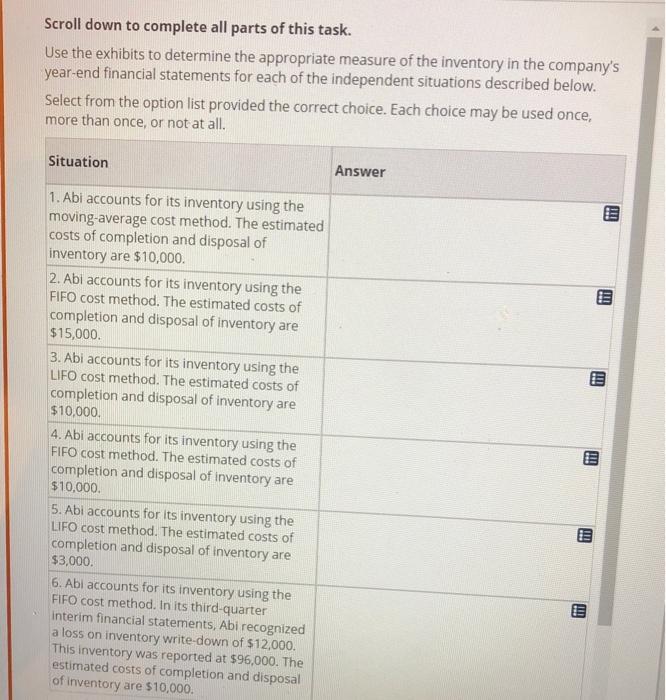

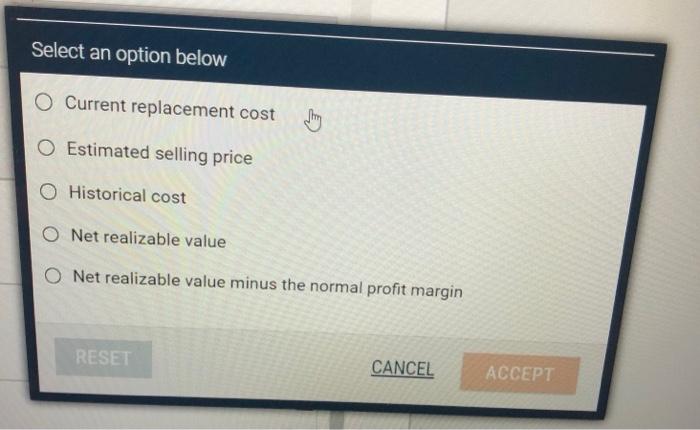

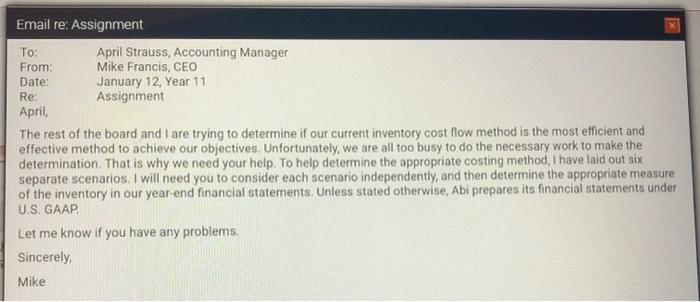

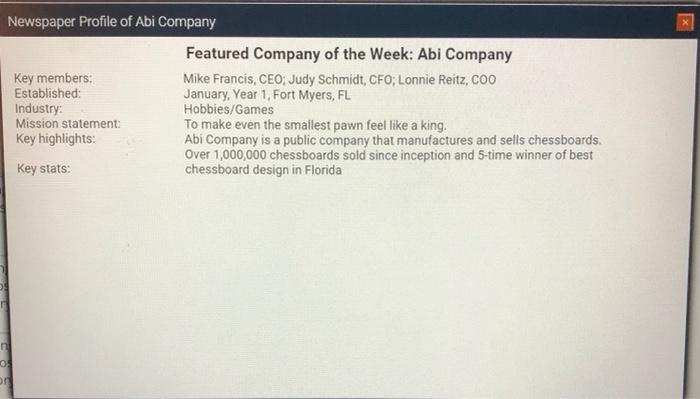

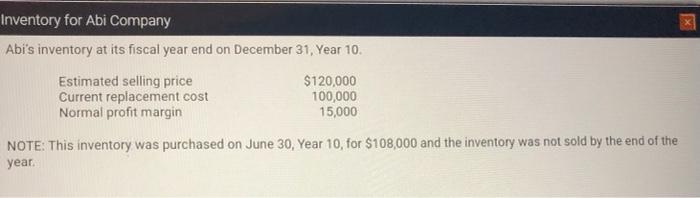

Scroll down to complete all parts of this task. Use the exhibits to determine the appropriate measure of the inventory in the company's year-end financial statements for each of the independent situations described below. Select from the option list provided the correct choice. Each choice may be used once, more than once, or not at all. Situation Answer III 1. Abi accounts for its inventory using the moving average cost method. The estimated costs of completion and disposal of inventory are $10,000. 2. Abi accounts for its inventory using the FIFO cost method. The estimated costs of completion and disposal of inventory are $15,000. 3. Abi accounts for its inventory using the LIFO cost method. The estimated costs of completion and disposal of inventory are $10,000. 4. Abi accounts for its inventory using the FIFO cost method. The estimated costs of completion and disposal of inventory are $10,000. 5. Abi accounts for its inventory using the LIFO cost method. The estimated costs of completion and disposal of inventory are $3,000. 6. Abi accounts for its inventory using the FIFO cost method. In its third-quarter interim financial statements, Abi recognized a loss on inventory write-down of $12,000. This inventory was reported at $96,000. The estimated costs of completion and disposal of inventory are $10,000. Am E Select an option below O Current replacement cost O Estimated selling price Historical cost O Net realizable value Net realizable value minus the normal profit margin RESET CANCEL ACCEPT X Email re: Assignment To: April Strauss, Accounting Manager From: Mike Francis, CEO Date: January 12, Year 11 Re: Assignment April The rest of the board and I are trying to determine if our current inventory cost flow method is the most efficient and effective method to achieve our objectives. Unfortunately, we are all too busy to do the necessary work to make the determination. That is why we need your help. To help determine the appropriate costing method, I have laid out six separate scenarios. I will need you to consider each scenario independently, and then determine the appropriate measure of the inventory in our year-end financial statements. Unless stated otherwise, Abi prepares its financial statements under U.S. GAAP Let me know if you have any problems. Sincerely, Mike x] Newspaper Profile of Abi Company Featured Company of the Week: Abi Company Key members: Mike Francis, CEO: Judy Schmidt, CFO, Lonnie Reitz, Coo Established: January, Year 1, Fort Myers, FL Industry: Hobbies/Games Mission statement: To make even the smallest pawn feel like a king. Key highlights: Abi Company is a public company that manufactures and sells chessboards Over 1,000,000 chessboards sold since inception and 5-time winner of best Key stats: chessboard design in Florida n 03 on x Inventory for Abi Company Abi's inventory at its fiscal year end on December 31, Year 10. Estimated selling price $120,000 Current replacement cost 100,000 Normal profit margin 15,000 NOTE: This inventory was purchased on June 30, Year 10, for $108,000 and the inventory was not sold by the end of the year