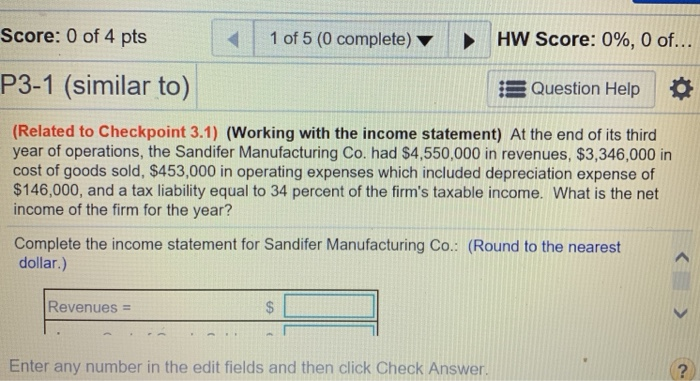

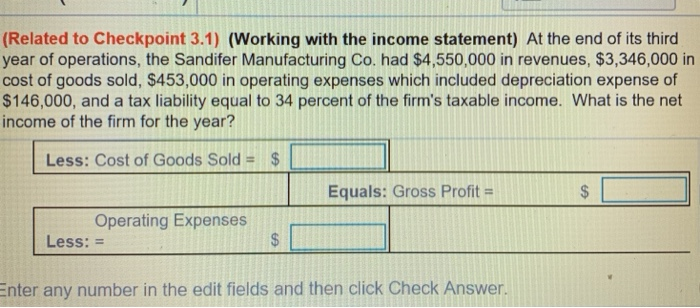

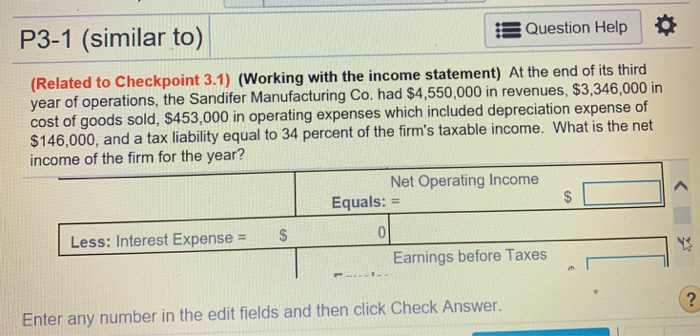

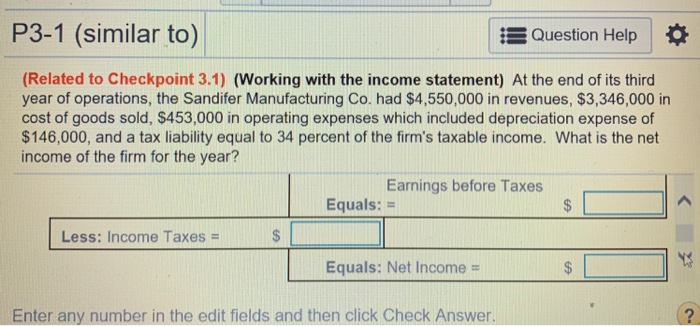

Score: 0 of 4 pts 1 of 5 (0 complete) HW Score: 0%, 0 of P3-1 (similar to) Question Help (Related to Checkpoint 3.1) (Working with the income statement) At the end of its third year of operations, the Sandifer Manufacturing Co. had $4,550,000 in revenues, $3,346,000 in cost of goods sold, $453,000 in operating expenses which included depreciation expense of $146,000, and a tax liability equal to 34 percent of the firm's taxable income. What is the net income of the firm for the year? Complete the income statement for Sandifer Manufacturing Co.: (Round to the nearest dollar.) Revenues Enter any number in the edit fields and then click Check Answer. Related to Checkpoint 3.1) (Working with the income statement) At the end of its third year of operations, the Sandifer Manufacturing Co. had $4,550,000 in revenues, $3,346,000 in cost of goods sold, $453,000 in operating expenses which included depreciation expense of $146,000, and a tax liability equal to 34 percent of the firm's taxable income. What is the net income of the firm for the year? Less: Cost of Goods Sold$ Equals: Gross Profit Operating Expenses Less:- Enter any number in the edit fields and then click Check Answer P3-1 (similar to Question Help (Related to Checkpoint 3.1) (Working with the income statement) At the end of its third year of operations, the Sandifer Manufacturing Co. had $4,550,000 in revenues, $3,346,000 in cost of goods sold, $453,000 in operating expenses which included depreciation expense of $146,000, and a tax liability equal to 34 percent of the firm's taxable income. What is the net income of the firm for the year? Net Operating Income Equals: Less: Interest ExpenseS Earnings before Taxes 2 Enter any number in the edit fields and then click Check Answer P3-1 (similar to) E Question Help (Related to Checkpoint 3.1) (Working with the income statement) At the end of its third year of operations, the Sandifer Manufacturing Co. had $4,550,000 in revenues, $3,346,000 in cost of goods sold, $453,000 in operating expenses which included depreciation expense of $146,000, and a tax liability equal to 34 percent of the firm's taxable income. What is the net income of the firm for the year? Earnings before Taxes Equals: = Less: Income Taxes = $ Equals: Net Income - Enter any number in the edit fields and then click Check