Question

Scenario Your business has been open for a month, and you have prepared an income statement and completed a variance analysis on the data. Now

Scenario

Your business has been open for a month, and you have prepared an income statement and completed a variance analysis on the data. Now you will meet with investors and a few other internal stakeholders to share your companys progress over the past month and how it has performed with respect to your cost and budget projections. The investors would like to see the thought process behind your financial strategy and how your company has performed in its first month. They have therefore asked you to present a report that includes the costing and income data from your Project Workbook.

Directions

Submit a detailed report to your potential investors and other stakeholders to explain and defend your costing strategies and to share your businesss performance to date. Your report can be in the form of a PowerPoint presentation or a Word document (based on the templates provided in the What to Submit section). In either format, be sure to effectively communicate with your stakeholders by breaking down concepts and using investor-friendly language to build their trust and confidence. If you choose to do a PowerPoint presentation, youll need to include speaker notes for each slide.

- Introduction: Provide a short overview of your company and the purpose of this report.

- Business Overview: Name your company and describe its business and your vision for its future.

- Purpose of the Report: Explain the purpose of the report and describe why the information is important.

- Methods and Approach: Explain the management accounting methods you used for generating the information that you are about to share in terms of your adherence to industry standards and the American Institute of Certified Public Accountants (AICPA) code of ethics.

- Financial Strategy: Review your original business plan and costing strategies.

- Costing System: Justify the use of job order costing for this business. Be sure to compare and contrast the various costing systems you learned about in this course as part of your defense.

- Selling Prices: Share and explain the selling prices you established for each of your products. Be sure to reference your cost-volume-profit analysis in your defense.

- Contribution Margin: Share and explain your contribution margin per unit. Be sure to reference your cost-volume-profit analysis in your defense.

- Target Profits: Identify your break-even points for achieving different target profits. Then explain the target profits you selected for each area of your business. Be sure to reference your cost-volume-profit analysis in your defense.

- Financial Statements: Using the information in the Milestone Two Market Research Data Appendix, assess your financial performance to date.

- Statement of Cost of Goods Sold: Share the statement of cost of goods sold and logically interpret the businesss performance against the provided benchmarks.

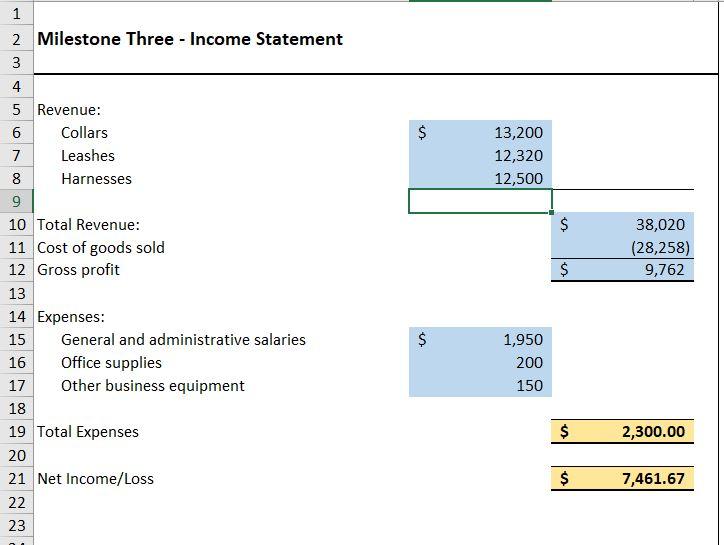

- Income Statement: Share the income statement and logically interpret the businesss performance against the provided benchmarks.

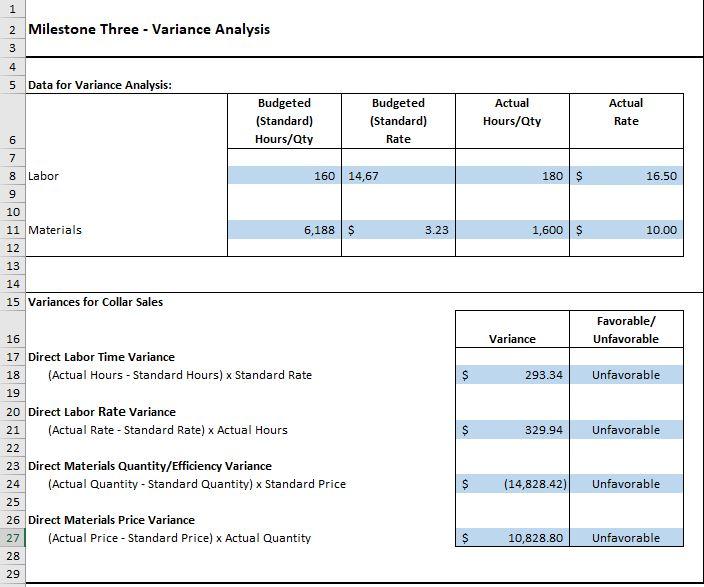

- Variances: Illustrate all variances for the direct labor time and the materials price.

- Significance of Variances: Evaluate the significance of the variances in terms of the potential to impact future budgeting decisions and planning.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started