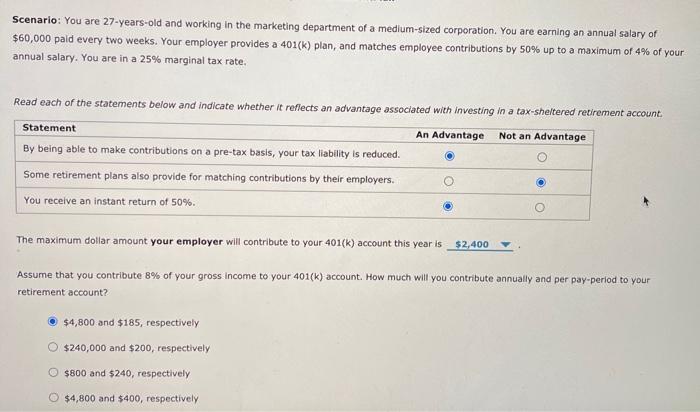

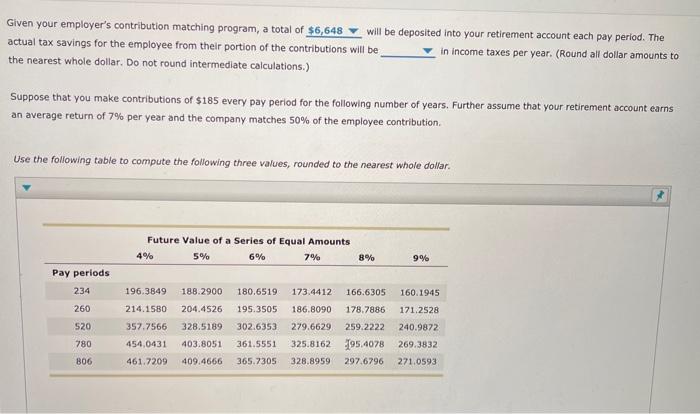

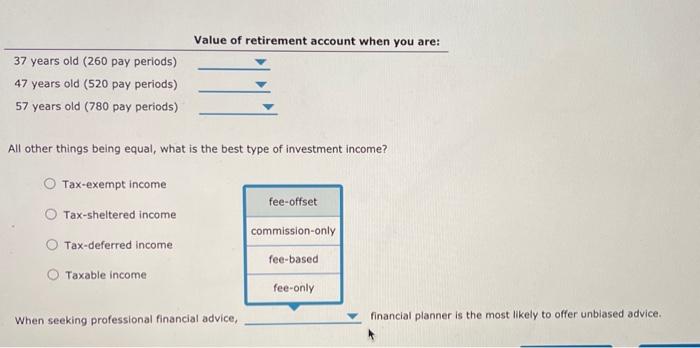

Scenario: You are 27-years-old and working in the marketing department of a medium-sized corporation. You are earning an annual salary of $60,000 pald every two weeks. Your employer provides a 401(k) plan, and matches employee contributions by 50% up to a maximum of 4% of your annual salary. You are in a 25% marginal tax rate. Read each of the statements below and indicate whether it reflects an advantage associated with investing in a tax-sheltered retirement account Statement An Advantage Not an Advantage By being able to make contributions on a pre-tax basis, your tax liability is reduced. Some retirement plans also provide for matching contributions by their employers. You receive an instant return of 50%. The maximum dollar amount your employer will contribute to your 401(k) account this year is $2,400 Assume that you contribute 8% of your gross income to your 401(k) account. How much will you contribute annually and per pay-period to your retirement account? $4,800 and $185, respectively $240,000 and $200, respectively $800 and $240, respectively $4,800 and $400, respectively Given your employer's contribution matching program, a total of $6,648 will be deposited into your retirement account each pay period. The actual tax savings for the employee from their portion of the contributions will be in income taxes per year. (Round all dollar amounts to the nearest whole dollar. Do not round intermediate calculations.) Suppose that you make contributions of $185 every pay period for the following number of years. Further assume that your retirement account earns an average return of 7% per year and the company matches 50% of the employee contribution Use the following table to compute the following three values, rounded to the nearest whole dollar. Future Value of a Series of Equal Amounts 4% 5% 6% 7% 8% 9% Pay periods 234 260 196.3849 180.6519 188.2900 204.4526 214.1580 357.7566 520 328.5189 195.3505 302.6353 361.5551 365.7305 173.4412 166.6305 160.1945 186.8090 178.7886 171.2528 279.6629 259.2222 240.9872 325.8162 95.4078 269.3832 328.8959 297.6796 271.0593 780 454,0431 461.7209 403.8051 409.4666 B06 Value of retirement account when you are: 37 years old (260 pay periods) 47 years old (520 pay periods) 57 years old (780 pay periods) All other things being equal, what is the best type of investment income? Tax-exempt income fee-offset Tax-sheltered Income commission-only Tax-deferred income Taxable income fee-based fee-only When seeking professional financial advice, financial planner is the most likely to offer unbiased advice