Question: Section A: Multiple Choice Questions (each MCO is worth 2 points) For each of the following, please pick the best answer 1. According to constant

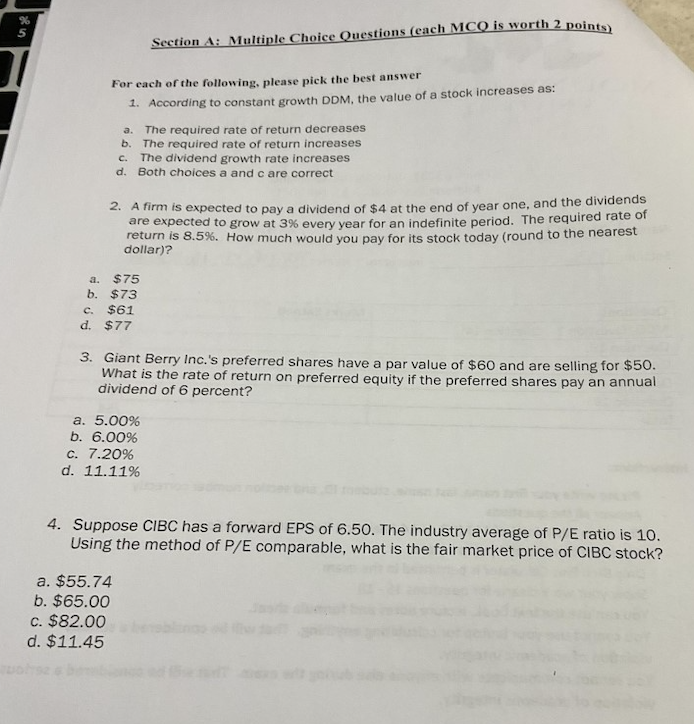

Section A: Multiple Choice Questions (each MCO is worth 2 points) For each of the following, please pick the best answer 1. According to constant growth DDM, the value of a stock increases as: a. The required rate of return decreases b. The required rate of return increases The dividend growth rate increases d. Both choices a and c are correct C. 2. A firm is expected to pay a dividend of $4 at the end of year one, and the dividends are expected to grow at 3% every year for an indefinite period. The required rate of return is 8.5%. How much would you pay for its stock today (round to the nearest dollar)? $75 b. $73 c. $61 d. $77 3. Giant Berry Inc.'s preferred shares have a par value of $60 and are selling for $50. What is the rate of return on preferred equity if the preferred shares pay an annual dividend of 6 percent? a. 5.00% b. 6.00% c. 7.20% d. 11.11% 4. Suppose CIBC has a forward EPS of 6.50. The industry average of P/E ratio is 10. Using the method of P/E comparable, what is the fair market price of CIBC stock? a. $55.74 b. $65.00 c. $82.00 d. $11.45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts