Question

Scenario Snidely Limited spent $1 million this year to upgrade its manufacturing plant, which had received several warnings from the state environmental agency about releasing

Scenario

Snidely Limited spent $1 million this year to upgrade its manufacturing plant, which had received several warnings from the state environmental agency about releasing pollution into the local river. Late in the year, Snidely received an assessment of $700,000 for violating the state's Clean Water Act. After he negotiated with the state, which cost $135,000 in legal fees, Snidely promised to spend another $200,000 next year for more pollution-control devices, and the fine was reduced to $450,000. How much of these expenditures can Snidely Limited deduct for tax purposes?

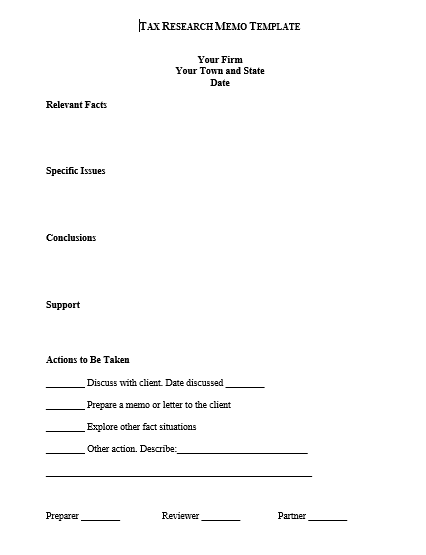

Prepare (in good form) a research memorandum.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started