Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Scenario Alex, a talented amateur baker, won first place in a reality - show baking competition and was awarded $ 1 0 0 , 0

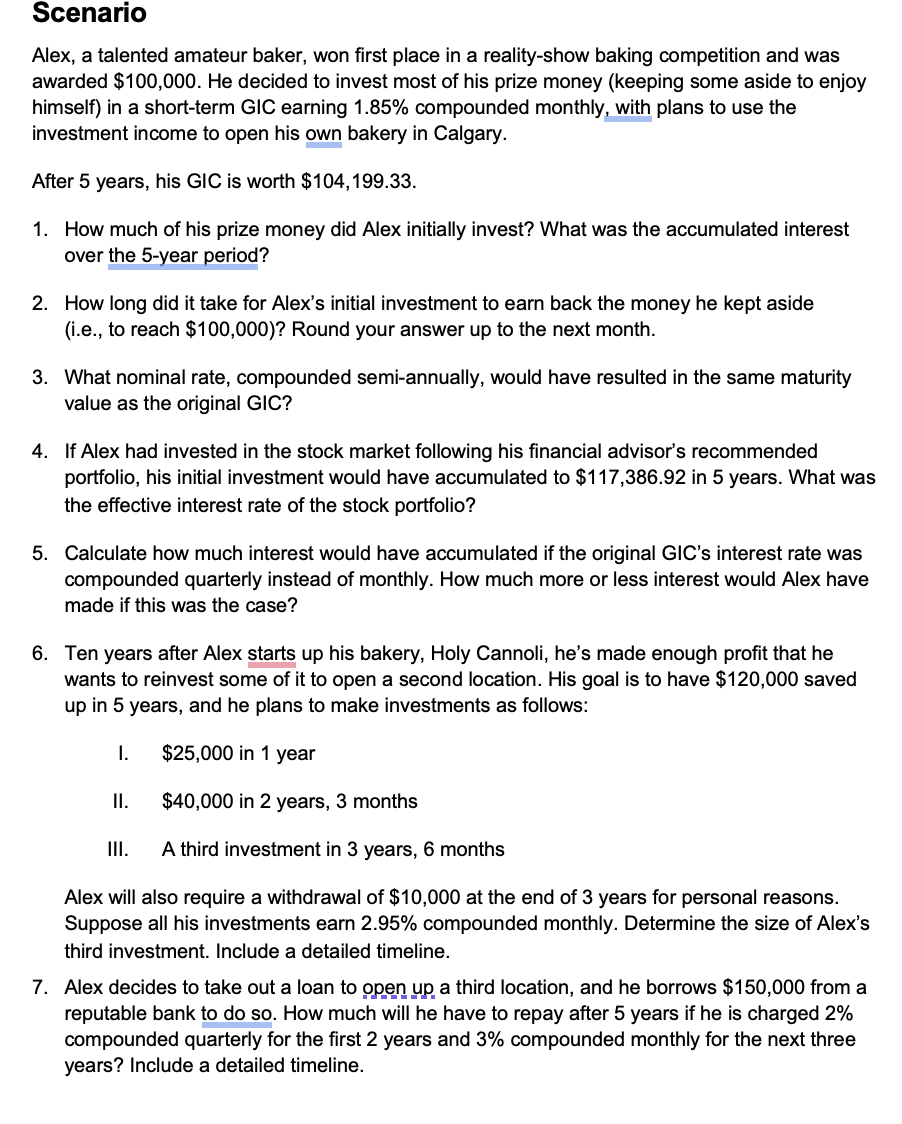

Scenario

Alex, a talented amateur baker, won first place in a realityshow baking competition and was

awarded $ He decided to invest most of his prize money keeping some aside to enjoy

himself in a shortterm GIC earning compounded monthly, with plans to use the

investment income to open his own bakery in Calgary.

After years, his GIC is worth $

How much of his prize money did Alex initially invest? What was the accumulated interest

over the year period?

How long did it take for Alex's initial investment to earn back the money he kept aside

ie to reach $ Round your answer up to the next month.

What nominal rate, compounded semiannually, would have resulted in the same maturity

value as the original GIC?

If Alex had invested in the stock market following his financial advisor's recommended

portfolio, his initial investment would have accumulated to $ in years. What was

the effective interest rate of the stock portfolio?

Calculate how much interest would have accumulated if the original GIC's interest rate was

compounded quarterly instead of monthly. How much more or less interest would Alex have

made if this was the case?

Ten years after Alex starts up his bakery, Holy Cannoli, he's made enough profit that he

wants to reinvest some of it to open a second location. His goal is to have $ saved

up in years, and he plans to make investments as follows:

I. $ in year

II $ in years, months

III. A third investment in years, months

Alex will also require a withdrawal of $ at the end of years for personal reasons.

Suppose all his investments earn compounded monthly. Determine the size of Alex's

third investment. Include a detailed timeline.

Alex decides to take out a loan to open up a third location, and he borrows $ from a

reputable bank to do so How much will he have to repay after years if he is charged

compounded quarterly for the first years and compounded monthly for the next three

years? Include a detailed timeline.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started