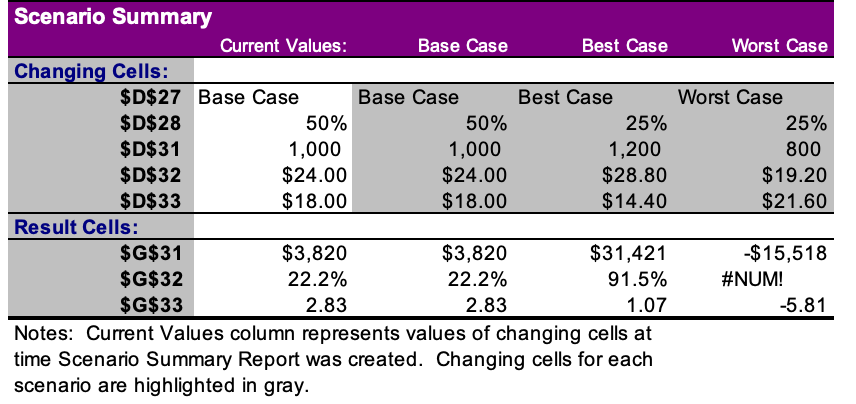

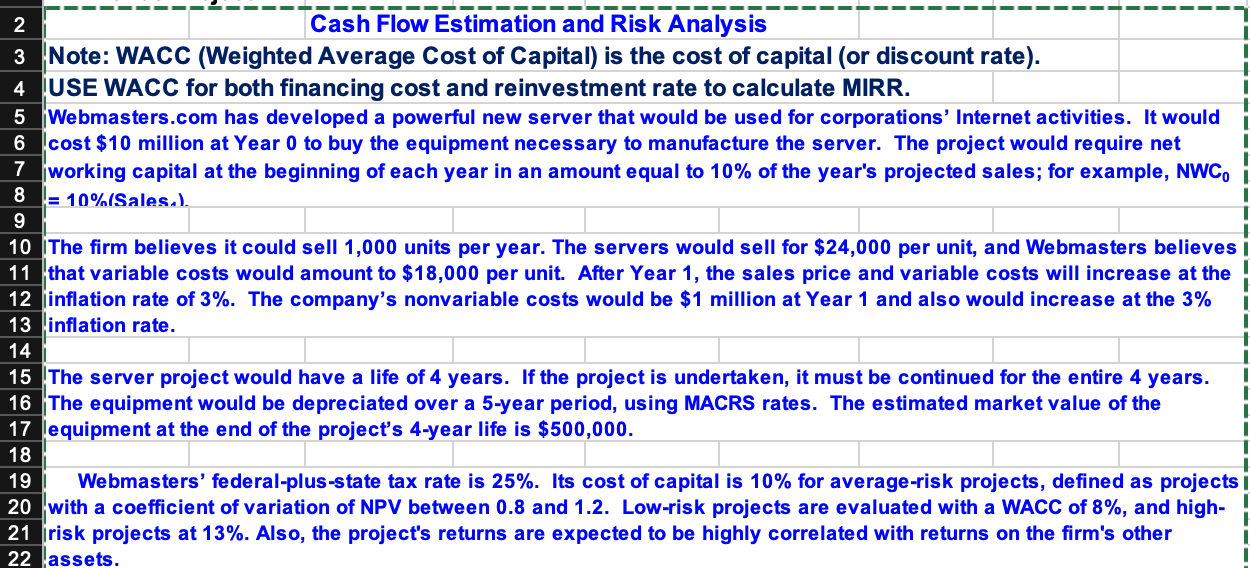

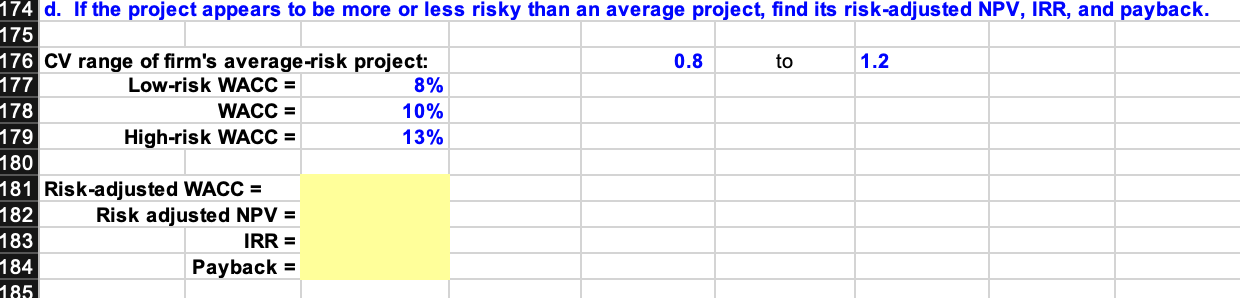

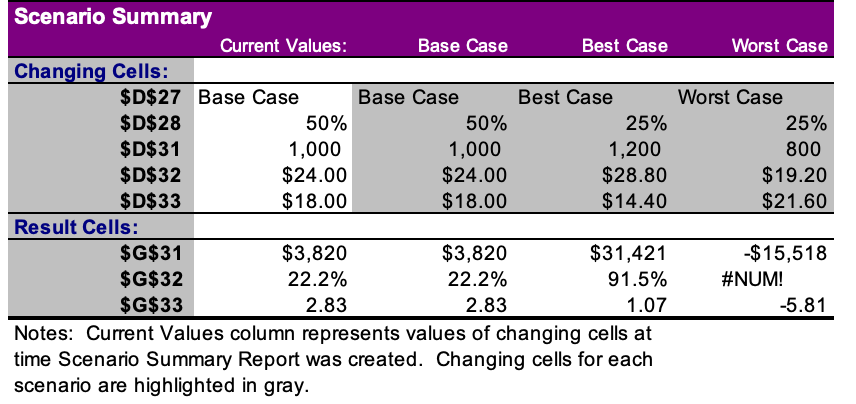

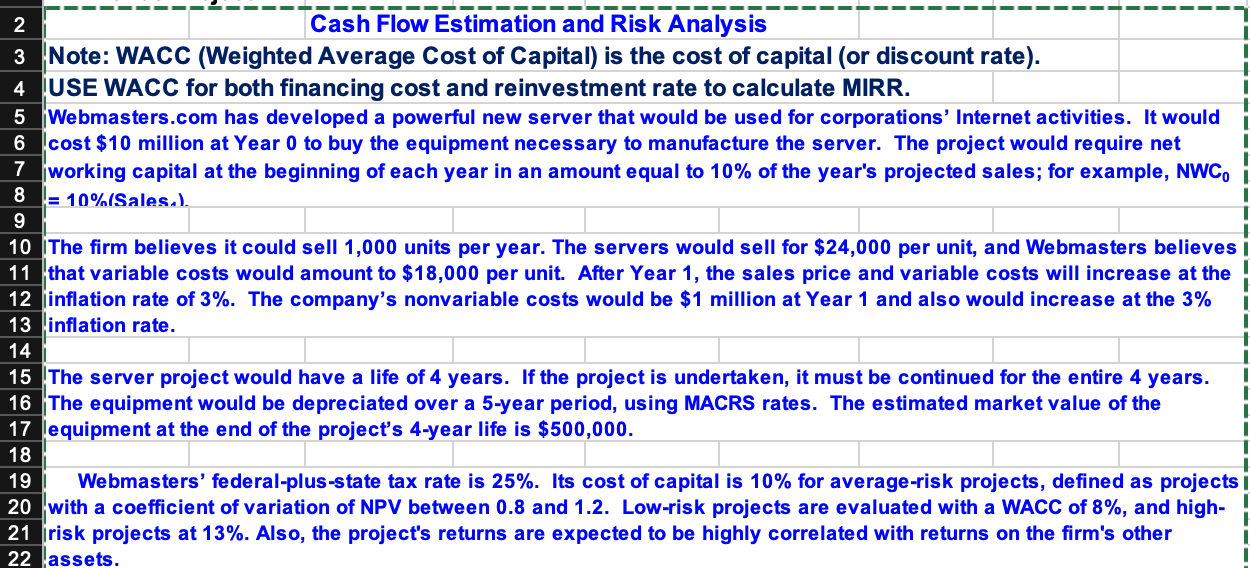

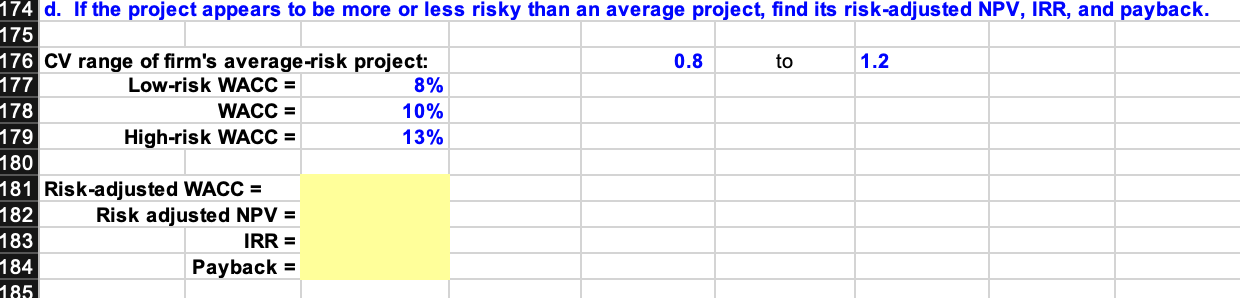

Scenario Summary Current Values: Base Case Best Case Worst Case Changing Cells: $D$27 Base Case Base Case Best Case Worst Case $D$28 50% 50% 25% 25% $D$31 1,000 1,000 1,200 800 $D$32 $24.00 $24.00 $28.80 $19.20 $D$33 $18.00 $18.00 $14.40 $21.60 Result Cells: $G$31 $3,820 $3,820 $31,421 $15,518 $G$32 22.2% 22.2% 91.5% #NUM! $G$33 2.83 2.83 1.07 -5.81 Notes: Current Values column represents values of changing cells at time Scenario Summary Report was created. Changing cells for each scenario are highlighted in gray. 2 Cash Flow Estimation and Risk Analysis 3 Note: WACC (Weighted Average Cost of Capital) is the cost of capital (or discount rate). 4 USE WACC for both financing cost and reinvestment rate to calculate MIRR. 5 Webmasters.com has developed a powerful new server that would be used for corporations' Internet activities. It would 6 cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net 7 working capital at the beginning of each year in an amount equal to 10% of the year's projected sales; for example, NWC, i 8 = 10%(Sales.). 9 10 The firm believes it could sell 1,000 units per year. The servers would sell for $24,000 per unit, and Webmasters believes 11 that variable costs would amount to $18,000 per unit. After Year 1, the sales price and variable costs will increase at the 12 inflation rate of 3%. The company's nonvariable costs would be $1 million at Year 1 and also would increase at the 3% 13 inflation rate. 14 15 The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. 