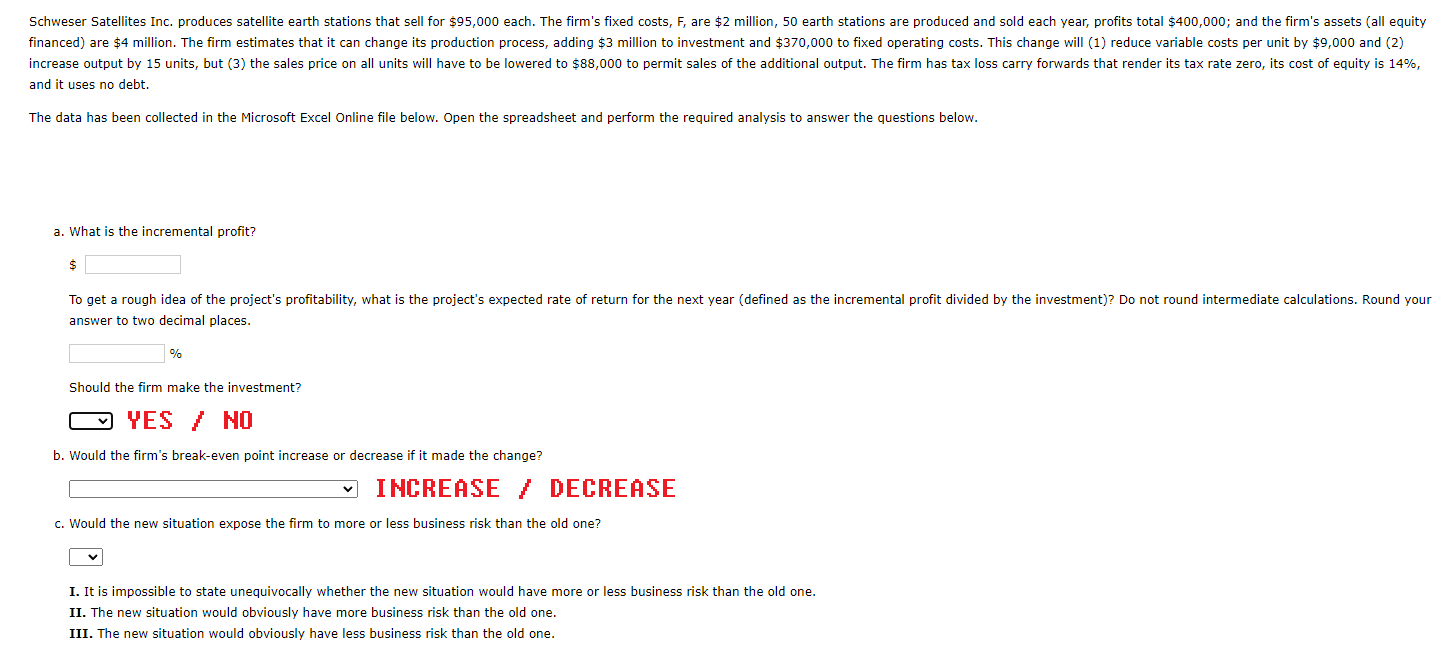

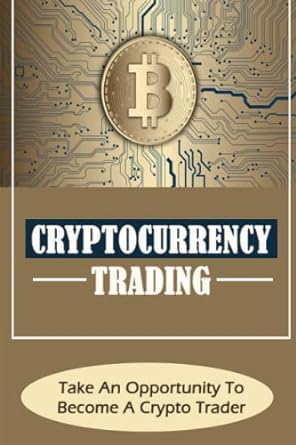

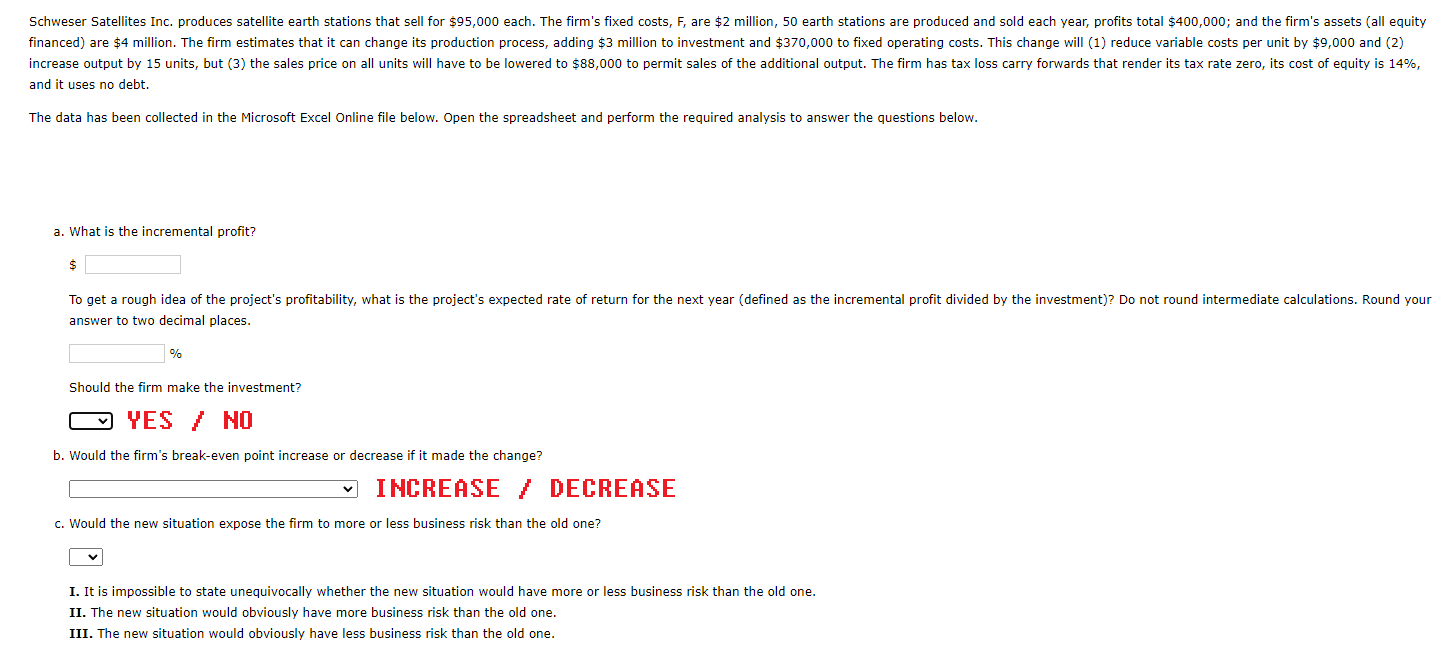

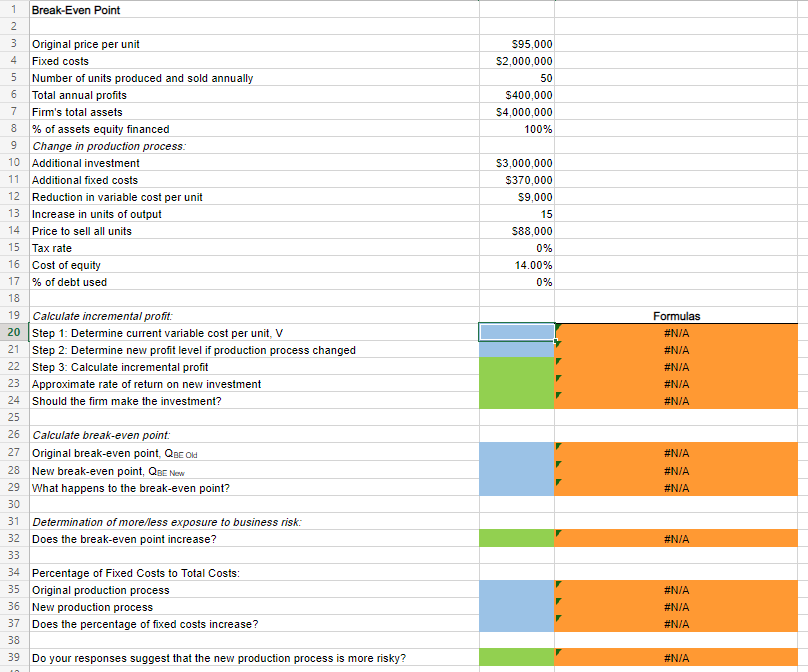

Schweser Satellites Inc. produces satellite earth stations that sell for $95,000 each. The firm's fixed costs, F, are $2 million, 50 earth stations are produced and sold each year, profits total $400,000; and the firm's assets (all equity financed) are $4 million. The firm estimates that it can change its production process, adding $3 million to investment and $370,000 to fixed operating costs. This change will (1) reduce variable costs per unit by $9,000 and (2) increase output by 15 units, but (3) the sales price on all units will have to be lowered to $88,000 to permit sales of the additional output. The firm has tax loss carry forwards that render its tax rate zero, its cost of equity is 14%, and it uses no debt. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. a. What is the incremental profit? $ To get a rough idea of the project's profitability, what is the project's expected rate of return for the next year (defined as the incremental profit divided by the investment)? Do not round intermediate calculations. Round your answer to two decimal places. % Should the firm make the investment? O YES / NO b. Would the firm's break-even point increase or decrease if it made the change? INCREASE / DECREASE c. Would the new situation expose the firm to more or less business risk than the old one? I. It is impossible to state unequivocally whether the new situation would have more or less business risk than the old one. II. The new situation would obviously have more business risk than the old one. III. The new situation would obviously have less business risk than the old one. 4 595,000 $2,000,000 50 $400,000 $4,000,000 100% 1 Break-Even Point 2 3 Original price per unit Fixed costs 5 Number of units produced and sold annually 6 Total annual profits 7 Firm's total assets 8 % of assets equity financed 9 Change in production process: 10 