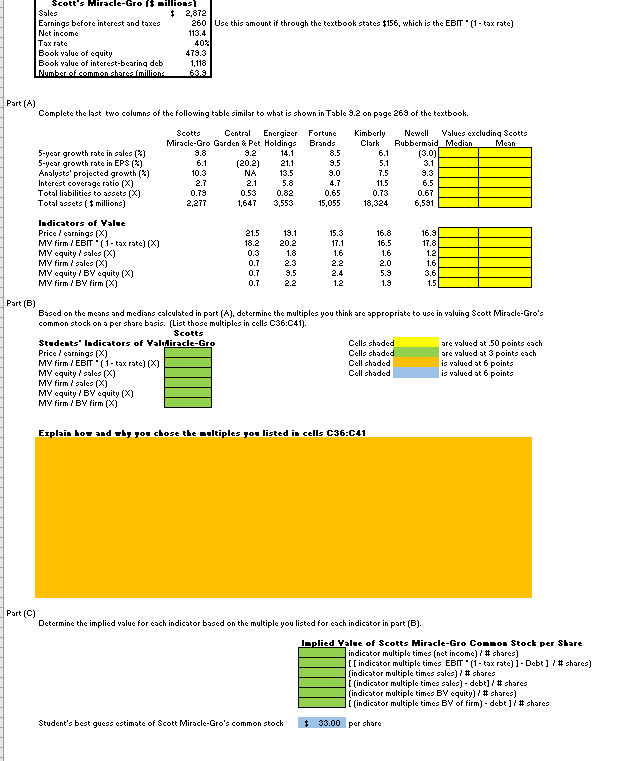

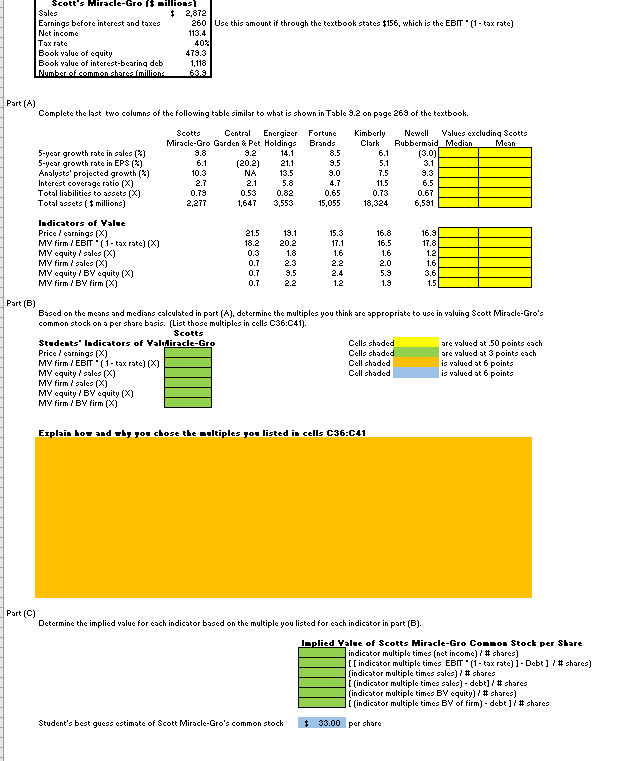

Scott's Miracle-Gro ( illiOss 2,872 Sales Earnings before interest and taxes Net income Tax rate 260 Use this amount if through the textbook states $156, which is the EBIT (1- tax rate) 113.4 40% Book yalue of equity Book value of interest-bearinq deb Number of common shares (millions 4T3.3 1,118 63.3 Part (A) Complete the last two columns of the following table similar to what is shown in Table 9.2 on page 263 of the textbook Energizer Kimberly Clark Values excluding Scotto Scotts Miracle-Gro Garden & Pet Holdings Central Fortune Newell Brands Rubbermaid Median Mean 5-year growth rate in sales (%) 5-year growth rate in EPS (%) Analyst projected growth (%) Interest coverage ratio (X) Total liabilities to assets (X Total asat(millions 3.8 3.2 14.1 8.5 6.1 (3.0) 3.1 (20.2) NA 6,1 21,1 3.5 5.1 10.3 13.5 3.0 7.5 3.3 2.7 2.1 5.8 4.7 11.5 6.5 0.7S 2,277 0.53 0.82 0.65 0.73 0.67 1,647 3,553 15,055 18,324 6,531 Indicators of Yalue Priceornings (X) MV firm EBIT '(1-tox rate) (X) MV equitycales (X MV firm oales (X) MV equity BV equity (X) MV firm BV firm (X) 21.5 13.1 15.3 16.8 16.9 18.2 20.2 17.1 16.5 17.8 0.3 1.8 1,6 1,6 1,2 0.7 2.3 2.2 2.0 1,6 0.7 9.5 2.4 5.3 3.6 0.7 2.2 1,2 1,3 1.5 Part (B Based on the means and medians calculated in part (A), determine the multiples you think are appropriate to use in valuing Scott Miracle-Gro's common stock on a per share basis. (List those multiples in cells C36:C41) Scotts Students adicators of Valdiracle-Gro Priceearninga (X) MV firm EBIT (1- tax rate) (X) MV equity ales (X MY firm/ sales (X MV equity BV equity (X) MY firm/B firm (X Cells shaded are valued at .50 points each ars valued at 3 pointe each is valued at 6 points is valued at 6 points Cells shaded Cell shaded Cell shaded Explain bo and rh o chose the multiples go listed in cells C36:C41 Part (C) the multiple you listed for cach indicator in part (B) Determine the implied value for cach indicator based aplied Yalue of Scotts Hiracle-Gro Common Stock per Share indicator multiple times (net income) /# chares) [[ indicator multiple times EBIT (1- tax rate)1- Debt] #shares) (indicator multiple times sales)#shares [ (indicator multiple times sales)- debbt]/ # chares (indicator multiple times BV equity) #ohares) [(indicator multiple times BV of firm] - debt ]/# shares 33.00 per ahare Student's best quess