16 The equipment would be depreciated over a 5-year period, using MACRS rates. The estimated market value of the . 17 equipment at the end of the project's 4-year life is $500,000. 18 19 Webmasters' federal-plus-state tax rate is 25%. Its cost of capital is 10% for average-risk projects, defined as projects 20 with a coefficient of variation of NPV between 0.8 and 1.2. Low-risk projects are evaluated with a WACC of 8%, and high- 21 frisk projects at 13%. Also, the project's returns are expected to be highly correlated with returns on the firm's other I 22 assets. 1 1 174 d. If the project appears to be more or less risky than an average project, find its risk-adjusted NPV, IRR, and payback. 175 176 CV range of firm's average-risk project: 0.8 to 1.2 177 Low-risk WACC = 8% 178 WACC = 10% 179 High-risk WACC = 13% 180 181 Risk-adjusted WACC = 182 Risk adjusted NPV = 183 IRR = 184 Payback = 185 Scenario Summary Current Values: Base Case Best Case Worst Case Changing Cells: $D$27 Base Case Base Case Best Case Worst Case $D$28 50% 50% 25% 25% $D$31 1,000 1,000 1,200 800 $D$32 $24.00 $24.00 $28.80 $19.20 $D$33 $18.00 $18.00 $14.40 $21.60 Result Cells: $G$31 $3,820 $3,820 $31,421 $15,518 $G$32 22.2% 22.2% 91.5% #NUM! $G$33 2.83 2.83 1.07 -5.81 Notes: Current Values column represents values of changing cells at time Scenario Summary Report was created. Changing cells for each scenario are highlighted in gray. 2 Cash Flow Estimation and Risk Analysis 3 Note: WACC (Weighted Average Cost of Capital) is the cost of capital (or discount rate). 