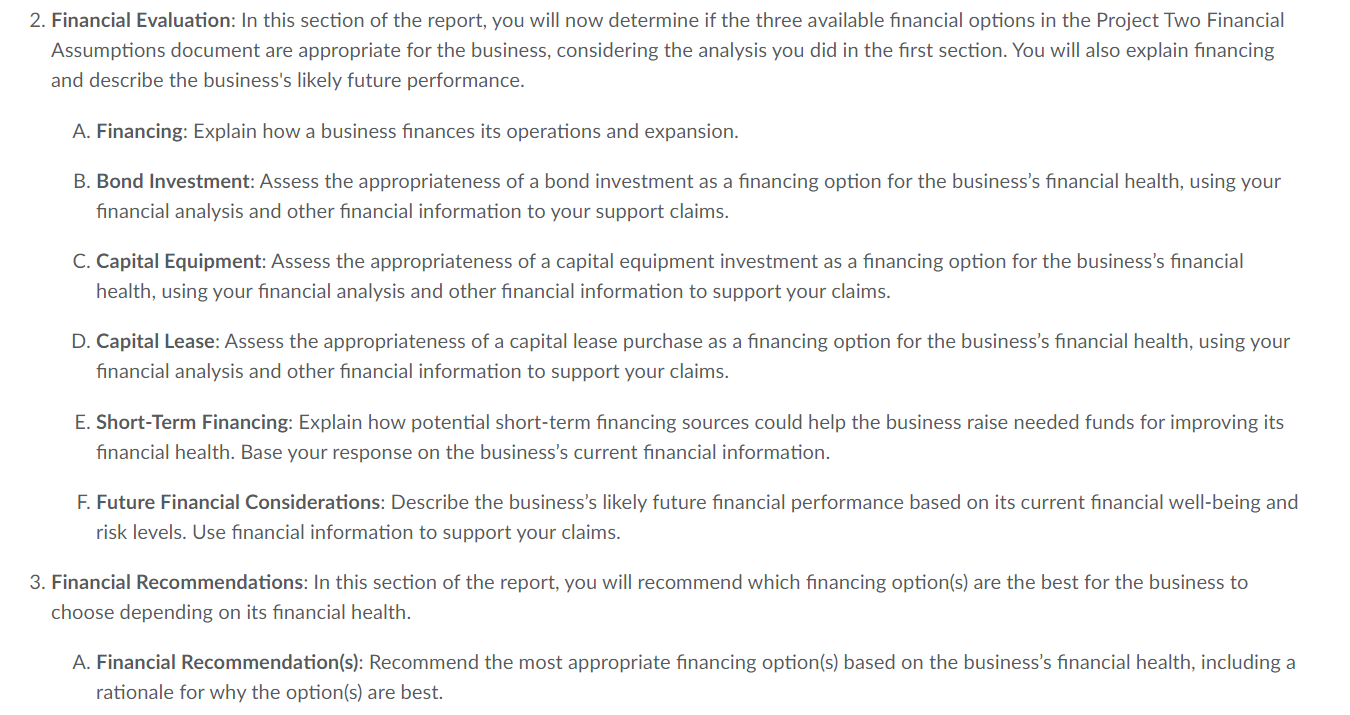

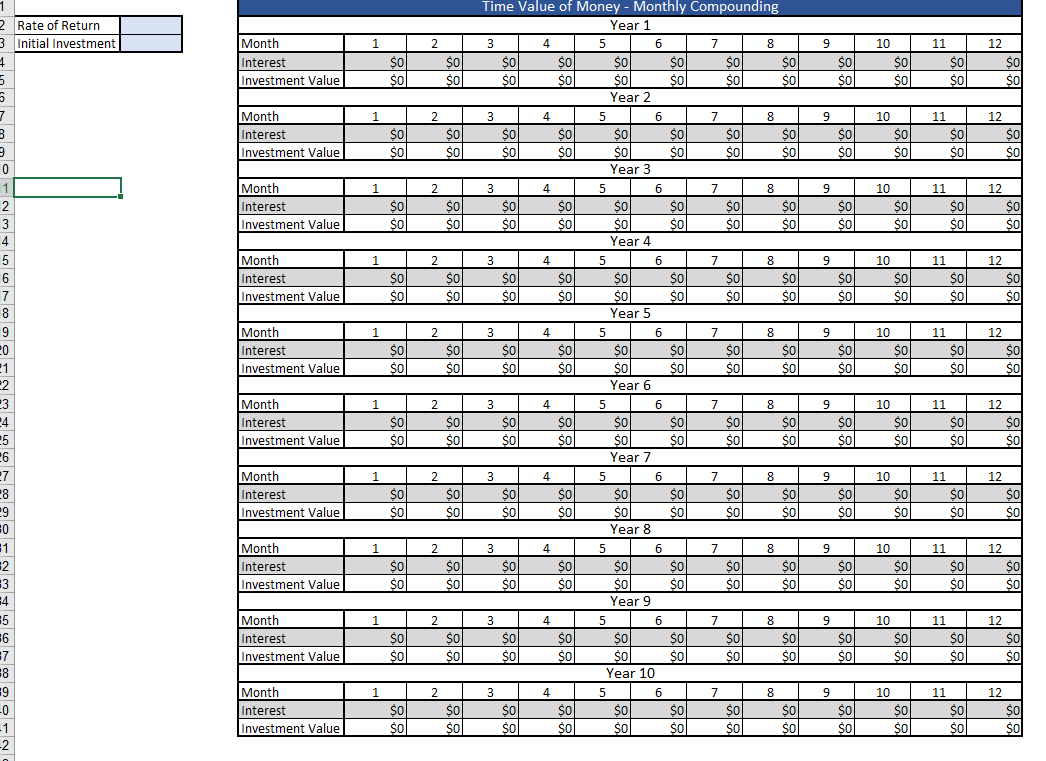

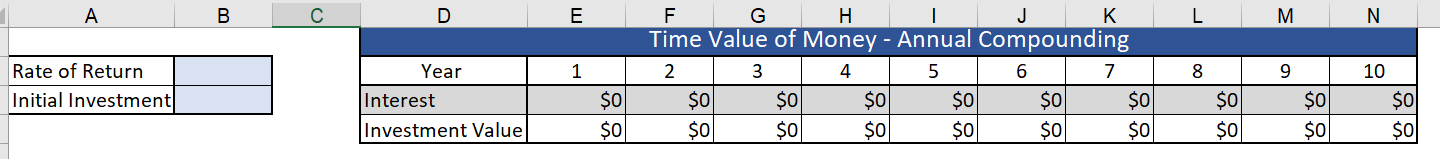

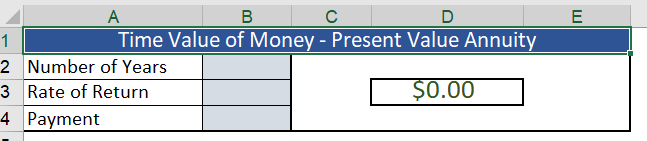

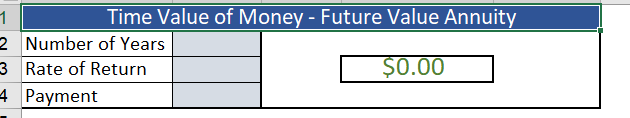

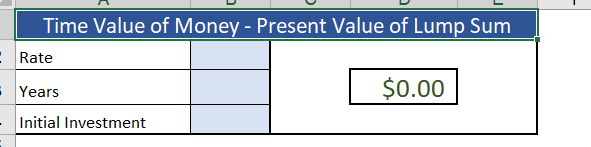

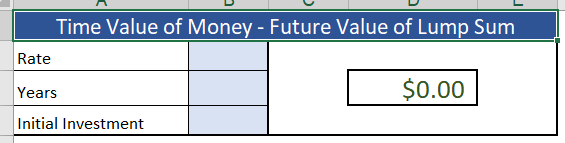

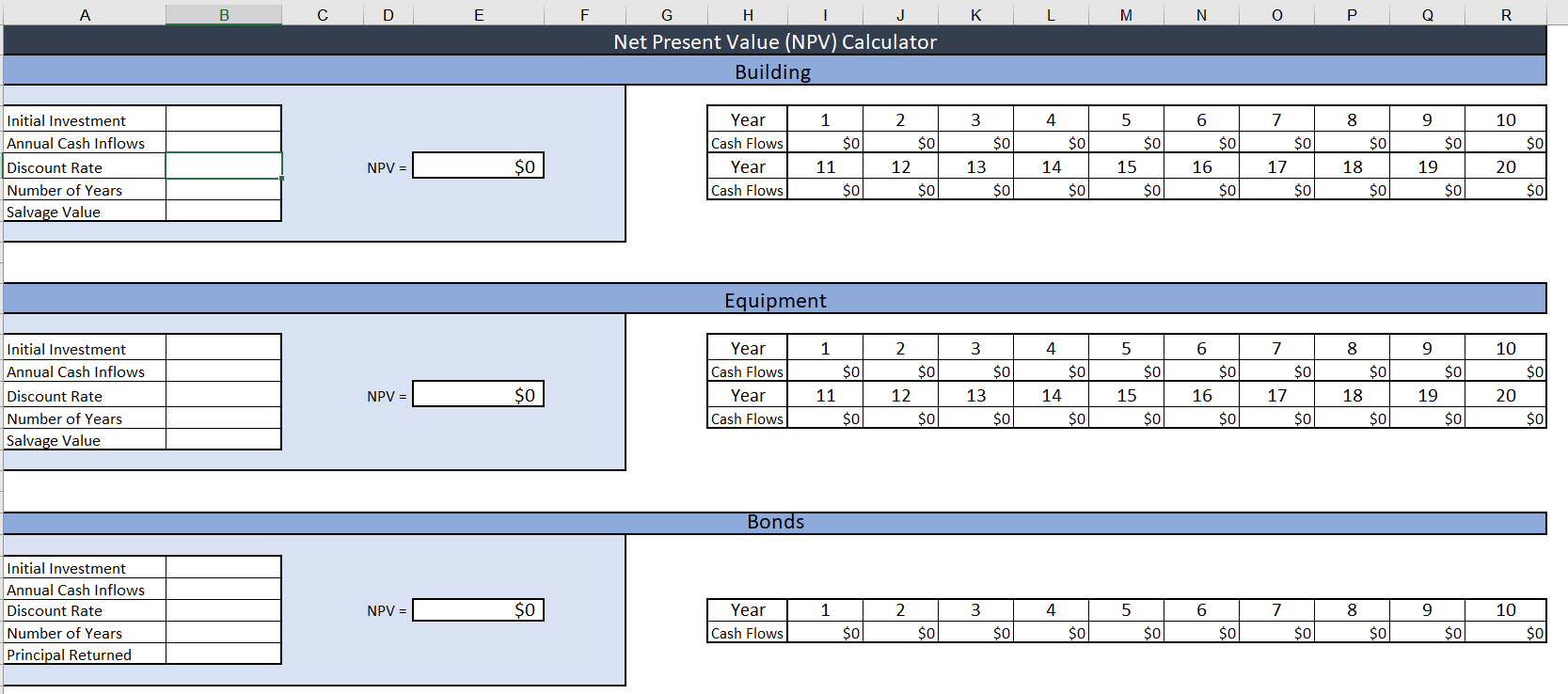

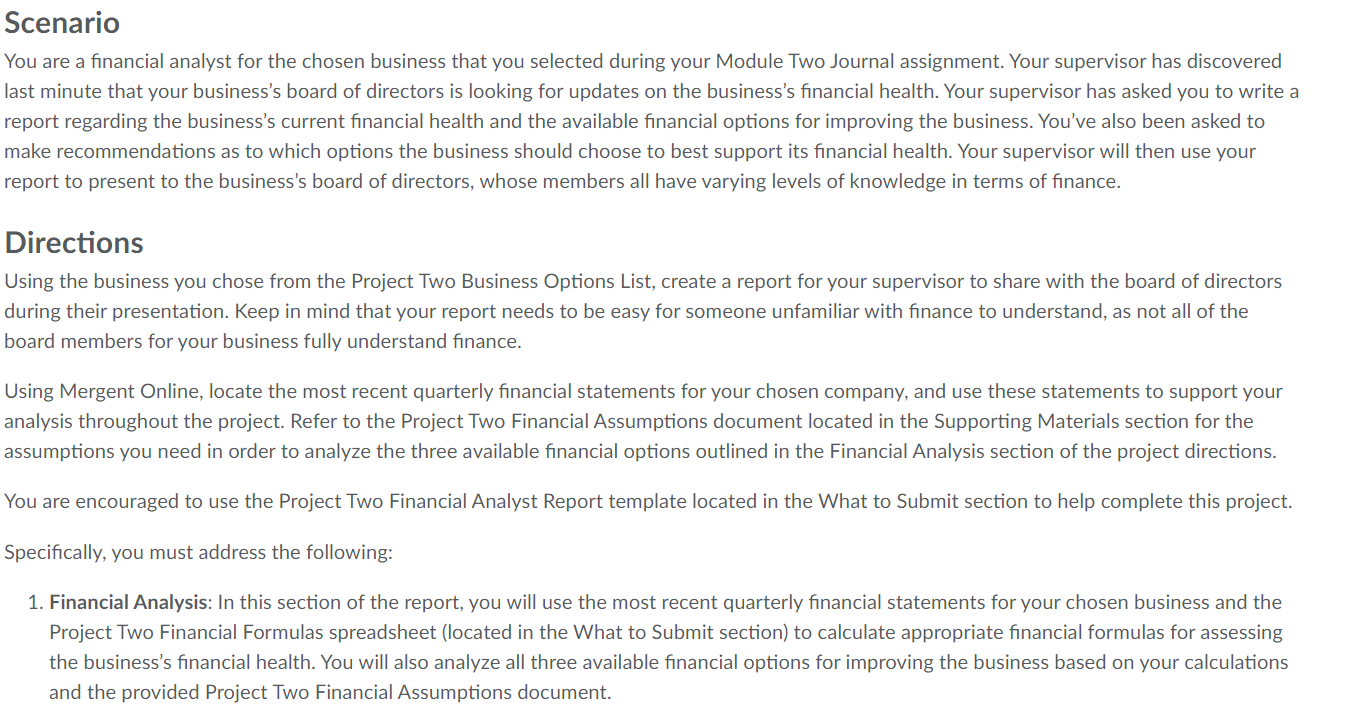

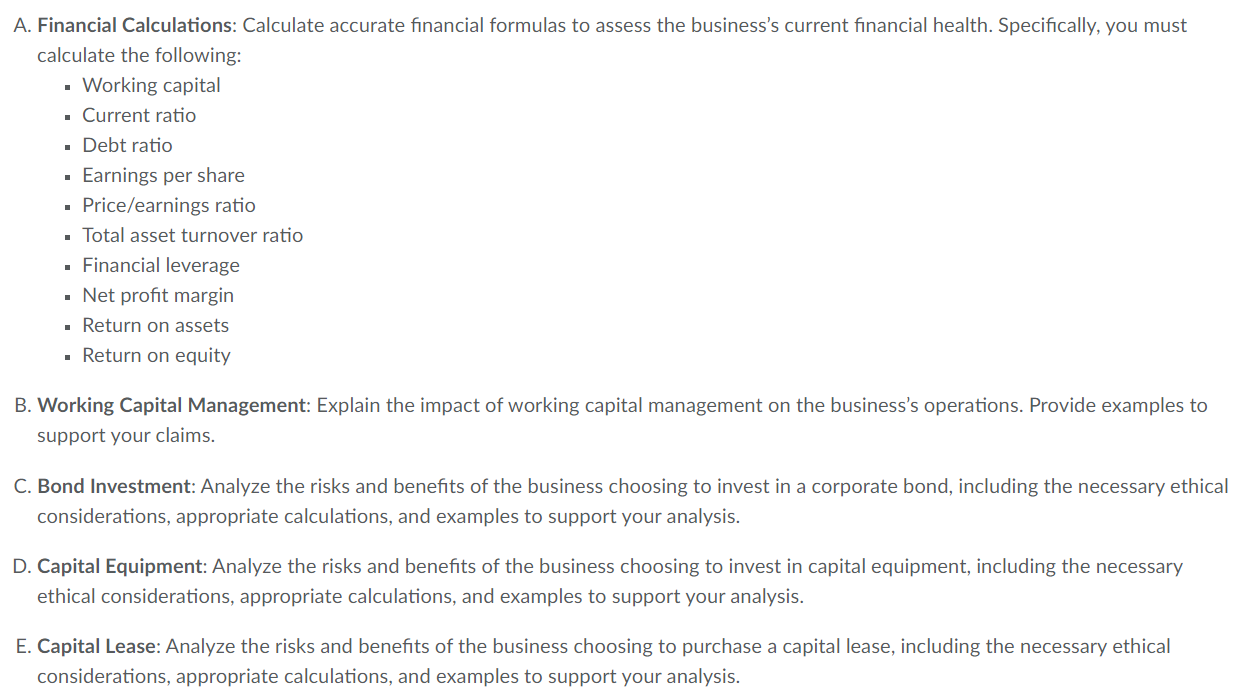

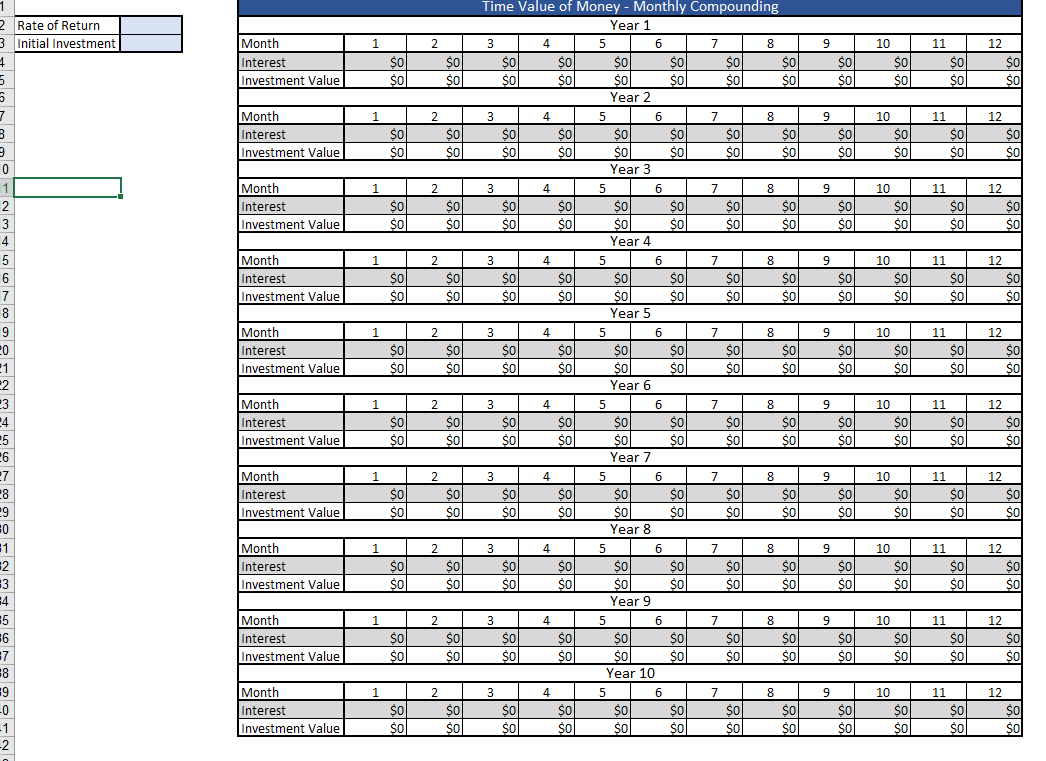

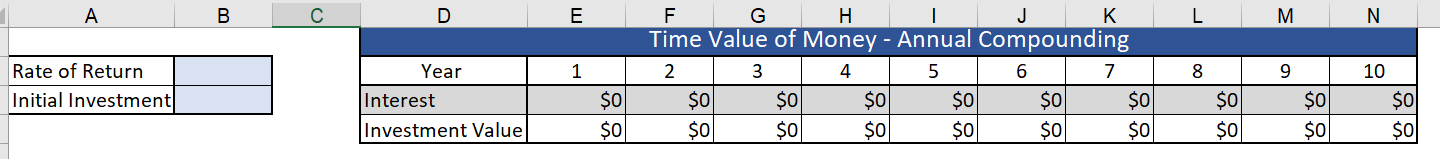

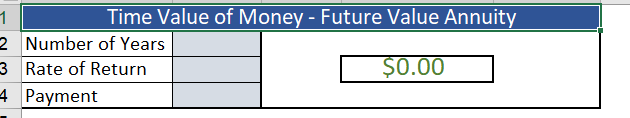

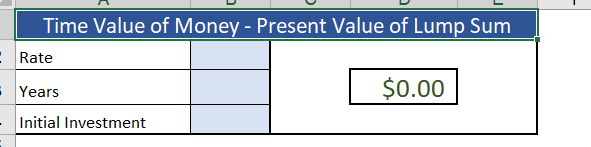

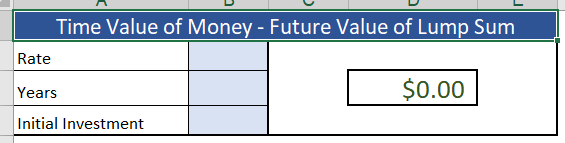

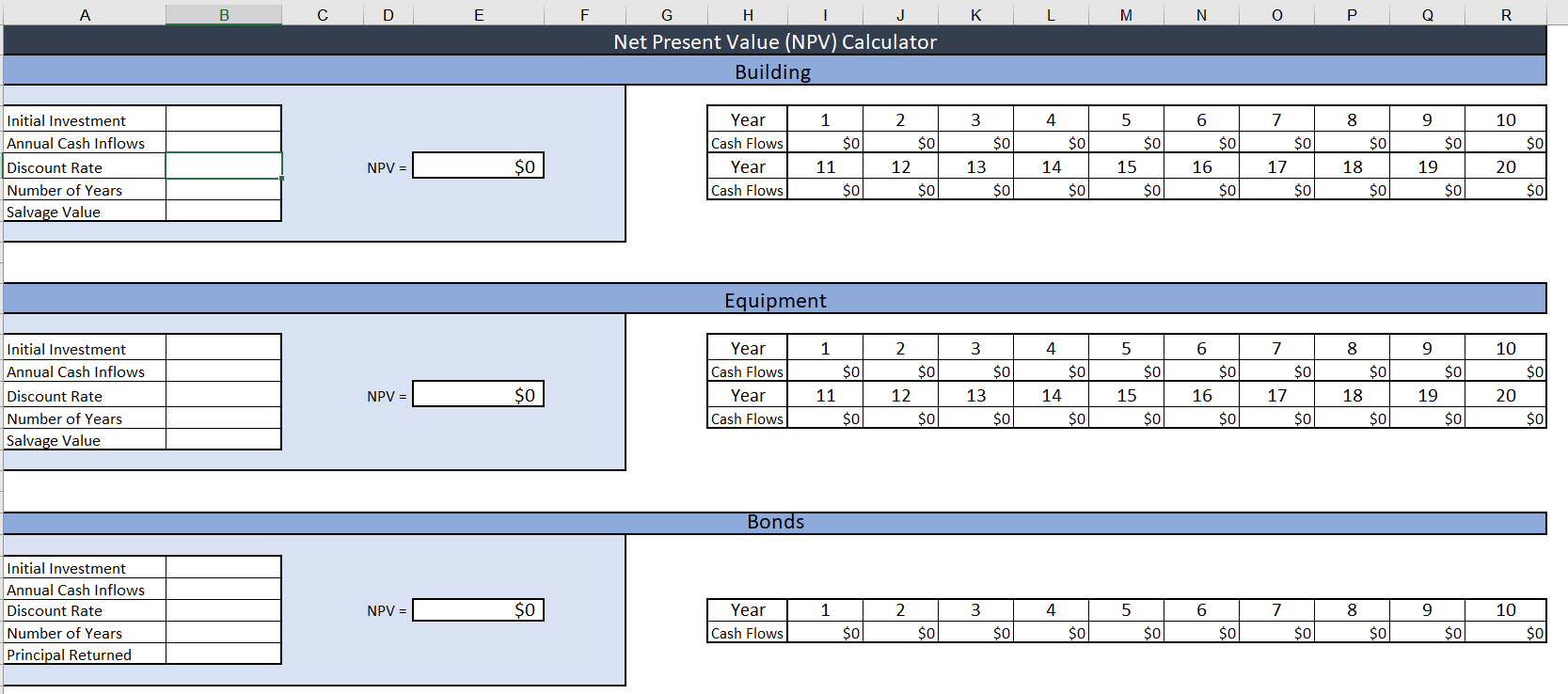

Scenario You are a financial analyst for the chosen business that you selected during your Module Two Journal assignment. Your supervisor has discovered last minute that your business's board of directors is looking for updates on the business's financial health. Your supervisor has asked you to write a report regarding the business's current financial health and the available financial options for improving the business. You've also been asked to make recommendations as to which options the business should choose to best support its financial health. Your supervisor will then use your report to present to the business's board of directors, whose members all have varying levels of knowledge in terms of finance. Directions Using the business you chose from the Project Two Business Options List, create a report for your supervisor to share with the board of directors during their presentation. Keep in mind that your report needs to be easy for someone unfamiliar with finance to understand, as not all of the board members for your business fully understand finance. Using Mergent Online, locate the most recent quarterly financial statements for your chosen company, and use these statements to support your analysis throughout the project. Refer to the Project Two Financial Assumptions document located in the Supporting Materials section for the assumptions you need in order to analyze the