Answered step by step

Verified Expert Solution

Question

1 Approved Answer

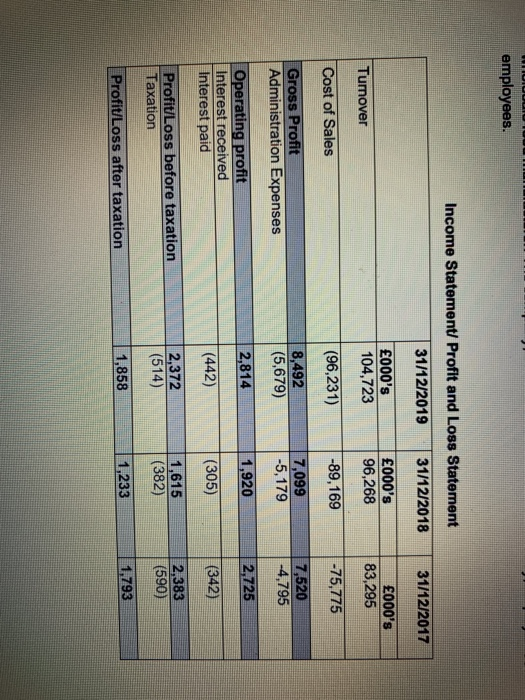

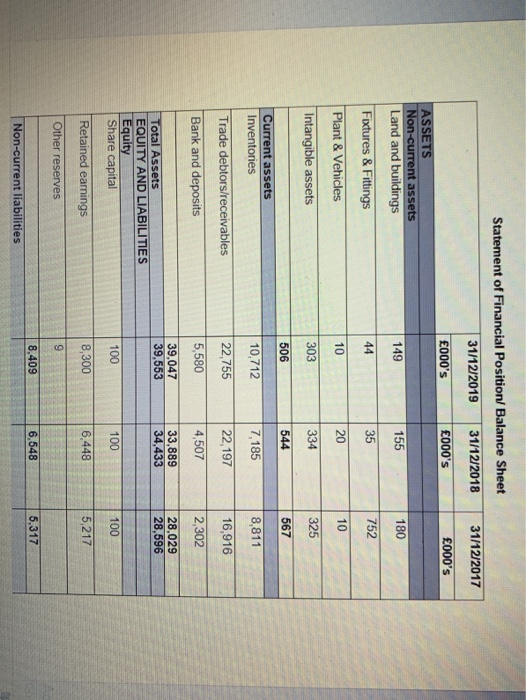

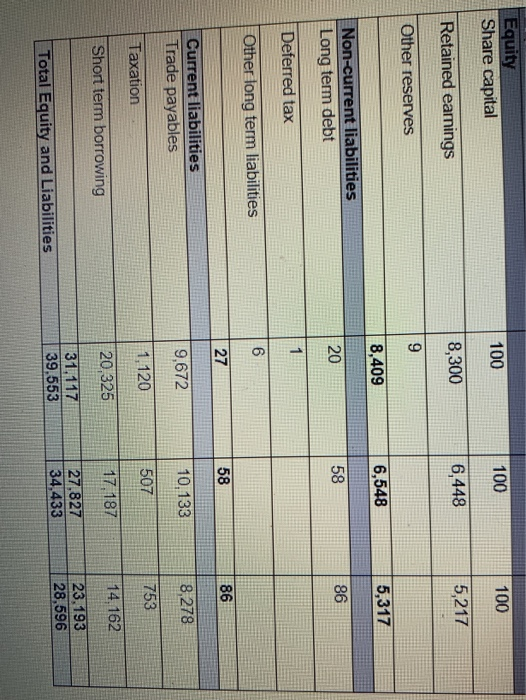

SECTION 2: COMPULSORY (weighting 70%) Company Information: The following financial statements relate to OBriens Limited, an SME that operates as a wholesale food manufacturer. The

SECTION 2: COMPULSORY (weighting 70%)

Company Information:

The following financial statements relate to OBriens Limited, an SME that operates as a wholesale food manufacturer. The company, which is located in Wales currently, employs 150 employees.

Using the following account statement from the images ( answer the following questions)

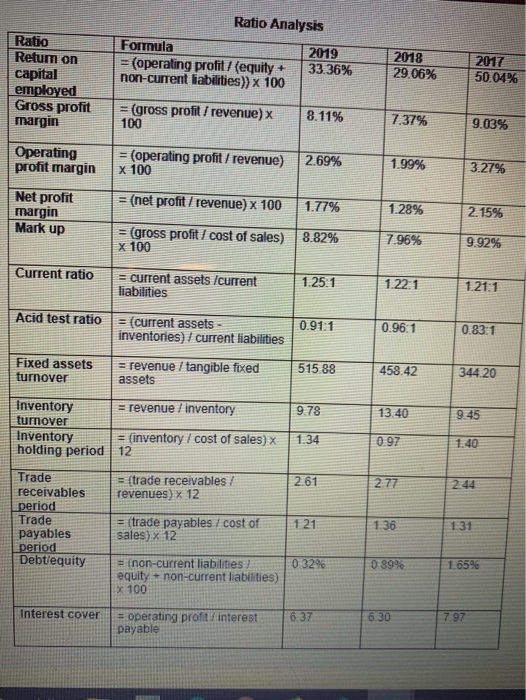

Basing your answers on the information contained within the financial accounts and ratio analysis for OBriens Ltd. answer all SEVEN questions below (Q4 - Q10). This section is worth 70% and all questions are equally weighted.

Q4. How has the business performed over the past three years in terms of generating sales and gross profit? (10 marks).

Q5. Explain what the return on capital employed ratio measures, why it is important and discuss how the business has performed in this regard over the period 2019-2016 (10 marks).

Q6. Explain the difference between operating profit margin and net profit margin and explain what they tell us about this business performance over the past three years? (10 marks).

Q7. Explain the difference between inventory turnover and inventory holding period and explain what the figures tell us about this business performance over the past three years (10 marks).

Q8. How has the business performed in terms of the time taken to pay suppliers and collect money from customers over the past three years? (10 marks).

Q9. Evaluate the liquidity of the business over the three years using the two relevant ratios and identify which is the more stringent measure and why (10 marks).

Q10. Evaluate the business gearing ratios over the three years using the two relevant ratios (10 marks).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started