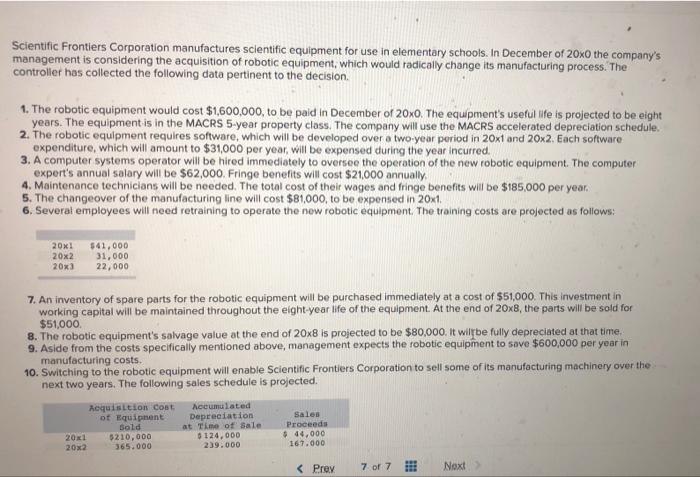

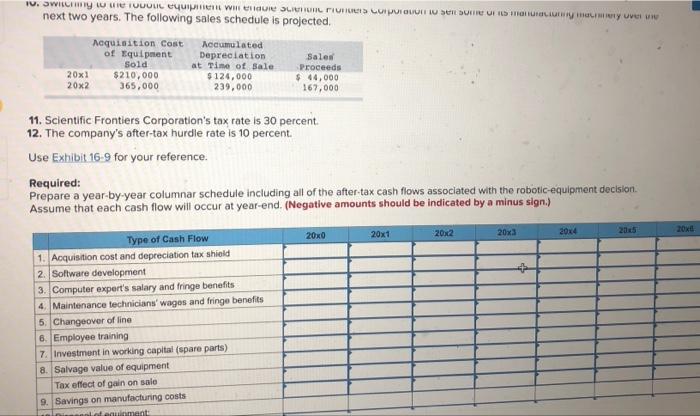

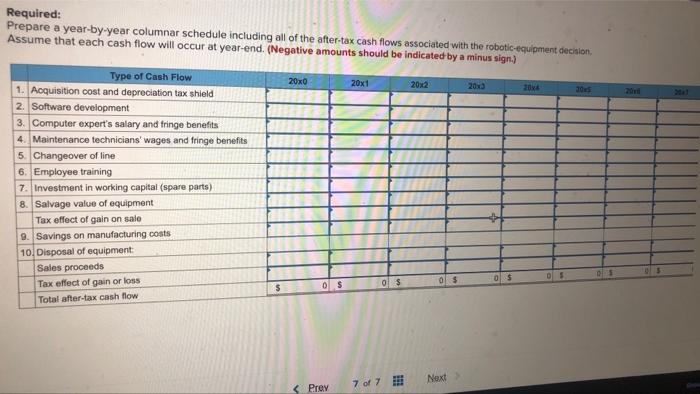

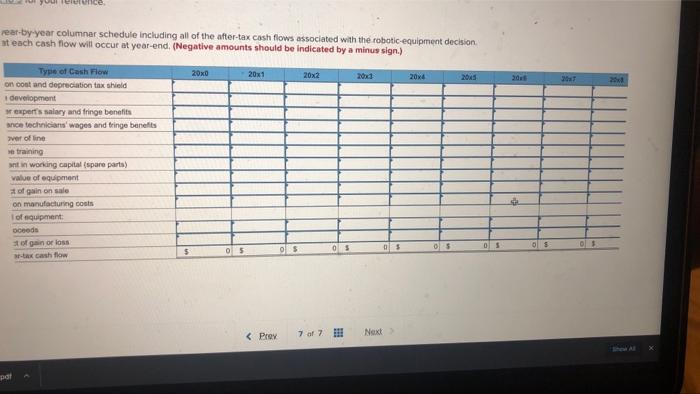

Scientific Frontiers Corporation manufactures scientific equipment for use in elementary schools. In December of 20x0 the company's management is considering the acquisition of robotic equipment, which would radically change its manufacturing process. The controller has collected the following data pertinent to the decision 1. The robotic equipment would cost $1,600,000, to be paid in December of 20x0. The equipment's useful life is projected to be eight years. The equipment is in the MACRS 5-year property class. The company will use the MACRS accelerated depreciation schedule. 2. The robotic equipment requires software, which will be developed over a two year period in 20x7 and 20x2. Each software expenditure, which will amount to $31,000 per year, will be expensed during the year incurred. 3. A computer systems operator will be hired immediately to oversee the operation of the new robotic equipment. The computer expert's annual salary will be $62,000. Fringe benefits will cost $21,000 annually 4. Maintenance technicians will be needed. The total cost of their wages and fringe benefits will be $185,000 per year, 5. The changeover of the manufacturing line will cost $81,000, to be expensed in 20x1. 6. Several employees will need retraining to operate the new robotic equipment. The training costs are projected as follows: 20x1 20x2 20x3 $41,000 31,000 22,000 7. An inventory of spare parts for the robotic equipment will be purchased immediately at a cost of $51,000. This investment in working capital will be maintained throughout the eight-year life of the equipment. At the end of 20x8, the parts will be sold for $51,000 8. The robotic equipment's salvage value at the end of 20x8 is projected to be $80,000, it will be fully depreciated at that time, 9. Aside from the costs specifically mentioned above, management expects the robotic equipment to save $600,000 per year in manufacturing costs. 10. Switching to the robotic equipment will enable Scientific Frontiers Corporation to sell some of its manufacturing machinery over the next two years. The following sales schedule is projected. Requisition cost Accumulated of Equipment Depreciation Sales at Time of Sale 201 5210,000 $124,000 44,000 Bold Proceeds 20x2 365.000 239.000 167.000