three available financial options outlined in the Financial Analysis section of the project directions. You are encouraged to use the Project Two Financial Analyst Report template located in the What to Submit section to help complete this project. Specifically, you must address the following: 1. Financial Analysis: In this section of the report, you will use the most recent quarterly financial statements for your chosen business and the Project Two Financial Formulas spreadsheet (located in the What to Submit section) to calculate appropriate financial formulas for assessing the business's financial health. You will also analyze all three available financial options for improving the business based on your calculations and the provided Project Two Financial Assumptions document. A. Financial Calculations: Calculate accurate financial formulas to assess the business's current financial health. Specifically, you must calculate the following: . Working capital . Current ratio . Debt ratio Earnings per share Price/earnings ratio Total asset turnover ratio . Financial leverage . Net profit margin Return on assets . Return on equity . B. Working Capital Management: Explain the impact of working capital management on the business's operations. Provide examples to support your claims. C. Bond Investment: Analyze the risks and benefits of the business choosing to invest in a corporate bond, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis. D. Capital Equipment: Analyze the risks and benefits of the business choosing to invest in capital equipment, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis. E. Capital Lease: Analyze the risks and benefits of the business choosing to purchase a capital lease, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis. 2. Financial Evaluation: In this section of the report, you will now determine if the three available financial options in the Project Two Financial Assumptions document are appropriate for the business, considering the analysis you did in the first section. You will also explain financing and