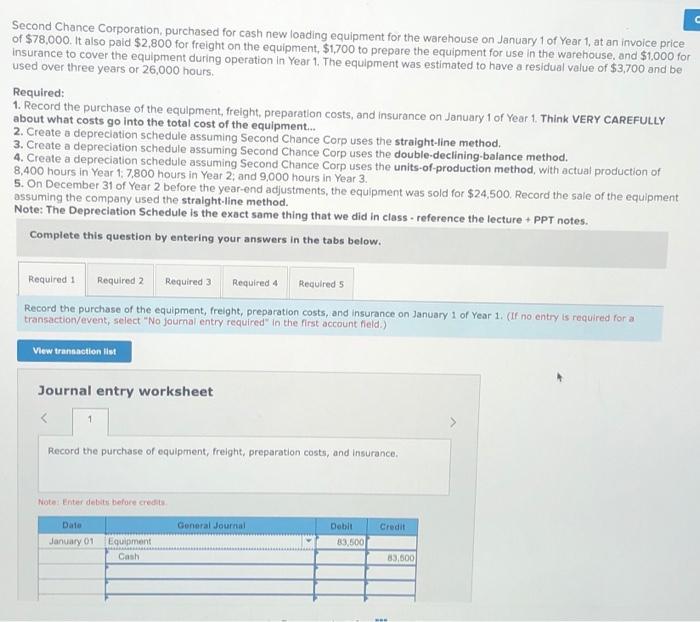

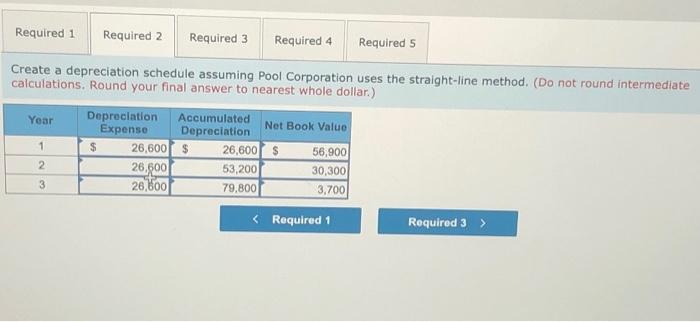

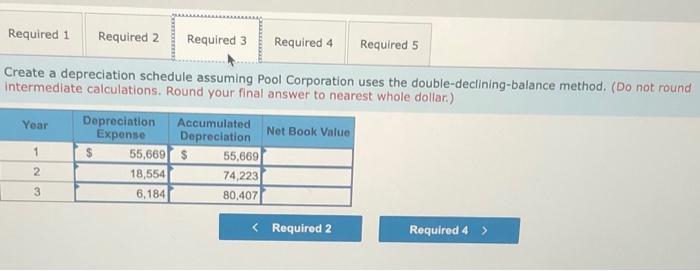

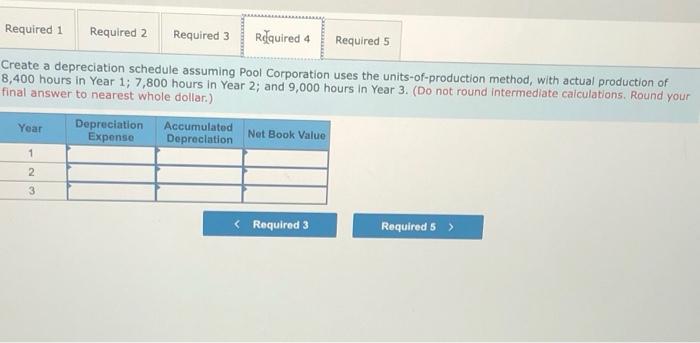

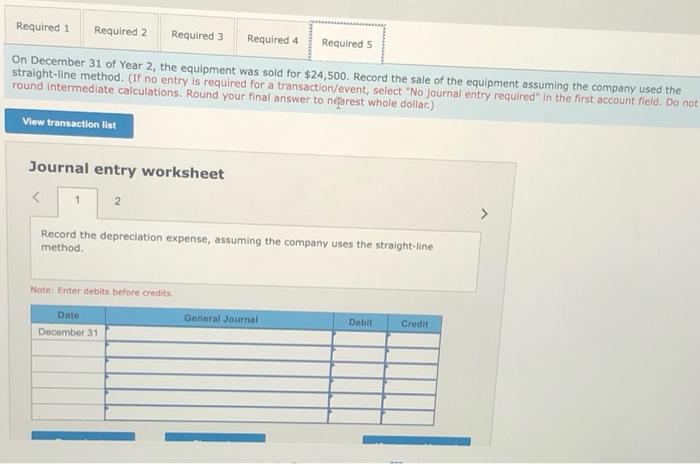

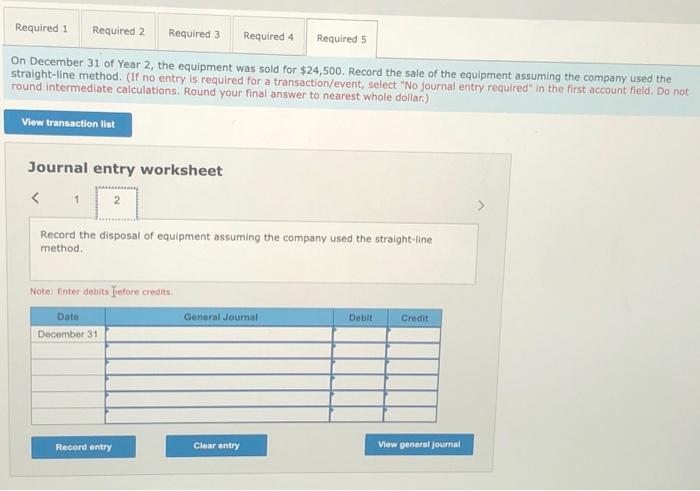

Second Chance Corporation, purchased for cash new loading equipment for the warehouse on January 1 of Year 1, at an invoice price of $78,000. It also paid $2,800 for freight on the equipment, $1,700 to prepare the equipment for use in the warehouse, and $1.000 for insurance to cover the equipment during operation in Year 1. The equipment was estimated to have a residual velue of $3,700 and be used over three years or 26,000 hours. Required: 1. Record the purchase of the equipment, freight, preparation costs, and insurance on January 1 of Year 1 Think VERY CAREFULLY about what costs go into the total cost of the equipment... 2. Create a depreciation schedule assuming Second Chance Corp uses the straight-line method. 3. Create a depreciation schedule assuming Second Chance Corp uses the double-declining balance method. 4. Create a depreciation schedule assuming Second Chance Corp uses the units-of-production method, with actual production of 8,400 hours in Year 1: 7,800 hours in Year 2, and 9,000 hours in Year 3. 5. On December 31 of Year 2 before the year-end adjustments, the equipment was sold for $24,500. Record the sale of the equipment assuming the company used the straight-line method. Note: The Depreciation Schedule is the exact same thing that we did in class-reference the lecture + PPT notes. Complete this question by entering your answers in the tabs below. Required: Required 2 Required 3 Required 4 Required Record the purchase of the equipment, freight, preparation costs, and insurance on January 1 of Year 1. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field) View transaction ist Journal entry worksheet Record the purchase of equipment, freight, preparation costs, and insurance, Nota: Enter det before credits Date General Journal Credit Doblo 83,500 January 01 Equipment Cash 83,000 Required 1 Required 2 Required 3 Required 4 Required 5 Create a depreciation schedule assuming Pool Corporation uses the straight-line method. (Do not round intermediate calculations. Round your final answer to nearest whole dollar.) Year Net Book Value 1 Depreciation Accumulated Expense Depreciation $ 26,600 $ 26,600 26,900 53,200 26,600 79,800 $ 2 56,900 30,300 3,700 3 Required 1 Required 2 Required 3 Required 4 Required 5 Create a depreciation schedule assuming Pool Corporation uses the double-declining-balance method. (Do not round Intermediate calculations, Round your final answer to nearest whole dollar.) Year 1 Depreciation Accumulated Expense Depreciation Net Book Value $ 55,669 $ 55,669 18,554 74,223 6,184 80,407 2 3 Required 1 Required 2 Required 3 Rdquired 4 Required 5 Create a depreciation schedule assuming Pool Corporation uses the units-of-production method, with actual production of 8,400 hours in Year 1; 7,800 hours in Year 2; and 9,000 hours in Year 3. (Do not round Intermediate calculations. Round your final answer to nearest whole dollar.) Year Depreciation Expense Accumulated Depreciation Net Book Value 1 2 3 Required 1 Required 2 Required 3 Required 4 Required 5 On December 31 of Year 2, the equipment was sold for $24,500. Record the sale of the equipment assuming the company used the straight-line method. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your final answer to nearest whole dollar) View transaction list Journal entry worksheet