Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Section 1 : The Basics of Hedging A small German firm bought a patent from a British firm and will make a payment of 1

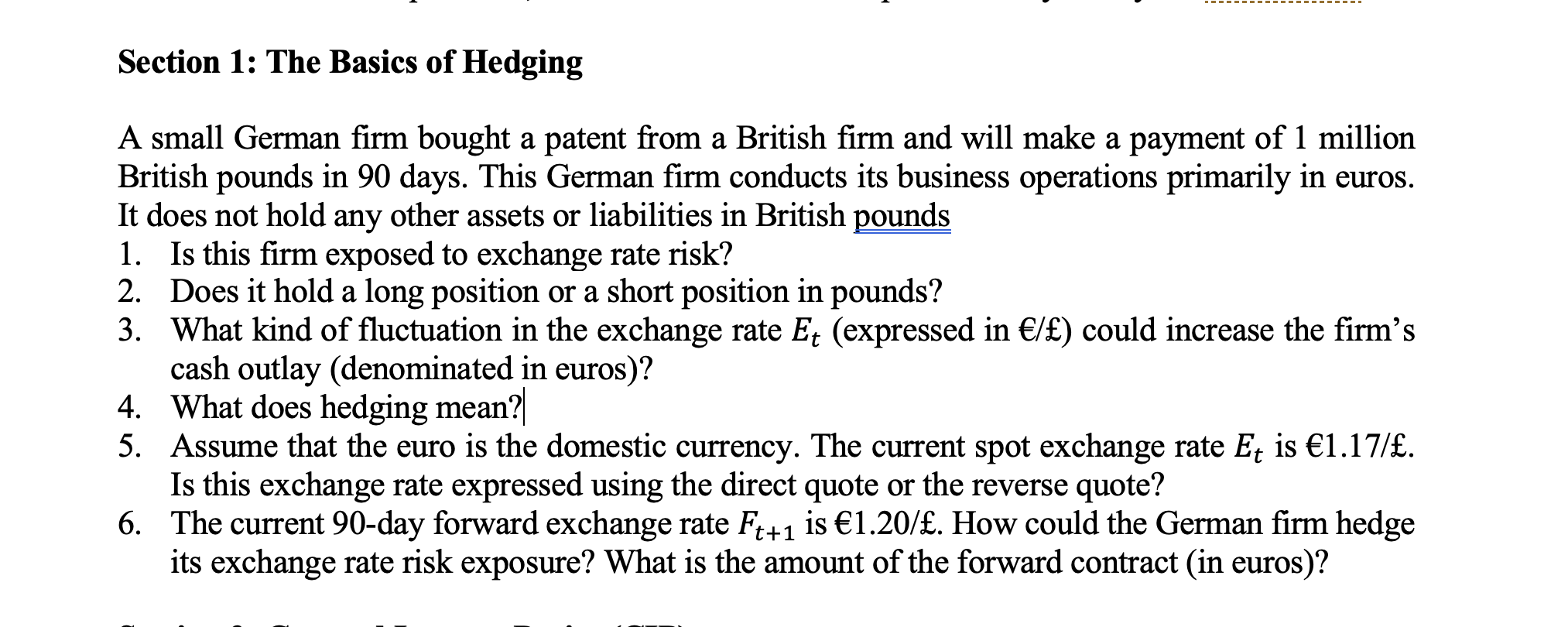

Section : The Basics of Hedging

A small German firm bought a patent from a British firm and will make a payment of million

British pounds in days. This German firm conducts its business operations primarily in euros.

It does not hold any other assets or liabilities in British pounds

Is this firm exposed to exchange rate risk?

Does it hold a long position or a short position in pounds?

cash outlay denominated in euros

What does hedging mean?

Assume that the euro is the domestic currency. The current spot exchange rate is

Is this exchange rate expressed using the direct quote or the reverse quote?

The current day forward exchange rate is How could the German firm hedge

its exchange rate risk exposure? What is the amount of the forward contract in euros

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started