describe the business's likely future performance. A. Financing: Explain how a business finances its operations and expansion. B. Bond Investment: Assess the appropriateness of a bond investment as a financing option for the business's financial health, using your financial analysis and other financial information to your support claims. C. Capital Equipment: Assess the appropriateness of a capital equipment investment as a financing option for the business's financial health, using your financial analysis and other financial information to support your claims. D. Capital Lease: Assess the appropriateness of a capital lease purchase as a financing option for the business's financial health, using your financial analysis and other financial information to support your claims. E. Short-Term Financing: Explain how potential short-term financing sources could help the business raise needed funds for improving its financial health. Base your response on the business's current financial information. F. Future Financial Considerations: Describe the business's likely future financial performance based on its current financial well-being and risk levels. Use financial information to support your claims. 3. Financial Recommendations: In this section of the report, you will recommend which financing option(s) are the best for the business to choose depending on its financial health. A. Financial Recommendation(s): Recommend the most appropriate financing option(s) based on the business's financial health, including a rationale for why the option(s) are best. 1 2 9 10 Month Interest Investment Value 11 $0 $0 Sol SO $0 $0 $0 SO SOL 12 sol SO 1 Month Interest Investment Value SO sol 2 SO 0 $0 9 SO $0 10 SO $o 11 SC $0 12 SO $0 2 12 Month Interest Investment Value 1 $0 sol SO $ol 9 SO $0 10 $0 sol 11 SO $0 $0 $0 2 Month Interest Investment Value 1 SO $0 SO $0 9 $0 $0 10 SO sol 11 $ SO 12 SO $0 1 2 Month Interest Investment Value $0 $0 SO $ol 9 $0 $0 Time Value of Money - Monthly Compounding Year 1 3 4 5 6 7 8 $0 SO $0 $0 $0 $0 $0 $0 Sol $0 $0 $0 Year 2 3 4 5 