4 USE WACC for both financing cost and reinvestment rate to calculate MIRR. 5 Webmasters.com has developed a powerful new server that would be used for corporations' Internet activities. It would 6 cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net 7 working capital at the beginning of each year in an amount equal to 10% of the year's projected sales; for example, NWC, i 8 = 10%(Sales.). 9 10 The firm believes it could sell 1,000 units per year. The servers would sell for $24,000 per unit, and Webmasters believes 11 that variable costs would amount to $18,000 per unit. After Year 1, the sales price and variable costs will increase at the 12 inflation rate of 3%. The company's nonvariable costs would be $1 million at Year 1 and also would increase at the 3% 13 inflation rate. 14 15 The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. 16 The equipment would be depreciated over a 5-year period, using MACRS rates. The estimated market value of the . 17 equipment at the end of the project's 4-year life is $500,000. 18 19 Webmasters' federal-plus-state tax rate is 25%. Its cost of capital is 10% for average-risk projects, defined as projects 20 with a coefficient of variation of NPV between 0.8 and 1.2. Low-risk projects are evaluated with a WACC of 8%, and high- 21 frisk projects at 13%. Also, the project's returns are expected to be highly correlated with returns on the firm's other I 22 assets. 1 1 174 d. If the project appears to be more or less risky than an average project, find its risk-adjusted NPV, IRR, and payback. 175 176 CV range of firm's average-risk project: 0.8 to 1.2 177 Low-risk WACC = 8% 178 WACC = 10% 179 High-risk WACC = 13% 180 181 Risk-adjusted WACC = 182 Risk adjusted NPV = 183 IRR = 184 Payback = 185