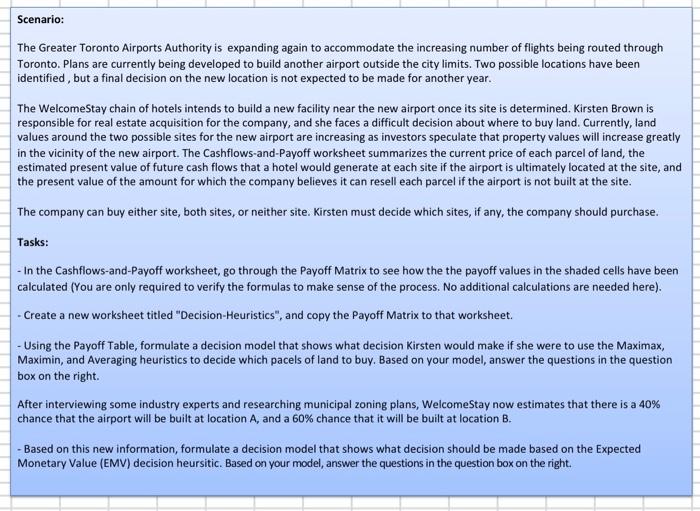

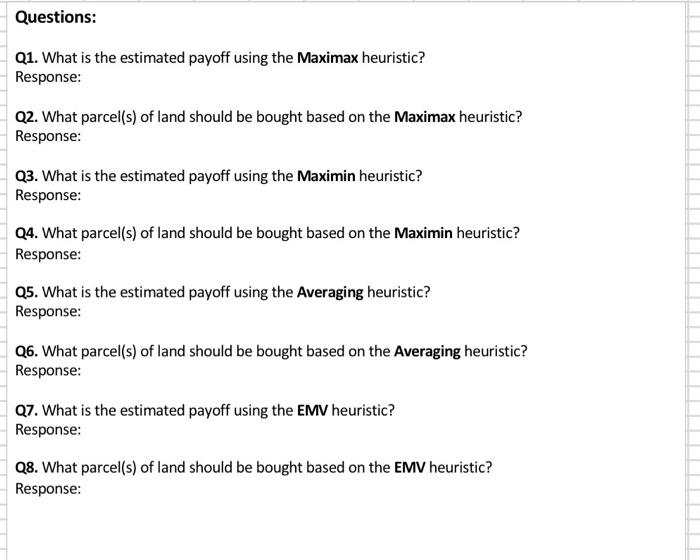

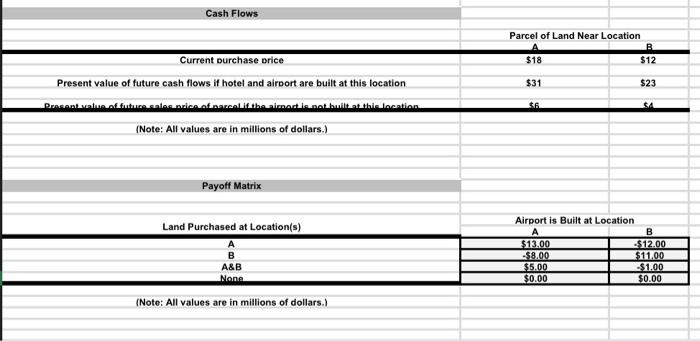

Scenario: The Greater Toronto Airports Authority is expanding again to accommodate the increasing number of flights being routed through Toronto. Plans are currently being developed to build another airport outside the city limits. Two possible locations have been identified, but a final decision on the new location is not expected to be made for another year. The WelcomeStay chain of hotels intends to build a new facility near the new airport once its site is determined. Kirsten Brown is responsible for real estate acquisition for the company, and she faces a difficult decision about where to buy land. Currently, land values around the two possible sites for the new airport are increasing as investors speculate that property values will increase greatly in the vicinity of the new airport. The Cashflows-and-Payoff worksheet summarizes the current price of each parcel of land, the estimated present value of future cash flows that a hotel would generate at each site if the airport is ultimately located at the site, and the present value of the amount for which the company believes it can resell each parcel if the airport is not built at the site. The company can buy either site, both sites, or neither site. Kirsten must decide which sites, if any, the company should purchase. Tasks: - In the Cashflows-and-Payoff worksheet, go through the Payoff Matrix to see how the the payoff values in the shaded cells have been calculated (You are only required to verify the formulas to make sense of the process. No additional calculations are needed here). Create a new worksheet titled "Decision-Heuristics", and copy the Payoff Matrix to that worksheet. - Using the Payoff Table, formulate a decision model that shows what decision Kirsten would make if she were to use the Maximax, Maximin, and Averaging heuristics to decide which pacels of land to buy. Based on your model, answer the questions in the question box on the right After interviewing some industry experts and researching municipal zoning plans, WelcomeStay now estimates that there is a 40% chance that the airport will be built at location A, and a 60% chance that it will be built at location B. - Based on this new information, formulate a decision model that shows what decision should be made based on the Expected Monetary Value (EMV) decision heursitic. Based on your model, answer the questions in the question box on the right. Questions: Q1. What is the estimated payoff using the Maximax heuristic? Response: Q2. What parcel(s) of land should be bought based on the Maximax heuristic? Response: Q3. What is the estimated payoff using the Maximin heuristic? Response: Q4. What parcel(s) of land should be bought based on the Maximin heuristic? Response: Q5. What is the estimated payoff using the Averaging heuristic? Response: Q6. What parcel(s) of land should be bought based on the Averaging heuristic? Response: Q7. What is the estimated payoff using the EMV heuristic? Response: Q8. What parcel(s) of land should be bought based on the EMV heuristic? Response: Cash Flows Parcel of Land Near Location $18 $12 $31 $23 Current purchase price Present value of future cash flows it hotel and airport are built at this location Presentation of sales price of narcolinha nimadile not hit at this location (Note: All values are in millions of dollars.) $6 Payoff Matrix Land Purchased at Location(s) A B A&B None Airport is Built at Location A B $13.00 $12.00 -$8.00 $11,00 $5.00 $1.00 $0.00 $0.00 (Note: All values are in millions of dollars.) Scenario: The Greater Toronto Airports Authority is expanding again to accommodate the increasing number of flights being routed through Toronto. Plans are currently being developed to build another airport outside the city limits. Two possible locations have been identified, but a final decision on the new location is not expected to be made for another year. The WelcomeStay chain of hotels intends to build a new facility near the new airport once its site is determined. Kirsten Brown is responsible for real estate acquisition for the company, and she faces a difficult decision about where to buy land. Currently, land values around the two possible sites for the new airport are increasing as investors speculate that property values will increase greatly in the vicinity of the new airport. The Cashflows-and-Payoff worksheet summarizes the current price of each parcel of land, the estimated present value of future cash flows that a hotel would generate at each site if the airport is ultimately located at the site, and the present value of the amount for which the company believes it can resell each parcel if the airport is not built at the site. The company can buy either site, both sites, or neither site. Kirsten must decide which sites, if any, the company should purchase. Tasks: - In the Cashflows-and-Payoff worksheet, go through the Payoff Matrix to see how the the payoff values in the shaded cells have been calculated (You are only required to verify the formulas to make sense of the process. No additional calculations are needed here). Create a new worksheet titled "Decision-Heuristics", and copy the Payoff Matrix to that worksheet. - Using the Payoff Table, formulate a decision model that shows what decision Kirsten would make if she were to use the Maximax, Maximin, and Averaging heuristics to decide which pacels of land to buy. Based on your model, answer the questions in the question box on the right After interviewing some industry experts and researching municipal zoning plans, WelcomeStay now estimates that there is a 40% chance that the airport will be built at location A, and a 60% chance that it will be built at location B. - Based on this new information, formulate a decision model that shows what decision should be made based on the Expected Monetary Value (EMV) decision heursitic. Based on your model, answer the questions in the question box on the right. Questions: Q1. What is the estimated payoff using the Maximax heuristic? Response: Q2. What parcel(s) of land should be bought based on the Maximax heuristic? Response: Q3. What is the estimated payoff using the Maximin heuristic? Response: Q4. What parcel(s) of land should be bought based on the Maximin heuristic? Response: Q5. What is the estimated payoff using the Averaging heuristic? Response: Q6. What parcel(s) of land should be bought based on the Averaging heuristic? Response: Q7. What is the estimated payoff using the EMV heuristic? Response: Q8. What parcel(s) of land should be bought based on the EMV heuristic? Response: Cash Flows Parcel of Land Near Location $18 $12 $31 $23 Current purchase price Present value of future cash flows it hotel and airport are built at this location Presentation of sales price of narcolinha nimadile not hit at this location (Note: All values are in millions of dollars.) $6 Payoff Matrix Land Purchased at Location(s) A B A&B None Airport is Built at Location A B $13.00 $12.00 -$8.00 $11,00 $5.00 $1.00 $0.00 $0.00 (Note: All values are in millions of dollars.)