6 7 8 SO $0 $0 $0 SO $0 $0 sol sol sol $0 $0 Year 3 3 4 5 6 7 8 SO $0 $0 $0 $0 $0 $0 sol $0 sol sol sol Year 4 3 4 5 6 7 8 SO $0 SO $0 SO $0 $0 sol $0 sol $0 $0 Year 5 3 4 5 6 7 8 SO $0 $0 $0 $0 $0 $0 sol $0 $0 $0 sol Year 6 3 4 5 6 7 8 SO $0 SO $0 $0 $0 $0 $0 sol sol $0 sol Year 7 3 4 5 6 7 8 SO $0 SO $0 SO $0 sol SOL SO Sol SOL SON Year 8 3 4 5 6 7 8 SO $0 SO $0 $0 $0 $0 $ $0 SO SO SO Year 9 3 4 5 6 7 8 SO $0 $0 $0 SO $0 SOL SOL SOL Sol SOL $o Year 10 3 4 5 6 7 SO $0 SO $0 SO $0 $0 $0 SO SOL sol $0 10 $0 $0 11 SO SO 2 Rate of Return 3 Initial Investment 4 5 5 7 33 3 0 1 2 3 4 5 6 7 8 9 EO 1 2 3 24 5 E6 E7 E8 9 =0 1 2 3 4 5 6 37 8 =9 -0 -1 -2 12 $0 $0 Month Interest Investment Value 1 SO sol 2 SO $0 9 $0 $0 10 SO sol 11 $ $0 12 SO sol 1 2 9 12 Month Interest Investment Value $0 SO SO SO SO SO 10 $0 SO 11 SO $0 $0 SO 1 2 12 Month Interest Investment Value SO SO $0 SO 9 $0 $0 10 $O $0 11 $0 SO $O1 SO 1 2 9 12 Month Interest Investment Value SO SO SO SO SO SO 10 $0 SO 11 SO SO $0 $0 1 2 Month Interest Investment Value SO SO $0 SOL 9 SO sol 10 SOL SO 11 SO SOL 12 SO SO . B D E L M N Rate of Return Year 1 F G . K Time Value of Money - Annual Compounding 2 3 4 5 6 7 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 00 9 10 Initial Investment Interest $0 $0 $0 $0 $0 $0 $0 $0 Investment Value E A B 1 Time Value of Money - Present Value Annuity 2 Number of Years 3 Rate of Return $0.00 4 Payment Time Value of Money - Future Value Annuity 2 Number of Years 3 Rate of Return $0.00 4. Payment Time Value of Money - Present Value of Lump Sum - Rate - Years $0.00 - Initial Investment Time Value of Money - Future Value of Lump Sum Rate Years $0.00 Initial Investment A B D E F K M N 0 P R G H Net Present Value (NPV) Calculator Building 6 7 8 9 10 SO SO SO SO $0 Initial Investment Annual Cash Inflows Discount Rate Number of Years Salvage Value Year Cash Flows Year Cash Flows 1 $0 11 $0 2 $0 12 $0. 3 $0 13 $0 4 $0 14 $0. 