estimate of Scott Miracle-Gro's common stock Scott's Miracle-Gro ( illiOss 2,872 Sales Earnings before interest and taxes Net income Tax rate 260 Use this amount if through the textbook states $156, which is the EBIT (1- tax rate) 113.4 40% Book yalue of equity Book value of interest-bearinq deb Number of common shares (millions 4T3.3 1,118 63.3 Part (A) Complete the last two columns of the following table similar to what is shown in Table 9.2 on page 263 of the textbook Energizer Kimberly Clark Values excluding Scotto Scotts Miracle-Gro Garden & Pet Holdings Central Fortune Newell Brands Rubbermaid Median Mean 5-year growth rate in sales (%) 5-year growth rate in EPS (%) Analyst projected growth (%) Interest coverage ratio (X) Total liabilities to assets (X Total asat(millions 3.8 3.2 14.1 8.5 6.1 (3.0) 3.1 (20.2) NA 6,1 21,1 3.5 5.1 10.3 13.5 3.0 7.5 3.3 2.7 2.1 5.8 4.7 11.5 6.5 0.7S 2,277 0.53 0.82 0.65 0.73 0.67 1,647 3,553 15,055 18,324 6,531 Indicators of Yalue Priceornings (X) MV firm EBIT '(1-tox rate) (X) MV equitycales (X MV firm oales (X) MV equity BV equity (X) MV firm BV firm (X) 21.5 13.1 15.3 16.8 16.9 18.2 20.2 17.1 16.5 17.8 0.3 1.8 1,6 1,6 1,2 0.7 2.3 2.2 2.0 1,6 0.7 9.5 2.4 5.3 3.6 0.7 2.2 1,2 1,3 1.5 Part (B Based on the means and medians calculated in part (A), determine the multiples you think are appropriate to use in valuing Scott Miracle-Gro's common stock on a per share basis. (List those multiples in cells C36:C41) Scotts Students adicators of Valdiracle-Gro Priceearninga (X) MV firm EBIT (1- tax rate) (X) MV equity ales (X MY firm/ sales (X MV equity BV equity (X) MY firm/B firm (X Cells shaded are valued at .50 points each ars valued at 3 pointe each is valued at 6 points is valued at 6 points Cells shaded Cell shaded Cell shaded Explain bo and rh o chose the multiples go listed in cells C36:C41 Part (C) the multiple you listed for cach indicator in part (B) Determine the implied value for cach indicator based aplied Yalue of Scotts Hiracle-Gro Common Stock per Share indicator multiple times (net income) /# chares) [[ indicator multiple times EBIT (1- tax rate)1- Debt] #shares) (indicator multiple times sales)#shares [ (indicator multiple times sales)- debbt]/ # chares (indicator multiple times BV equity) #ohares) [(indicator multiple times BV of firm] - debt ]/# shares 33.00 per ahare Student's best quess estimate of Scott Miracle-Gro's common stock