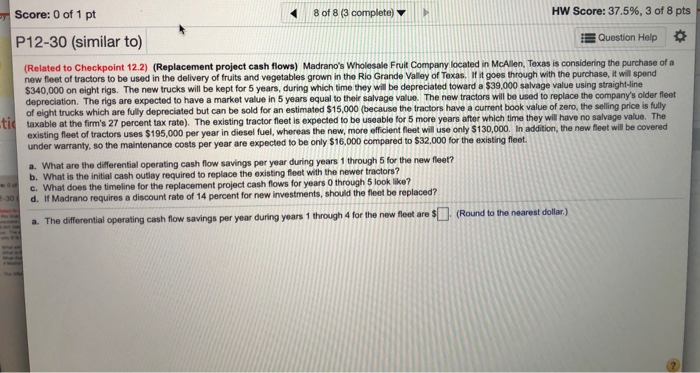

Score: 0 of 1 pt of 80 complete HW Score: 0%, 0 of 8p P12-30 (similar to) Question Help Related to Checkpoint 123 Replacement project cash flow Madrone's Wha Company located in M enasis considering the purchase of a new feet of tractors to be the very thus and vegetables grown the Rio Grande Vey of Texas through with the purchase will send 400.000 The news will be for years during which time they will be depred ada 130.000 ga ng e depreciation The expected to have a m etal in sy gew The new tractions will be used to the company's older fleet of eight trucks which ar e but can be sold foran d $19.000 because the actors have book of the gro w th percentaxe . The tractor is expected to be used for more year whime they w e r e The f actors 100.000 de met terly $110.000 new www media be only $16.000 compared 30.000 for i nt What are the cas e per year during t h e What does the main for the replacement project cash fosfora ? d. Madane regresa contrate of 8 percent for investment hom e placed The rol ering cash flow swings per year during years thought for the new features Round to the nearest doar Score: 0 of 1 pt 8 of 8 (3 complete) HW Score: 37.5%, 3 of 8 pts P12-30 (similar to) Question Help (Related to Checkpoint 12.2) (Replacement project cash flows) Madrano's Wholesale Frult Company located in McAllen, Texas is considering the purchase of a new feet of tractors to be used in the delivery of fruits and vegetables grown in the Rio Grande Valley of Texas. If it goes through with the purchase, it will spend $340,000 on eight rigs. The new trucks will be kept for 5 years, during which time they will be depreciated toward a $39,000 salvage value using straight-line depreciation. The rigs are expected to have a market value in 5 years equal to their salvage value. The new tractors will be used to replace the company's older fleet of eight trucks which are fully depreciated but can be sold for an estimated $15,000 (because the tractors have a current book value of zero, the selling price is fully taxable at the firm's 27 percent tax rate). The existing tractor fleet is expected to be useable for 5 more years after which time they will have no salvage value. The existing fleet of tractors uses $195,000 per year in diesel fuel, whereas the new, more efficient feet will use only $130,000. In addition, the new fleet will be covered under warranty, so the maintenance costs per year are expected to be only $16,000 compared to $32,000 for the existing fleet. a. What are the differential operating cash flow savings per year during years 1 through 5 for the new fleet? b. What is the initial cash outlay required to replace the existing fleet with the newer tractors? c. What does the timeline for the replacement project cash flows for yours through look like? d. If Madrano requires a discount rate of 14 percent for new investments, should the foot be replaced? a. The differential operating cash flow savings per year during years 1 through 4 for the new feet are $ (Round to the nearest dollar Score: 0 of 1 pt of 80 complete HW Score: 0%, 0 of 8p P12-30 (similar to) Question Help Related to Checkpoint 123 Replacement project cash flow Madrone's Wha Company located in M enasis considering the purchase of a new feet of tractors to be the very thus and vegetables grown the Rio Grande Vey of Texas through with the purchase will send 400.000 The news will be for years during which time they will be depred ada 130.000 ga ng e depreciation The expected to have a m etal in sy gew The new tractions will be used to the company's older fleet of eight trucks which ar e but can be sold foran d $19.000 because the actors have book of the gro w th percentaxe . The tractor is expected to be used for more year whime they w e r e The f actors 100.000 de met terly $110.000 new www media be only $16.000 compared 30.000 for i nt What are the cas e per year during t h e What does the main for the replacement project cash fosfora ? d. Madane regresa contrate of 8 percent for investment hom e placed The rol ering cash flow swings per year during years thought for the new features Round to the nearest doar Score: 0 of 1 pt 8 of 8 (3 complete) HW Score: 37.5%, 3 of 8 pts P12-30 (similar to) Question Help (Related to Checkpoint 12.2) (Replacement project cash flows) Madrano's Wholesale Frult Company located in McAllen, Texas is considering the purchase of a new feet of tractors to be used in the delivery of fruits and vegetables grown in the Rio Grande Valley of Texas. If it goes through with the purchase, it will spend $340,000 on eight rigs. The new trucks will be kept for 5 years, during which time they will be depreciated toward a $39,000 salvage value using straight-line depreciation. The rigs are expected to have a market value in 5 years equal to their salvage value. The new tractors will be used to replace the company's older fleet of eight trucks which are fully depreciated but can be sold for an estimated $15,000 (because the tractors have a current book value of zero, the selling price is fully taxable at the firm's 27 percent tax rate). The existing tractor fleet is expected to be useable for 5 more years after which time they will have no salvage value. The existing fleet of tractors uses $195,000 per year in diesel fuel, whereas the new, more efficient feet will use only $130,000. In addition, the new fleet will be covered under warranty, so the maintenance costs per year are expected to be only $16,000 compared to $32,000 for the existing fleet. a. What are the differential operating cash flow savings per year during years 1 through 5 for the new fleet? b. What is the initial cash outlay required to replace the existing fleet with the newer tractors? c. What does the timeline for the replacement project cash flows for yours through look like? d. If Madrano requires a discount rate of 14 percent for new investments, should the foot be replaced? a. The differential operating cash flow savings per year during years 1 through 4 for the new feet are $ (Round to the nearest dollar