5 $0 15 $0 NPV = $0 16 17 18 20 19 $0 $0 SO $0 $0 Equipment 1 3 4 5 6 7 8 9 10 $0 $0 $0 $0 $0 $0 $0 Initial Investment Annual Cash Inflows Discount Rate Number of Years Salvage Value Year Cash Flows Year Cash Flows 2 $0 12 $0 NPV = $0 $O 13 $0 11 $0 $O 14 $0 20 15 $0 16 $0 17 $0 18 $0 19 $0 $0 Bonds Initial Investment Annual Cash Inflows Discount Rate Number of Years Principal Returned NPV = $0 1 2 3 4 5 6 7 8 9 10 Year Cash Flows $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Scenario You are a financial analyst for the chosen business that you selected during your Module Two Journal assignment. Your supervisor has discovered last minute that your business's board of directors is looking for updates on the business's financial health. Your supervisor has asked you to write a report regarding the business's current financial health and the available financial options for improving the business. You've also been asked to make recommendations as to which options the business should choose to best support its financial health. Your supervisor will then use your report to present to the business's board of directors, whose members all have varying levels of knowledge in terms of finance. Directions Using the business you chose from the Project Two Business Options List, create a report for your supervisor to share with the board of directors during their presentation. Keep in mind that your report needs to be easy for someone unfamiliar with finance to understand, as not all of the board members for your business fully understand finance. Using Mergent Online, locate the most recent quarterly financial statements for your chosen company, and use these statements to support your analysis throughout the project. Refer to the Project Two Financial Assumptions document located in the Supporting Materials section for the assumptions you need in order to analyze the three available financial options outlined in the Financial Analysis section of the project directions. You are encouraged to use the Project Two Financial Analyst Report template located in the What to Submit section to help complete this project. Specifically, you must address the following: 1. Financial Analysis: In this