Answered step by step

Verified Expert Solution

Question

1 Approved Answer

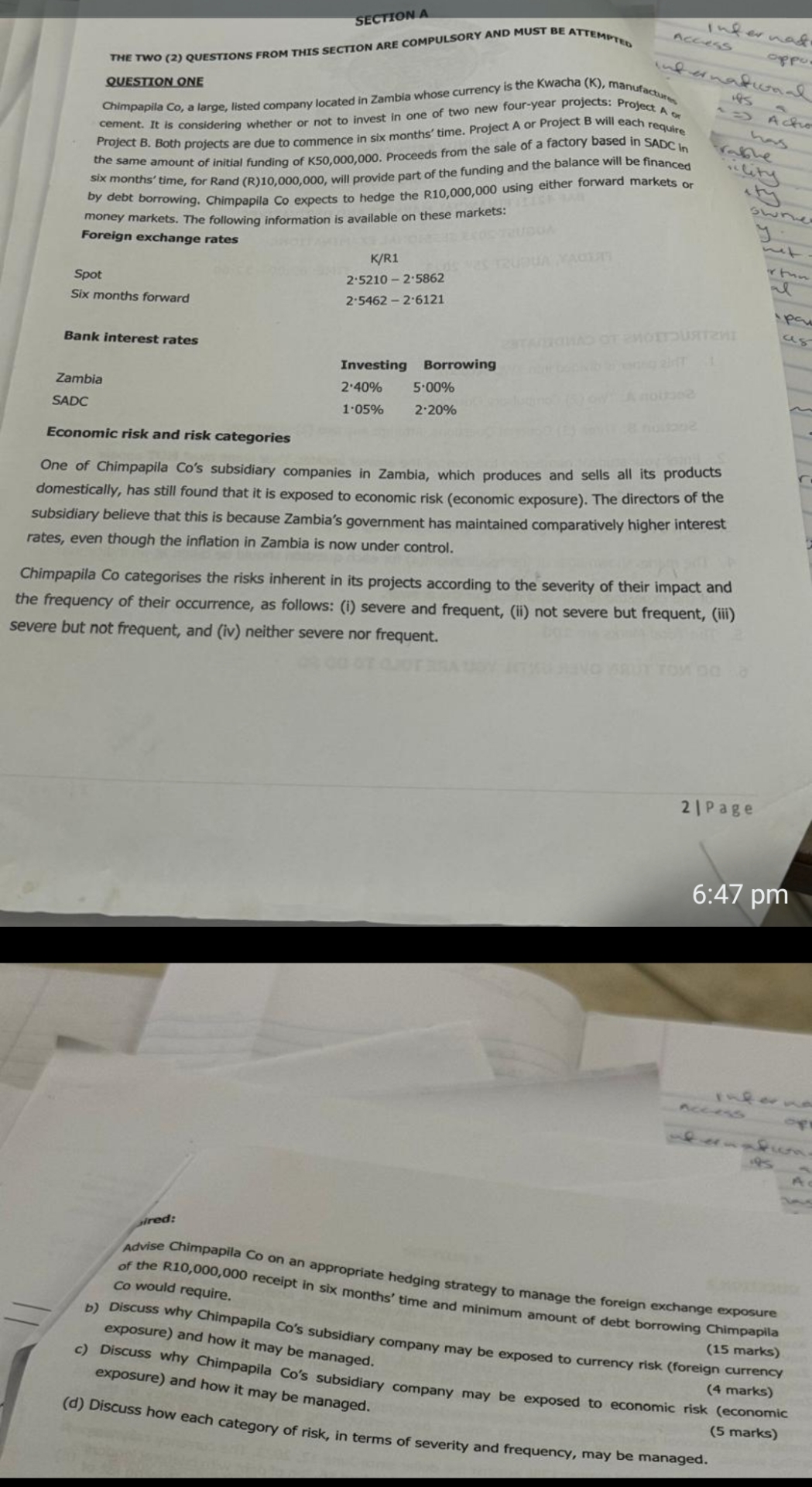

SECTION A THE TWO ( 2 ) QUESTIONS FROM THIS SECTION ARE COMPULSORY AND MUST BE ATTEMDTEO QUESTION ONE Chimpapila Co , a large, listed

SECTION A

THE TWO QUESTIONS FROM THIS SECTION ARE COMPULSORY AND MUST BE ATTEMDTEO QUESTION ONE

Chimpapila Co a large, listed company located in Zambia whose currency is the Kwacha K manufactury cement. It is considering whether or not to invest in one of two new fouryear projects: Procct or Project B Both projects are due to commence in six months' time. Project A sale of a factory based in SADC in by debt borrowing. Chimpapila Co expects to hedge the R using either forward markets or money markets. The following information is available on these markets:

Foreign exchange rates

Spot

Six months forward

Bank interest rates

Zambia

SADC

KR

Economic risk and risk categories

One of Chimpapila Co's subsidiary companies in Zambia, which produces and sells all its products domestically, has still found that it is exposed to economic risk economic exposure The directors of the subsidiary believe that this is because Zambia's government has maintained comparatively higher interest rates, even though the inflation in Zambia is now under control.

Chimpapila Co categorises the risks inherent in its projects according to the severity of their impact and the frequency of their occurrence, as follows: i severe and frequent, ii not severe but frequent, iii severe but not frequent, and iv neither severe nor frequent.

: pm

ired:

Advise Chimpapila Co on an appropriate hedging strategy to manage the foreign exchange exposure

of the R receipt in six month's' time and minimum amount of debt borrowing Chimpapila

Co would require.

tableInvestingBorrowing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started