Question

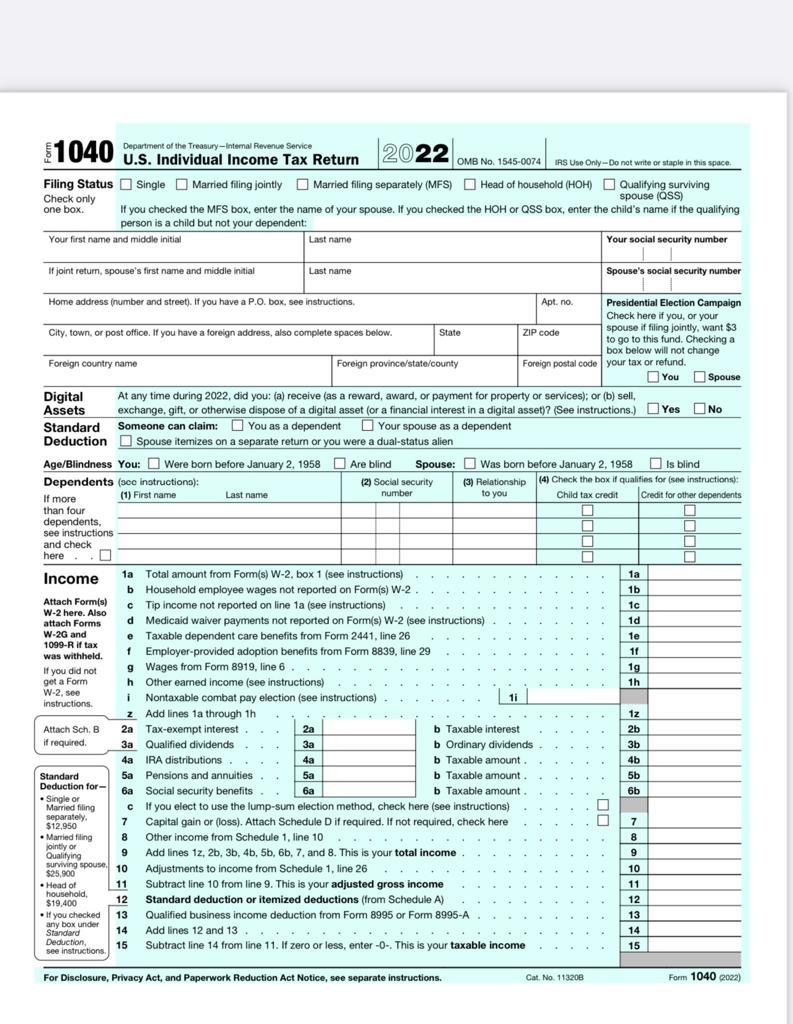

Scenario: During the 2021 tax year, Timothy Palmer ( SS 011-25-8598) ( 55 year old) received $ 44,900 in Salaries and tax withheld of $

Scenario:

During the 2021 tax year, Timothy Palmer ( SS 011-25-8598) ( 55 year old) received

$ 44,900 in Salaries and tax withheld of $ 4,900

His wife Bonnie ( SS 012-65-8978) have 50 year old, and earned $ 38,500 from salary and tax withheld of $ 3,890.

Thimothy also receives $1,200 in taxable interest and 800 in ordinary dividends.

Timothy began receiving benefits under a Annuity. He received his first payment in July 1, 2022. The monthly payment is $2,000. He contributed $62,000.

Bonnie has a Certificate of Deposit in the State Bank that generated $ 1,000 in interest revenue, taxable.

DEPENDENTS:

Thommy Palmer ( SS 225-23-5698) , born in July 4, 2004

Donnie Palmer (ss226-24-5698) born in january 10, 2006

Instructions:

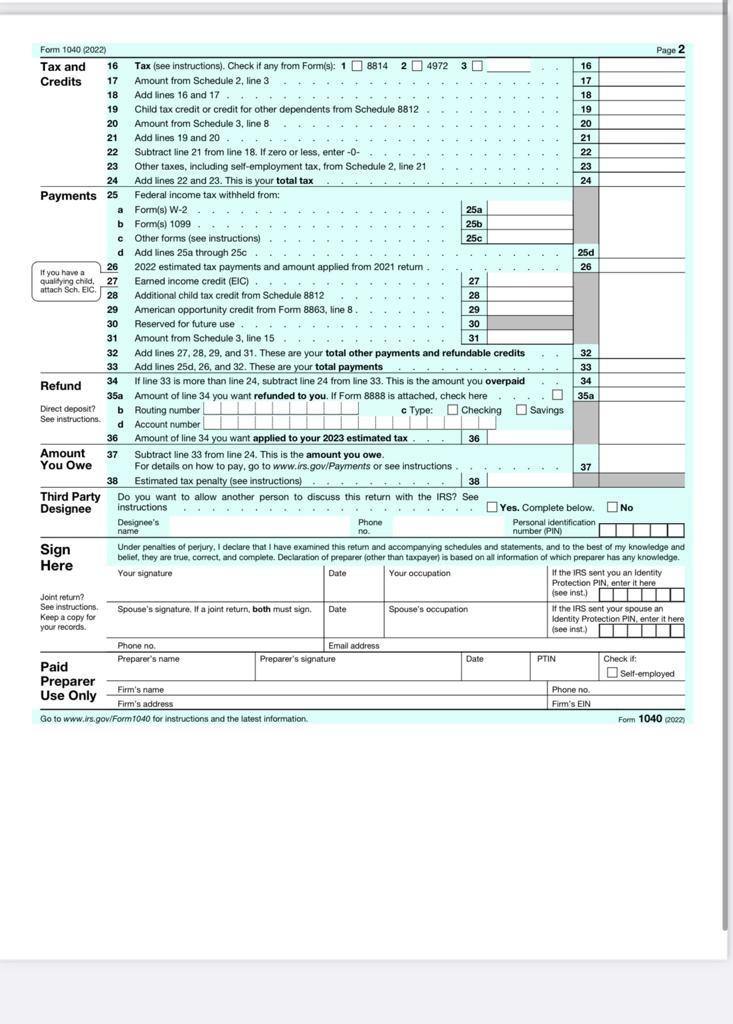

Prepare Form 1040

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started