section of the report, you will use the most recent quarterly financial statements for your chosen business and the Project Two Financial Formulas spreadsheet (located in the What to Submit section) to calculate appropriate financial formulas for assessing the business's financial health. You will also analyze all three available financial options for improving the business based on your calculations and the provided Project Two Financial Assumptions document. A. Financial Calculations: Calculate accurate financial formulas to assess the business's current financial health. Specifically, you must calculate the following: . Working capital . Current ratio . Debt ratio Earnings per share Price/earnings ratio Total asset turnover ratio . Financial leverage . Net profit margin Return on assets . Return on equity . B. Working Capital Management: Explain the impact of working capital management on the business's operations. Provide examples to support your claims. C. Bond Investment: Analyze the risks and benefits of the business choosing to invest in a corporate bond, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis. D. Capital Equipment: Analyze the risks and benefits of the business choosing to invest in capital equipment, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis. E. Capital Lease: Analyze the risks and benefits of the business choosing to purchase a capital lease, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis. 2. Financial Evaluation: In this section of the report, you will now determine if the three available financial options in the Project Two Financial Assumptions document are appropriate for the business, considering the analysis you did in the first section. You will also explain financing and describe the business's likely future performance. A. Financing: Explain how a business finances its operations and expansion. B. Bond Investment: Assess the appropriateness of a bond investment as a financing option for the business's financial health, using your financial analysis and other financial information to your