Additional investment 11 Additional fixed costs 12 Reduction in variable cost per unit 13 Increase in units of output 14 Price to sell all units 15 Tax rate 16 Cost of equity 17 % of debt used $3,000,000 $370,000 $9,000 15 S88,000 0% 14.00% 0% 18 Formulas #N/A #N/A #N/A #N/A #N/A 19 Calculate incremental profit: 20 Step 1: Determine current variable cost per unit, V 21 Step 2: Determine new profit level if production process changed 22 Step 3: Calculate incremental profit 23 Approximate rate of return on new investment 24 Should the firm make the investment? 25 26 Calculate break-even point: 27 Original break-even point, Q. Be Old 28 New break-even point, Q.BE New 29 What happens to the break-even point? 30 31 Determination of more/less exposure to business risk: 32 Does the break-even point increase? 33 34 Percentage of Fixed Costs to Total Costs: 35 Original production process 36 New production process 37 Does the percentage of fixed costs increase? 38 39 Do your responses suggest that the new production process is more risky? #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A Schweser Satellites Inc. produces satellite earth stations that sell for $95,000 each. The firm's fixed costs, F, are $2 million, 50 earth stations are produced and sold each year, profits total $400,000; and the firm's assets (all equity financed) are $4 million. The firm estimates that it can change its production process, adding $3 million to investment and $370,000 to fixed operating costs. This change will (1) reduce variable costs per unit by $9,000 and (2) increase output by 15 units, but (3) the sales price on all units will have to be lowered to $88,000 to permit sales of the additional output. The firm has tax loss carry forwards that render its tax rate zero, its cost of equity is 14%, and it uses no debt. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. a. What is the incremental profit? $ To get a rough idea of the project's profitability, what is the project's expected rate of return for the next year (defined as the incremental profit divided by the investment)? Do not round intermediate calculations. Round your answer to two decimal places. % Should the firm make the investment? O YES / NO b. Would the firm's break-even point increase or decrease if it made the change? INCREASE / DECREASE c. Would the new situation expose the firm to more or less business risk than the old one? I. It is impossible to state unequivocally whether the new situation would have more or less business risk than the old one. II. The new situation would obviously have more business risk than the old one. III. The new situation would obviously have less business risk than the old one. 4 595,000 $2,000,000 50 $400,000 $4,000,000 100% 1 Break-Even Point 2 3 Original price per unit Fixed costs 5 Number of units produced and sold annually 6 Total annual profits 7 Firm's total assets 8 % of assets equity financed 9 Change in production process: 10 Additional investment 11 Additional fixed costs 12 Reduction in variable cost per unit 13 Increase in units of output 14 Price to sell all units 15 Tax rate 16 Cost of equity 17 % of debt used $3,000,000 $370,000 $9,000 15 S88,000 0% 14.00% 0% 18 Formulas #N/A #N/A #N/A #N/A #N/A 19 Calculate incremental profit: 20 Step 1: Determine current variable cost per unit, V 21 Step 2: Determine new profit level if production process changed 22 Step 3: Calculate incremental profit 23 Approximate rate of return on new investment 24 Should the firm make the investment? 25 26 Calculate break-even point: 27 Original break-even point, Q. Be Old 28 New break-even point, Q.BE New 29 What happens to the break-even point? 30 31 Determination of more/less exposure to business risk: 32 Does the break-even point increase? 33 34 Percentage of Fixed Costs to Total Costs: 35 Original production process 36 New production process 37 Does the percentage of fixed costs increase? 38 39 Do your responses suggest that the new production process is more risky? #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A