Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SCENARIO Kitchen Gadgets (Pty) Ltd is a small retail store that sells a unique range of branded kettles, toasters, food processors and coffee machines. The

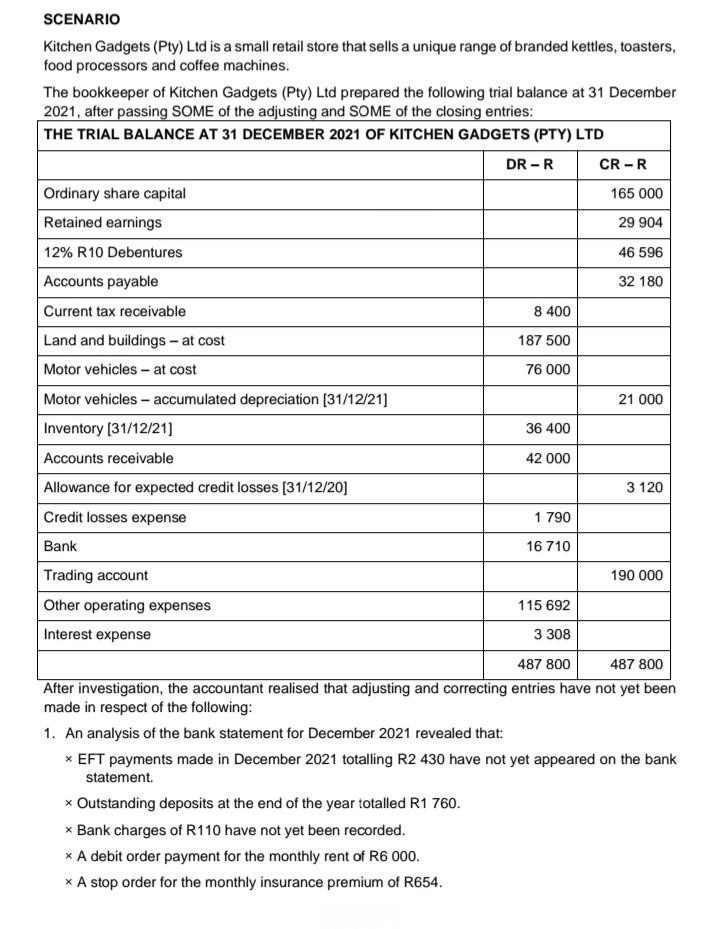

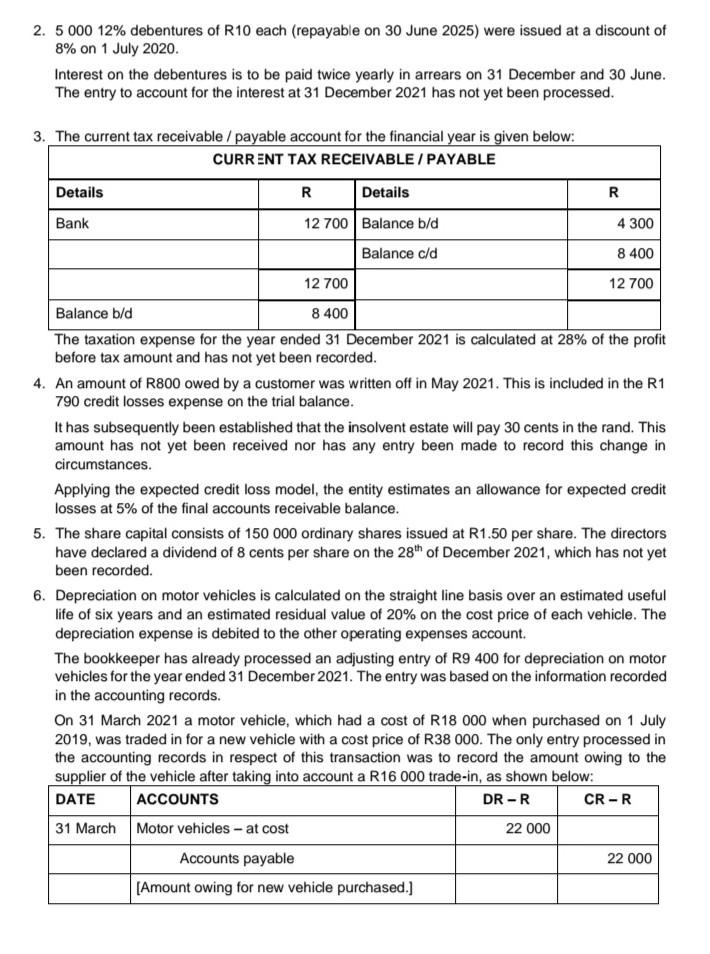

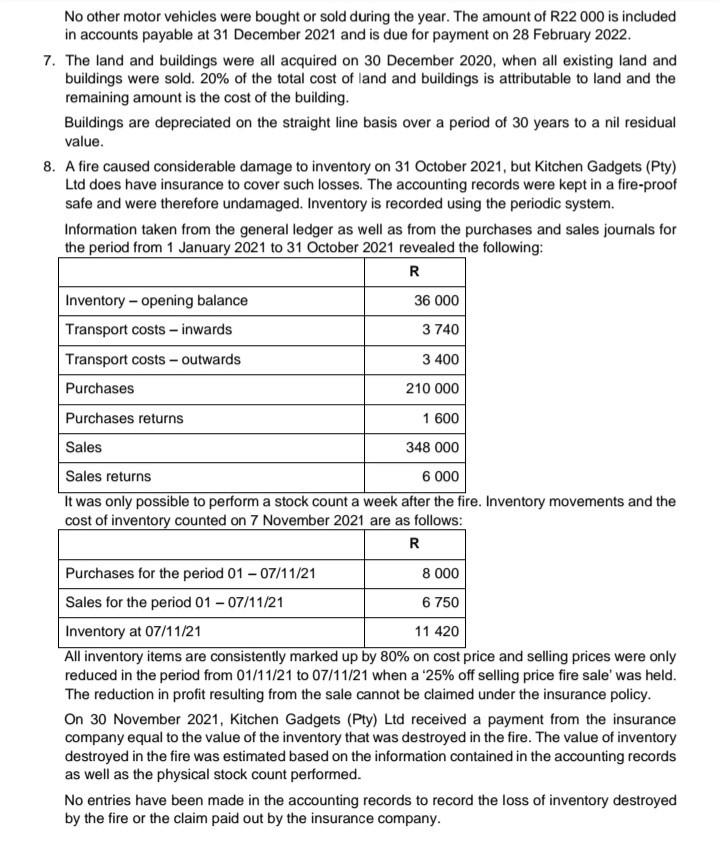

SCENARIO Kitchen Gadgets (Pty) Ltd is a small retail store that sells a unique range of branded kettles, toasters, food processors and coffee machines. The bookkeeper of Kitchen Gadgets (Pty) Ltd prepared the following trial balance at 31 December 2021, after passing SOME of the adjusting and SOME of the closing entries: After investigation, the accountant realised that adjusting and correcting entries have not yet been made in respect of the following: 1. An analysis of the bank statement for December 2021 revealed that: EFT payments made in December 2021 totalling R2 430 have not yet appeared on the bank statement. Outstanding deposits at the end of the year totalled R1 760 . Bank charges of R110 have not yet been recorded. A debit order payment for the monthly rent of R6000. A stop order for the monthly insurance premium of R654. 2. 500012% debentures of R10 each (repayable on 30 June 2025) were issued at a discount of 8% on 1 July 2020. Interest on the debentures is to be paid twice yearly in arrears on 31 December and 30 June. The entry to account for the interest at 31 December 2021 has not yet been processed. The taxation expense for the year ended 31 December 2021 is calculated at 28% of the profit before tax amount and has not yet been recorded. 4. An amount of R800 owed by a customer was written off in May 2021. This is included in the R1 790 credit losses expense on the trial balance. It has subsequently been established that the insolvent estate will pay 30 cents in the rand. This amount has not yet been received nor has any entry been made to record this change in circumstances. Applying the expected credit loss model, the entity estimates an allowance for expected credit losses at 5% of the final accounts receivable balance. 5. The share capital consists of 150000 ordinary shares issued at R1.50 per share. The directors have declared a dividend of 8 cents per share on the 28th of December 2021 , which has not yet been recorded. 6. Depreciation on motor vehicles is calculated on the straight line basis over an estimated useful life of six years and an estimated residual value of 20% on the cost price of each vehicle. The depreciation expense is debited to the other operating expenses account. The bookkeeper has already processed an adjusting entry of R9 400 for depreciation on motor vehicles for the year ended 31 December 2021 . The entry was based on the information recorded in the accounting records. On 31 March 2021 a motor vehicle, which had a cost of R18 000 when purchased on 1 July 2019 , was traded in for a new vehicle with a cost price of R38 000 . The only entry processed in No other motor vehicles were bought or sold during the year. The amount of R22 000 is included in accounts payable at 31 December 2021 and is due for payment on 28 February 2022. 