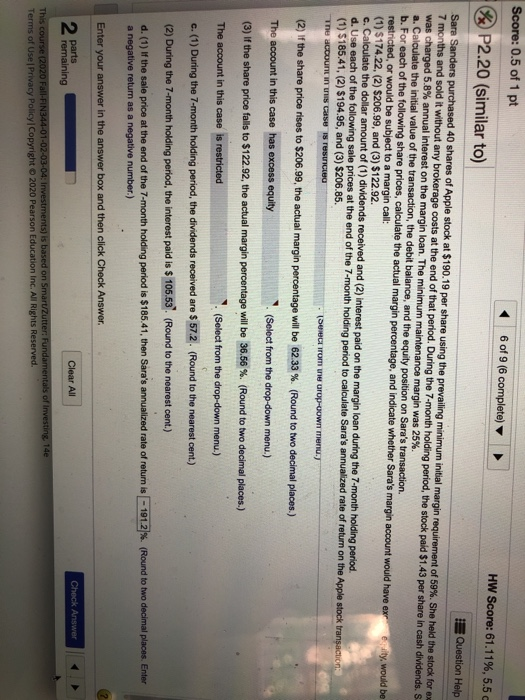

Score: 0.5 of 1 pt 6 of 9 (6 complete) HW Score: 61.11%, 5.5 P2.20 (similar to) Question Help Sara Sanders purchased 40 shares of Apple stock at $190.19 per share using the prevailing minimum initial margin requirement of 59%. She held the stock forex 7 months and sold it without any brokerage costs at the end of that period. During the 7-month holding period, the stock paid $1.43 per share in cash dividends. S was charged 5.8% annual interest on the margin loan. The minimum maintenance margin was 25% a. Calculate the initial value of the transaction, the debit balance, and the equity position on Sara's transaction. b. For each of the following share prices, calculate the actual margin percentage, and indicate whether Sara's margin account would have ex eilty, would be restricted, or would be subject to a margin call: (1) $174.22, (2) $206.99, and (3) $122.92. C. Calculate the dollar amount of (1) dividends received and (2) Interest paid on the margin loan during the 7-month holding period. d. Use each of the following sale prices at the end of the 7-month holding period to calculate Sara's annualized rate of return on the Apple stock transactions (1) $185.41, (2) $194.95, and (3) $206.85. The account in this case is rusite (SBC rom europ-cown menu.) (2) If the share price rises to $206.99, the actual margin percentage will be 62.33 %. (Round to two decimal places.) The account in this case has excess equity (Select from the drop-down menu.) (3) If the share price falls to $122.92, the actual margin percentage will be 36.56 %. (Round to two decimal places.) The account in this case is restricted (Select from the drop-down menu.) c. (1) During the 7-month holding period, the dividends received are $ 57.2. (Round to the nearest cent.) (2) During the 7-month holding period, the Interest paid is $ 105.53" (Round to the nearest cent.) d. (1) If the sale price at the end of the 7-month holding period is $185.41, then Sara's annualized rate of return is 191.2%. (Round to two decimal places. Enter a negative return as a negative number.) Enter your answer in the answer box and then click Check Answer. Check Answer 2 parts remaining Clear All This course (2020 Fall-FIN344-01-02-03-04: Investments) is based on Smart/Zutter: Fundamentals of Investing 14e Terms of Use Privacy Policy Copyright 2020 Pearson Education Inc. All Rights Reserved. Score: 0.5 of 1 pt 6 of 9 (6 complete) HW Score: 61.11%, 5.5 P2.20 (similar to) Question Help Sara Sanders purchased 40 shares of Apple stock at $190.19 per share using the prevailing minimum initial margin requirement of 59%. She held the stock forex 7 months and sold it without any brokerage costs at the end of that period. During the 7-month holding period, the stock paid $1.43 per share in cash dividends. S was charged 5.8% annual interest on the margin loan. The minimum maintenance margin was 25% a. Calculate the initial value of the transaction, the debit balance, and the equity position on Sara's transaction. b. For each of the following share prices, calculate the actual margin percentage, and indicate whether Sara's margin account would have ex eilty, would be restricted, or would be subject to a margin call: (1) $174.22, (2) $206.99, and (3) $122.92. C. Calculate the dollar amount of (1) dividends received and (2) Interest paid on the margin loan during the 7-month holding period. d. Use each of the following sale prices at the end of the 7-month holding period to calculate Sara's annualized rate of return on the Apple stock transactions (1) $185.41, (2) $194.95, and (3) $206.85. The account in this case is rusite (SBC rom europ-cown menu.) (2) If the share price rises to $206.99, the actual margin percentage will be 62.33 %. (Round to two decimal places.) The account in this case has excess equity (Select from the drop-down menu.) (3) If the share price falls to $122.92, the actual margin percentage will be 36.56 %. (Round to two decimal places.) The account in this case is restricted (Select from the drop-down menu.) c. (1) During the 7-month holding period, the dividends received are $ 57.2. (Round to the nearest cent.) (2) During the 7-month holding period, the Interest paid is $ 105.53" (Round to the nearest cent.) d. (1) If the sale price at the end of the 7-month holding period is $185.41, then Sara's annualized rate of return is 191.2%. (Round to two decimal places. Enter a negative return as a negative number.) Enter your answer in the answer box and then click Check Answer. Check Answer 2 parts remaining Clear All This course (2020 Fall-FIN344-01-02-03-04: Investments) is based on Smart/Zutter: Fundamentals of Investing 14e Terms of Use Privacy Policy Copyright 2020 Pearson Education Inc. All Rights Reserved