support claims. C. Capital Equipment: Assess the appropriateness of a capital equipment investment as a financing option for the business's financial health, using your financial analysis and other financial information to support your claims. D. Capital Lease: Assess the appropriateness of a capital lease purchase as a financing option for the business's financial health, using your financial analysis and other financial information to support your claims. E. Short-Term Financing: Explain how potential short-term financing sources could help the business raise needed funds for improving its financial health. Base your response on the business's current financial information. F. Future Financial Considerations: Describe the business's likely future financial performance based on its current financial well-being and risk levels. Use financial information to support your claims. 3. Financial Recommendations: In this section of the report, you will recommend which financing option(s) are the best for the business to choose depending on its financial health. A. Financial Recommendation(s): Recommend the most appropriate financing option(s) based on the business's financial health, including a rationale for why the option(s) are best. 1 2 9 10 Month Interest Investment Value 11 $0 $0 Sol SO $0 $0 $0 SO SOL 12 sol SO 1 Month Interest Investment Value SO sol 2 SO 0 $0 9 SO $0 10 SO $o 11 SC $0 12 SO $0 2 12 Month Interest Investment Value 1 $0 sol SO $ol 9 SO $0 10 $0 sol 11 SO $0 $0 $0 2 Month Interest Investment Value 1 SO $0 SO $0 9 $0 $0 10 SO sol 11 $ SO 12 SO $0 1 2 Month Interest Investment Value $0 $0 SO $ol 9 $0 $0 Time Value of Money - Monthly Compounding Year 1 3 4 5 6 7 8 $0 SO $0 $0 $0 $0 $0 $0 Sol $0 $0 $0 Year 2 3 4 5 6 7 8 SO $0 $0 $0 SO $0 $0 sol sol sol $0 $0 Year 3 3 4 5 6 7 8 SO $0 $0 $0 $0 $0 $0 sol $0 sol sol sol Year 4 3 4 5 6 7 8 SO $0 SO $0 SO $0 $0 sol $0 sol $0 $0 Year 5 3 4 5 6 7 8 SO $0 $0 $0 $0 $0 $0 sol $0 $0 $0 sol Year 6 3 4 5 6 7 8 SO $0 SO $0 $0 $0 $0 $0 sol sol $0 sol Year 7 3 4 5 6 7 8 SO $0 SO $0 SO $0 sol SOL SO