Answered step by step

Verified Expert Solution

Question

1 Approved Answer

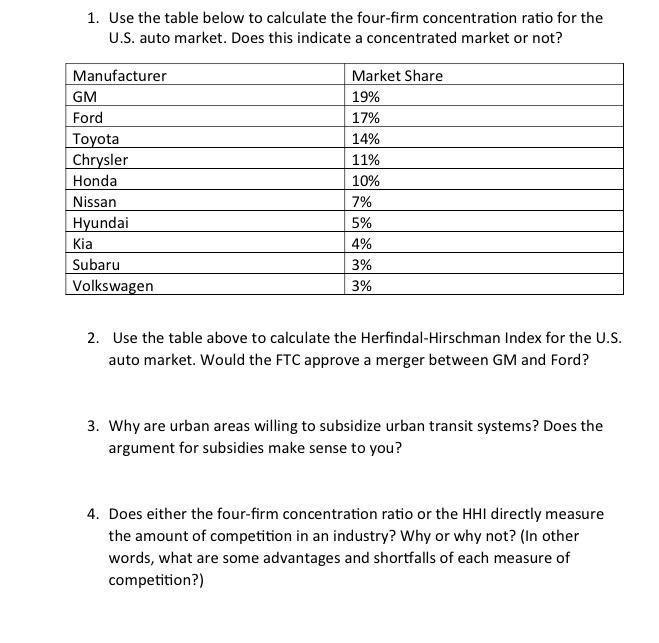

1. Use the table below to calculate the four-firm concentration ratio for the U.S. auto market. Does this indicate a concentrated market or not?

1. Use the table below to calculate the four-firm concentration ratio for the U.S. auto market. Does this indicate a concentrated market or not? Market Share 19% Manufacturer GM Ford Toyota Chrysler 17% 14% 11% Honda 10% Nissan Hyundai 7% 5% Kia 4% Subaru 3% Volkswagen 3% 2. Use the table above to calculate the Herfindal-Hirschman Index for the U.S. auto market. Would the FTC approve a merger between GM and Ford? 3. Why are urban areas willing to subsidize urban transit systems? Does the argument for subsidies make sense to you? 4. Does either the four-firm concentration ratio or the HHI directly measure the amount of competition in an industry? Why or why not? (In other words, what are some advantages and shortfalls of each measure of competition?)

Step by Step Solution

★★★★★

3.59 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Q1 It is used to study the level of market control by large market firms and to establish the level of competition that exists in the market It is a percentage of the market share percentage in the in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d5cc4311ac_174901.pdf

180 KBs PDF File

635d5cc4311ac_174901.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started