7. The land and buildings were all acquired on 30 December 2020, when all existing land and buildings were sold. 20% of the total cost of land and buildings is attributable to land and the remaining amount is the cost of the building. Buildings are depreciated on the straight line basis over a period of 30 years to a nil residual value. 8. A fire caused considerable damage to inventory on 31 October 2021, but Kitchen Gadgets (Pty) Ltd does have insurance to cover such losses. The accounting records were kept in a fire-proof safe and were therefore undamaged. Inventory is recorded using the periodic system. Information taken from the general ledger as well as from the purchases and sales journals for the period from 1 January 2021 to 31 October 2021 revealed the following: It was only possible to perform a stock count a week after the fire. Inventory movements and the cost of inventory counted on 7 November 2021 are as follows: All inventory items are consistently marked up by 80% on cost price and selling prices were only reduced in the period from 01/11/21 to 07/11/21 when a '25\% off selling price fire sale' was held. The reduction in profit resulting from the sale cannot be claimed under the insurance policy. On 30 November 2021, Kitchen Gadgets (Pty) Ltd received a payment from the insurance company equal to the value of the inventory that was destroyed in the fire. The value of inventory destroyed in the fire was estimated based on the information contained in the accounting records as well as the physical stock count performed. No entries have been made in the accounting records to record the loss of inventory destroyed by the fire or the claim paid out by the insurance company. SCENARIO Kitchen Gadgets (Pty) Ltd is a small retail store that sells a unique range of branded kettles, toasters, food processors and coffee machines. The bookkeeper of Kitchen Gadgets (Pty) Ltd prepared the following trial balance at 31 December 2021, after passing SOME of the adjusting and SOME of the closing entries: After investigation, the accountant realised that adjusting and correcting entries have not yet been made in respect of the following: 1. An analysis of the bank statement for December 2021 revealed that: EFT payments made in December 2021 totalling R2 430 have not yet appeared on the bank statement. Outstanding deposits at the end of the year totalled R1 760 . Bank charges of R110 have not yet been recorded. A debit order payment for the monthly rent of R6000. A stop order for the monthly insurance premium of R654. 2. 500012% debentures of R10 each (repayable on 30 June 2025) were issued at a discount of 8% on 1 July 2020. Interest on the debentures is to be paid twice yearly in arrears on 31 December and 30 June. The entry to account for the interest at 31 December 2021 has not yet been processed. The taxation expense for the year ended 31 December 2021 is calculated at 28% of the profit before tax amount and has not yet been recorded. 4. An amount of R800 owed by a customer was written off in May 2021. This is included in the R1 790 credit losses expense on the trial balance. It has subsequently been established that the insolvent estate will pay 30 cents in the rand. This amount has not yet been received nor has any entry been made to record this change in circumstances. Applying the expected credit loss model, the entity estimates an allowance for expected credit losses at 5% of the final accounts receivable balance. 5. The share capital consists of 150000 ordinary shares issued at R1.50 per share. The directors have declared a dividend of 8 cents per share on the 28th of December 2021 , which has not yet been recorded. 6. Depreciation on motor vehicles is calculated on the straight line basis over an estimated useful life of six years and an estimated residual value of 20% on the cost price of each vehicle. The depreciation expense is debited to the other operating expenses account. The bookkeeper has already processed an adjusting entry of R9 400 for depreciation on motor vehicles for the year ended 31 December 2021 . The entry was based on the information recorded in the accounting records. On 31 March 2021 a motor vehicle, which had a cost of R18 000 when purchased on 1 July 2019 , was traded in for a new vehicle with a cost price of R38 000 . The only entry processed in No other motor vehicles were bought or sold during the year. The amount of R22 000 is included in accounts payable at 31 December 2021 and is due for payment on 28 February 2022. 7. The land and buildings were all acquired on 30 December 2020, when all existing land and buildings were sold. 20% of the total cost of land and buildings is attributable to land and the remaining amount is the cost of the building. Buildings are depreciated on the straight line basis over a period of 30 years to a nil residual value. 8. A fire caused considerable damage to inventory on 31 October 2021, but Kitchen Gadgets (Pty) Ltd does have insurance to cover such losses. The accounting records were kept in a fire-proof safe and were therefore undamaged. Inventory is recorded using the periodic system. Information taken from the general ledger as well as from the purchases and sales journals for the period from 1 January 2021 to 31 October 2021 revealed the following: It was only possible to perform a stock count a week after the fire. Inventory movements and the cost of inventory counted on 7 November 2021 are as follows: All inventory items are consistently marked up by 80% on cost price and selling prices were only reduced in the period from 01/11/21 to 07/11/21 when a '25\% off selling price fire sale' was held. The reduction in profit resulting from the sale cannot be claimed under the insurance policy. On 30 November 2021, Kitchen Gadgets (Pty) Ltd received a payment from the insurance company equal to the value of the inventory that was destroyed in the fire. The value of inventory destroyed in the fire was estimated based on the information contained in the accounting records as well as the physical stock count performed. No entries have been made in the accounting records to record the loss of inventory destroyed by the fire or the claim paid out by the insurance company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started