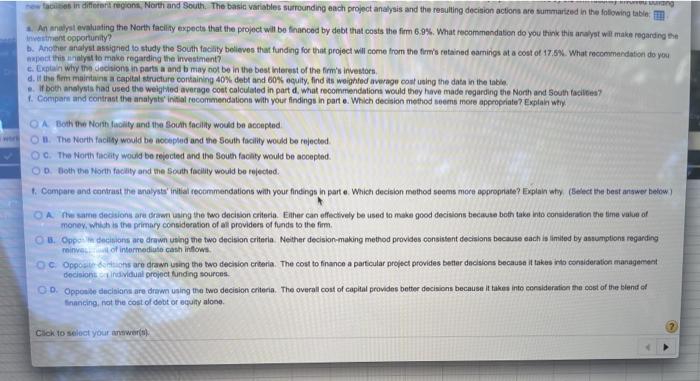

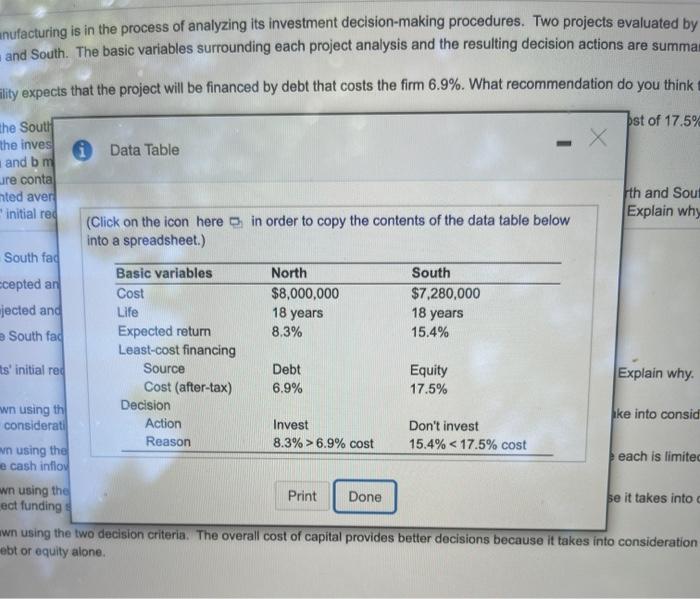

se o pts pos Concept of cost of capital Mace Manufacturing is in the process of analyzing its investment decision-making procedures. Two projects evaluated by the firm recently involved buildin new facilities in different regions, North and South. The basic variables surrounding each project analysis and the resulting decision actions are summarized in the following table, em 1. An analyst evaluating the North facility expects that the project will be financed by debt that costs the firm 6.9%. What recommendation do you think this analyst wil make regarding t Investment opportunity? b. Another analyst assigned to study the South facility believes that funding for that project will come from the firm's retained earnings at a cost of 17.5%. What recommendation do you expect this analyst to make regarding the investment? c. Explain why the decisions in parts a and b may not be in the best interest of the firm's Investors. d. If the fimm maintains a capital structure containing 40% debt and 60% equity, find its weighted average cost using the data in the table e. If both analysts had used the weighted average cost calculated in part d, what recommendations would they have made regarding the North and South facilities? 1. Compare and contrast the analysts initial recommendations with your findings in parte. Which decision method seems more appropriate? Explain why An analyst evaluating the North facility expects that the project will be financed by debt that costs the firm 6.9% What recommendation do you think this analyst will make regarding the investment opportunity? (Select the best answer below. after-tax cost of debt OA The analyst will probably recommend investing in the North project because the project's expected ratum of 6.9% is greater than the expected financing cost of 8.3% using the OB. The analyut will probably recommend not investing in the North project because the project's expected return of 8,3% is greater than the expected financing cost of 6.9% using the Of The analyst will probably recommend Investing in the North project because the project's expected return of 6,9% is greater than the expected financing cost of 83% uning the OD. The analyst will probably recommend investing in the North project because the project's expected return of 8.3% is greater than the expected financing cost of 6.9% using the after-tax cost of debt after-tax cost of dat rott of debt b. Another analyet antigned to study the South facility belleves that funding for that project will come from the firm's retained earnings at a cost of 17.5%. What recommendation do you expect this analyst to make regarding the investment? (Select the best answer below.) OA The analyst will probably recommend investing in the South project because the project's expected return of 17.5% is less than the expected financing cost of 15:45 using the cout of equity na The walve will halv ermmand inventine in the South michan there's anchor him of 154% than the earted financing met 17.6in the met Click to select your answers 21 Gtv Id commodation do you think this analyst will make regarding the Investment opportunity by Anoiner analyst signed to study the South facility believes that funding for that project will come from the firm's retained eamings at a cost of 175%. What recommendation do you expect this analyst to make regarding the investment? c. Explain why the decisions in partea and b may not be in the best interest of the firm's investors d. It the firm maintains a capital structure containing 40% debt and 60% equily, find its weighted average cost using the data in the table. If both analysts had used the weighted average cost calculated in part d, what recommendations would they have made regarding the North and South facilities? 1. Compare and contrast the analysts initial recommandations with your findings in parte. Which decision method seems more appropriate? Explain why b. Another analyst assigned to study the South facility believes that funding for that project will come from the fien's retained earnings at a cost of 175% What recommendation to you expect this analyst to make regarding the investment? (Select the best answer below.) OA The analyst will probably recommend investing in the South project because the projects expected return of 17.5% less than the expected trancing cost of 15:45 using the cont of equity OB. The analyst will probably recommand investing in the South project because the project's expected retum of 154% is less than the expected financing cost of 175% using the cout of equity OC. The analyst will probably recommend not investing in the South project bause the projects expected rotum of 17.6% less than the expected financing cont of 154% using the Lost of equity OD. The analyst will probably recommend not investing in the South project because the project's expected return of 15.4% is less than the expected financing cost of 175% using the c. Explain why decisions in parts and b may not be in the best interest of the firm's investors. (Select the t answer below) OA. The firm is basing its decision on the firm's combined cost of capital rather than on the cost to finance a particular project, which may lead to incorrect accept reject decisions OB. The firm is basing its decision on the cost to finance a particular project rather than on the least-cost financing sources, which would lead to incorrect accept reject decisions OC. The firm is using its decision on the cost to finance a particular project rather than on the initial cost and life of the project, which would lead to incorrect accept reject decisions costo quity Click to select your answers) In th the process of analyzing its investiment decision-making procedures. Two projects evaluated by the fimmrecordy involved Buliding new facilities in different regions, North and South The basic variables surrounding each project analysis and the resulting decision actions are summarized in the following tablet 1. An analyst evaluating the North facility expects that the project will be financed by debt that costs the firm 6.9%. What recommendation do you think this analyst will make regarding the Investment opportunity? 