Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SCENARIO You are a Financial Analyst at Agri Communications Ltd. (AgriComm). AgriCommdevelops and manufactures equipment for technology and communications in the rural environment. Since

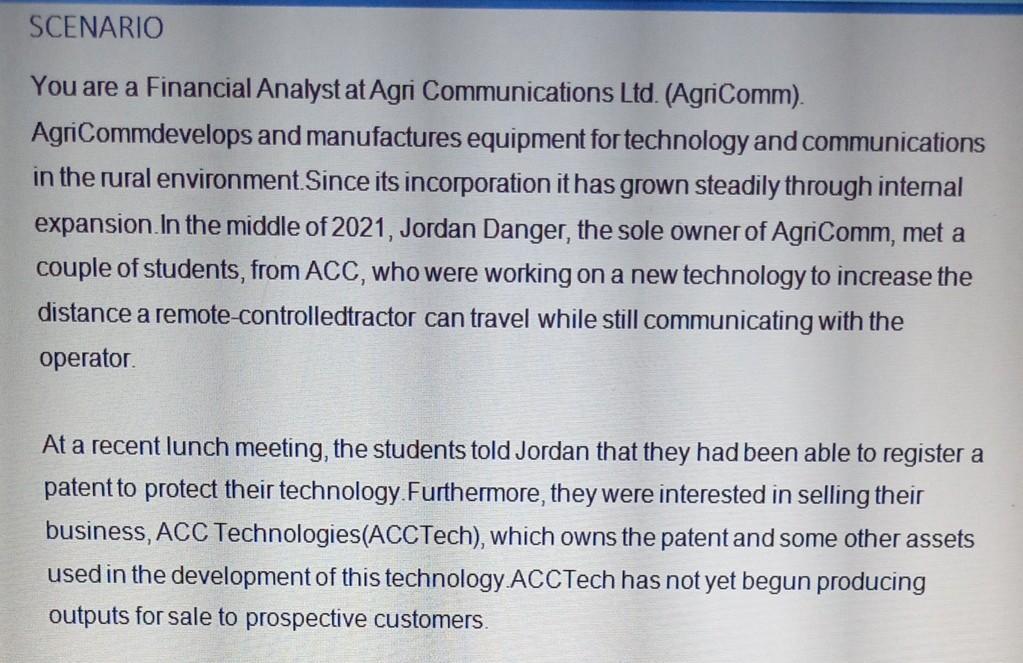

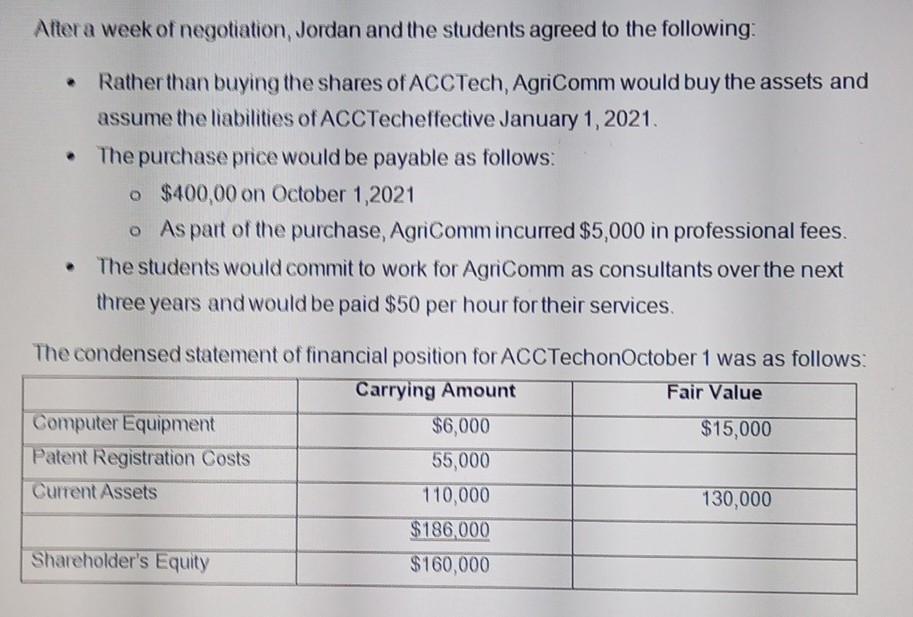

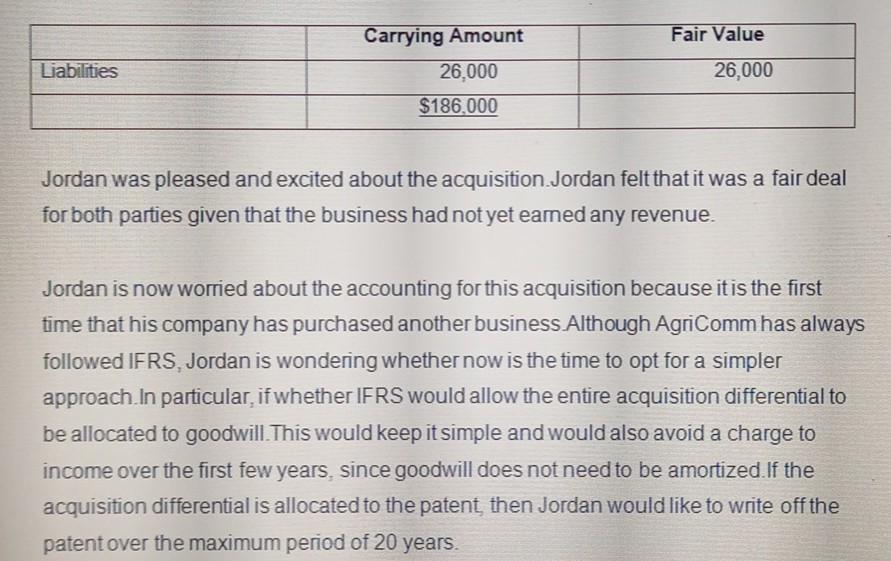

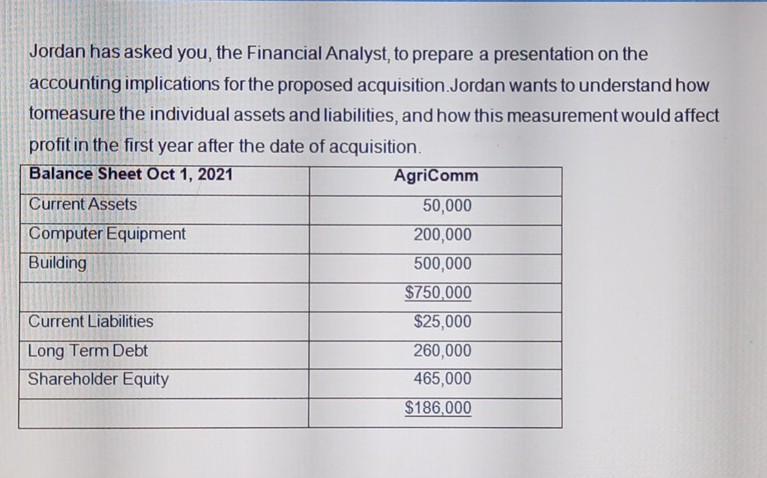

SCENARIO You are a Financial Analyst at Agri Communications Ltd. (AgriComm). AgriCommdevelops and manufactures equipment for technology and communications in the rural environment. Since its incorporation it has grown steadily through internal expansion. In the middle of 2021, Jordan Danger, the sole owner of AgriComm, met a couple of students, from ACC, who were working on a new technology to increase the distance a remote-controlledtractor can travel while still communicating with the operator. At a recent lunch meeting, the students told Jordan that they had been able to register a patent to protect their technology. Furthermore, they were interested in selling their business, ACC Technologies(ACCTech), which owns the patent and some other assets used in the development of this technology ACCTech has not yet begun producing outputs for sale to prospective customers. After a week of negotiation, Jordan and the students agreed to the following: Rather than buying the shares of ACCTech, AgriComm would buy the assets and assume the liabilities of ACCTecheffective January 1, 2021. The purchase price would be payable as follows: o $400,00 on October 1,2021 o As part of the purchase, AgriComm incurred $5,000 in professional fees. The students would commit to work for AgriComm as consultants over the next three years and would be paid $50 per hour for their services. The condensed statement of financial position for ACCTechonOctober 1 was