Question

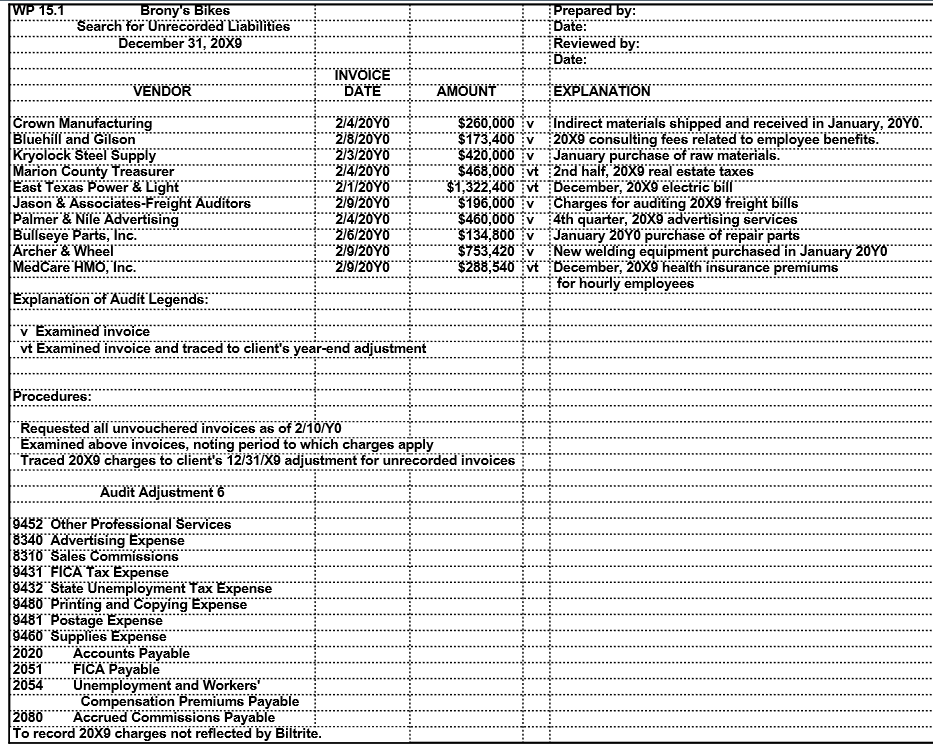

Search for Unrecorded Liabilities An important part of every audit is examining vendors invoices processed after year end. Related to cutoff, as discussed in Module

Search for Unrecorded Liabilities

An important part of every audit is examining vendors invoices processed after year end. Related to

cutoff, as discussed in Module VI, this set of procedures has the purpose of determining that no

significant invoices pertaining to the year being audited have been omitted from recorded liabilities.

Derick has asked that you examine the document prepared by Cheryl Lucas and entitled Search for

Unrecorded Liabilities, and review it for necessary audit adjustments.

Requirements

1. Retrieve the file labeled 20X9 Liab. (LINK) Comment on the adequacy of the procedures performed

by Lucas.

2. Assuming that you found the following additional unrecorded charges pertaining to 20X9, draft Audit

Adjustment 6 at the bottom of WP 15.1:

a. Sales commissions $366,900

b. Employers payroll taxes: FICA $94,000, state unemployment $126,000

c. Printing and copying $27,800

d. Postage $22,300

e. Office supplies $18,6002

3. Print or Save the document.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started