. runs Grants Emporium, a five and dime store. Hes thinking of opening another store. Your firm has analysed the problem and determined a number of key data inputs. This morning, you are meeting with W.T. to discuss your results and answer his questions. Based on some emails and prior meetings, you have a good idea what W.T. will ask, so you can prepare ahead. Your manager also has some suggestions about additional questions that he might ask. You will need to be prepared to answer these during the meeting.

Data: Opening Grants Emporium II

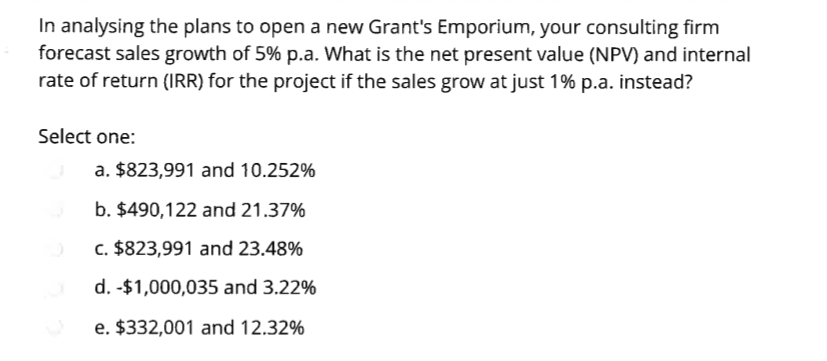

The capital investment required for opening a new store is $1,500,000, covering shop-fitting and other equipment such as cash registers etc. Additional working capital of $75,000 is also needed. The fixed costs of running a new store are $90,000 in the first year while variable costs, including labour costs, are $120,000. Both fixed and variable costs are expected to grow in line with inflation at 2 percent p.a. Forecast sales are $780,000 in the first year but can be expected to grow by 5 percent p.a. Advertising is important to this type of business and will cost $60,000 per year. The capital investment is to be depreciated straight-line to zero. W.T. hopes to keep the store running for 10 years. The discount rate that your team believes should be applied to the cash flows is 12 percent. The taxation rate is 27.5 percent (because this is a small-medium business in Australia). All working capital is returned at the end of the project. You intend to tell W.T. the NPV and IRR for this project idea and advise him on whether or not the idea will create market value for him and his family who own and operate the stores.

Your managers guidance: In addition to presenting the NPV and IRR (and associated advice), your manager, having worked with W.T. before, knows that he likes to scope out as many dimensions of a potential business decision as possible before committing. No doubt, W.T. will be interested in the sensitivity of the NPV and IRR to changes in forecast sales and the forecast growth rate. He might also be interested in knowing whether the project is viable if costs are greater (or grow faster) than expected or if additional working capital is required at different points. Being a bit of a finance buff, W.T. might also want to know more about the discount rate and how changes in it affect the viability of the project. You will need to make sure your spreadsheet analysis can cope with these adjustments so that you can quickly work out your answers during the meeting.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started