6. Another analyst assigned to study the South facility believes that funding for that project will come from the firm's retained earnings at a cost of 175%. What recommendation do you expect this analyst to make regarding the investment? c. Explain why the decisions in parts a and b may not be in the best interest of the firm's Investors d. If the firm intains a capital structure containing 40% debt and 60% equity, find its weighted average cost using the data in the table . both halysts had used the weighted average cost calculated in part d, what recommendations would they have made regarding the North and South facilities? F. Compare and contrast the analysts initial recommendations with your findings in parte. Which decision method seems more appropriate? Explain why new OA. The firm in basing its decision on the firm's combined cost of capital rather than on the cost to finance a particular project, which may lead to incorrect acceptraject decision OG. The form is basing its decision on the cost to finance a particular project rather than on the least-cost financing sources, which would lead to incorrect accept reject decisions OC. The firm is basing its decision on the cost to finance a particular project rather than on the initial cost and life of the project, which would lead to incorrect acoperoject decisions OD. The firm is being its decision on the cost to finance a particular project rather than on the firm's combined cost of capital, which may lead to incorrect accept reject decisions d. It the firm maintains a capital structure containing 40% debt and 60% equity. Ja weighted average cost is % (Round to two decimal places) both analysts had uued the weighted average cost calculated in part d', what recommendations would they have made regarding the North and South facilities? (Select the best swee below. DA Bocah facility and the South facility would be accepted. OB The Nortcity would be accepted and the South facility would be rejected. OG The Nortiacity would be rejected and the South facility would be accepted OD. Both the North facility and the South facility would be rejected 1. Compare and control the analysts initial recommendations with your findings in parte. Which decision method some more appropriate? Explain why Select the best anwer below Click to select your answers NO roos in different regions North and South. The basic variables surrounding ench project analysis and the resulting decision actions are summarized in the following table An analyst evaluating the North facility expects that the project will bo financed by debt that costs the fim 6.9%. What recommendation do you think this analyst will make regarding to Investment opportunity? b. Another analyst assigned to study the South facility believes that funding for that project will come from the firm's retained earnings at a cost of 17,5%. What recommandation do you port this analyst to make regarding the investment? c. Explain why the decisions in parts and may not be in the best interest of the firm's investors d. If the fimm maintains a capital structure containing 40% debit and 60% equity find its weighted average cout using the data in the table both analysts had used the weighted average cost calculated in part d. What recommendations would they have made regarding the North and South face 1. Compare and contract the analysts initial recommendations with your findings in parte. Which decision method soms more appropriate? Explain why O Both the North facility and the South facility would be accepted On The North facily would be nocepled and the South facility would be rejected OC. The North facility would to rejected and the Soum fachty would be acompted. OD Both the North facility and me South facility would be rejected 1. Compare and contrast the analysts' Initial recommendations with your findings in parte. Which decision method seems more appropriate? Explain why (Select the best answer below A fare decisions are drawn using the two decision criteria. Either can effectively be used to make good decisions because both take into consideration the time value of money, which is the primary consideration of all providers of funds to the firm, OB. Oppo decisions are drawn using the two decision criteria. Neither decision-making method provides consistent decisions because each is limited by assumptions regarding moines of intermediul cash inflows. Oc Opposite cortions are drawn using the two decision criteria. The cout to finance a particular project provides better decisions because it takes into consideration management decisione dividual project funding sources CD. Opponle decisions are drawn using the two decision criteria. The overall cost of capital provides better decisions because it takes into consideration the cost of the blend of financing, not the cost of debt or equity alone Click to select your answers manufacturing is in the process of analyzing its investment decision-making procedures. Two projects evaluated by and South. The basic variables surrounding each project analysis and the resulting decision actions are summa Eility expects that the project will be financed by debt that costs the firm 6.9%. What recommendation do you think 18 years pst of 17.5% the South the inves i Data Table and bm ure conta nted aver th and Sou initial reg Explain why (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) South fad Basic variables North South ecepted ar Cost $8,000,000 $7,280,000 jected and Life 18 years South fad Expected return 8.3% 15.4% Least-cost financing its initial reg Source Debt Equity Explain why. Cost (after-tax) 6.9% 17.5% wn using the Decision ake into consid considerat Action Invest Don't invest Reason 8.3% > 6.9% cost v using the 15.4%