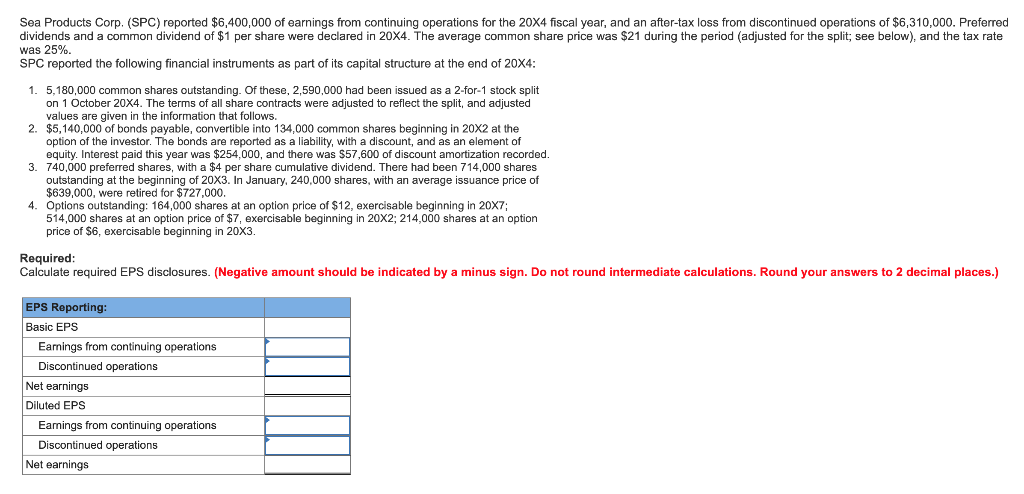

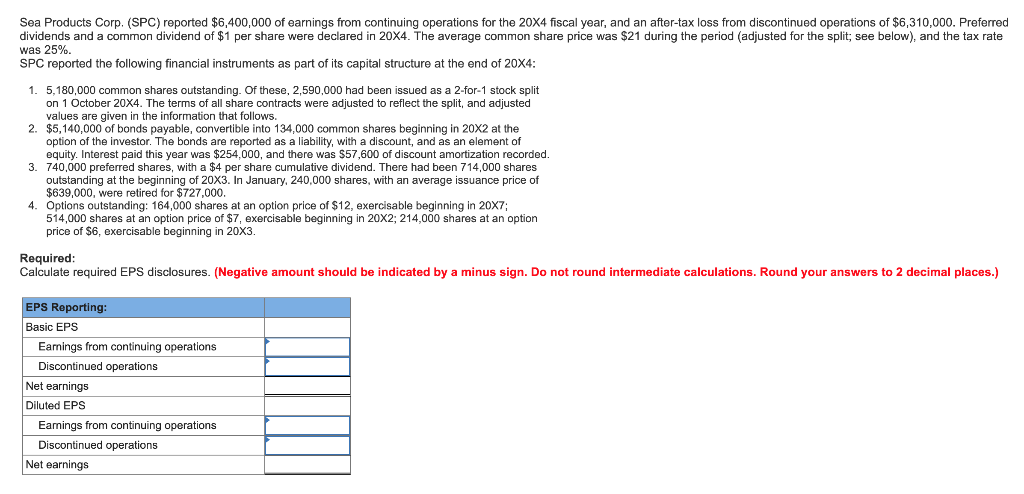

Sea Products Corp. (SPC) reported $6,400,000 of earnings from continuing operations for the 20X4 fiscal year, and an after-tax loss from discontinued operations of $6,310,000. Preferred dividends and a common dividend of $1 per share were declared in 20X4. The average common share price was $21 during the period (adjusted for the split; see below), and the tax rate was 25% SPC reported the following financial instruments as part of its capital structure at the end of 20X4 1. 5,180,000 common shares outstanding. Of these, 2,590,000 had been issued as a 2-for-1 stock split on 1 October 20X4. The terms of all share contracts were adjusted to reflect the split, and adjusted values are given in the information that follows. $5,140,000 of bonds payable, convertible into 134,000 common shares beginning in 20X2 at the option of the investor. The bonds are reported as a liability, with a discount, and as an element of equity. Interest paid this year was $254,000, and there was $57,600 of discount amortization recorded. 740,000 preferred shares, with a $4 per share cumulative dividend. There had been 714,000 shares outstanding at the beginning of 20X3. In January, 240,000 shares, with an average issuance price of $639,000, were retired for $727,000 Options outstanding: 164,000 shares at an option price of $12, exercisable beginning in 20X7; 514,000 shares at an option price of $7, exercisable beginning in 20X2; 214,000 shares at an option price of $6, exercisable beginning in 20X3. 2. 3. 4. Required Calculate required EPS disclosures. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) EPS Reporting Basic EPS Earnings from continuing operations Discontinued operations Net earnings Diluted EPS Earnings from continuing operations Discontinued operations Net earnings Sea Products Corp. (SPC) reported $6,400,000 of earnings from continuing operations for the 20X4 fiscal year, and an after-tax loss from discontinued operations of $6,310,000. Preferred dividends and a common dividend of $1 per share were declared in 20X4. The average common share price was $21 during the period (adjusted for the split; see below), and the tax rate was 25% SPC reported the following financial instruments as part of its capital structure at the end of 20X4 1. 5,180,000 common shares outstanding. Of these, 2,590,000 had been issued as a 2-for-1 stock split on 1 October 20X4. The terms of all share contracts were adjusted to reflect the split, and adjusted values are given in the information that follows. $5,140,000 of bonds payable, convertible into 134,000 common shares beginning in 20X2 at the option of the investor. The bonds are reported as a liability, with a discount, and as an element of equity. Interest paid this year was $254,000, and there was $57,600 of discount amortization recorded. 740,000 preferred shares, with a $4 per share cumulative dividend. There had been 714,000 shares outstanding at the beginning of 20X3. In January, 240,000 shares, with an average issuance price of $639,000, were retired for $727,000 Options outstanding: 164,000 shares at an option price of $12, exercisable beginning in 20X7; 514,000 shares at an option price of $7, exercisable beginning in 20X2; 214,000 shares at an option price of $6, exercisable beginning in 20X3. 2. 3. 4. Required Calculate required EPS disclosures. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) EPS Reporting Basic EPS Earnings from continuing operations Discontinued operations Net earnings Diluted EPS Earnings from continuing operations Discontinued operations Net earnings