Sol SOL SON Year 8 3 4 5 6 7 8 SO $0 SO $0 $0 $0 $0 $ $0 SO SO SO Year 9 3 4 5 6 7 8 SO $0 $0 $0 SO $0 SOL SOL SOL Sol SOL $o Year 10 3 4 5 6 7 SO $0 SO $0 SO $0 $0 $0 SO SOL sol $0 10 $0 $0 11 SO SO 2 Rate of Return 3 Initial Investment 4 5 5 7 33 3 0 1 2 3 4 5 6 7 8 9 EO 1 2 3 24 5 E6 E7 E8 9 =0 1 2 3 4 5 6 37 8 =9 -0 -1 -2 12 $0 $0 Month Interest Investment Value 1 SO sol 2 SO $0 9 $0 $0 10 SO sol 11 $ $0 12 SO sol 1 2 9 12 Month Interest Investment Value $0 SO SO SO SO SO 10 $0 SO 11 SO $0 $0 SO 1 2 12 Month Interest Investment Value SO SO $0 SO 9 $0 $0 10 $O $0 11 $0 SO $O1 SO 1 2 9 12 Month Interest Investment Value SO SO SO SO SO SO 10 $0 SO 11 SO SO $0 $0 1 2 Month Interest Investment Value SO SO $0 SOL 9 SO sol 10 SOL SO 11 SO SOL 12 SO SO . B D E L M N Rate of Return Year 1 F G . K Time Value of Money - Annual Compounding 2 3 4 5 6 7 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 00 9 10 Initial Investment Interest $0 $0 $0 $0 $0 $0 $0 $0 Investment Value E A B 1 Time Value of Money - Present Value Annuity 2 Number of Years 3 Rate of Return $0.00 4 Payment Time Value of Money - Future Value Annuity 2 Number of Years 3 Rate of Return $0.00 4. Payment Time Value of Money - Present Value of Lump Sum - Rate - Years $0.00 - Initial Investment Time Value of Money - Future Value of Lump Sum Rate Years $0.00 Initial Investment A B D E F K M N 0 P R G H Net Present Value (NPV) Calculator Building 6 7 8 9 10 SO SO SO SO $0 Initial Investment Annual Cash Inflows Discount Rate Number of Years Salvage Value Year Cash Flows Year Cash Flows 1 $0 11 $0 2 $0 12 $0. 3 $0 13 $0 4 $0 14 $0. 5 $0 15 $0 NPV = $0 16 17 18 20 19 $0 $0 SO $0 $0 Equipment 1 3 4 5 6 7 8 9 10 $0 $0 $0 $0 $0 $0 $0 Initial Investment Annual Cash Inflows Discount Rate Number of Years Salvage Value Year Cash Flows Year Cash Flows 2 $0 12 $0 NPV = $0 $O 13 $0 11 $0 $O 14 $0 20 15 $0 16 $0 17 $0 18 $0 19 $0 $0 Bonds Initial Investment Annual Cash Inflows Discount Rate Number of Years Principal Returned NPV = $0 1 2 3 4 5 6 7 8 9 10 Year Cash Flows $0 $0 $0 $0 $0 $0 $0 $0 $0 $0