as follows: Carrying Amount Fair Value $15,000 Computer Equipment Patent Registration Costs Current Assets Shareholder's Equity $6,000 55,000 110,000 $186,000 $160,000 130,000 Liabilities Carrying Amount 26,000 $186,000 Fair Value 26,000 Jordan was pleased and excited about the acquisition Jordan felt that it was a fair deal for both parties given that the business had not yet earned any revenue. Jordan is now worried about the accounting for this acquisition because it is the first time that his company has purchased another business Although AgriComm has always followed IFRS, Jordan is wondering whether now is the time to opt for a simpler approach.In particular, if whether IFRS would allow the entire acquisition differential to be allocated to goodwill. This would keep it simple and would also avoid a charge to income over the first few years, since goodwill does not need to be amortized. If the acquisition differential is allocated to the patent, then Jordan would like to write off the patent over the maximum period of 20 years. Jordan has asked you, the Financial Analyst, to prepare a presentation on the accounting implications for the proposed acquisition.Jordan wants to understand how tomeasure the individual assets and liabilities, and how this measurement would affect profit in the first year after the date of acquisition. Balance Sheet Oct 1, 2021 Current Assets Computer Equipment Building Current Liabilities Long Term Debt Shareholder Equity AgriComm 50,000 200,000 500,000 $750,000 $25,000 260,000 465,000 $186,000

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Presentation on Accounting Implications for the Acquisition of ACCTech by AgriComm Slide 1 Introduction Welcome to the presentation on the accounting implications of the proposed acquisition of ACCTec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started