Answered step by step

Verified Expert Solution

Question

1 Approved Answer

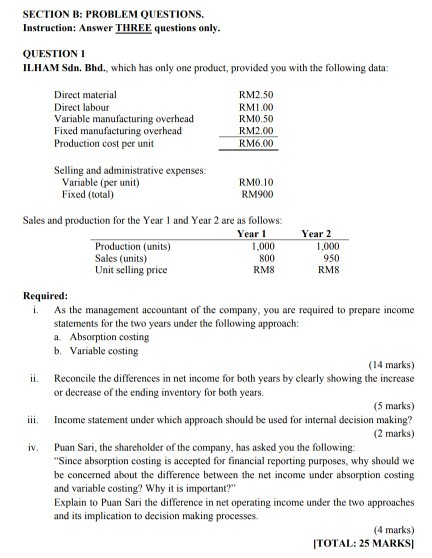

SECTION B: PROBLEM QUESTIONS Instruction: Answer THREE questions only QUESTION I ILHAM Sdn. Bhd., which has only one product, provided you with the following data:

SECTION B: PROBLEM QUESTIONS Instruction: Answer THREE questions only QUESTION I ILHAM Sdn. Bhd., which has only one product, provided you with the following data: Direct material Direct labour Variable manufacturing overhead Fixed manufacturing overhead Production cost per unit RM2.50 RM1.00 RM0.50 RM2.00 RM6.00 Selling and administrative expenses: Variable (per unit) Fixed (total) RM0.10 RM900 Sales and production for the Year 1 and Year 2 are as follows: Year I Year 2 Production (units) Sales (units) Unit selling price 1,000 800 RM8 1,000 950 RM8 Required i. As the management accountant of the company, you are required to prepare income statements for the two years under the following approach: a. Absorption costing b. Variable costing (14 marks) ii. Reconcile the differences in net income for both years by clearly showing the increase or decrease of the ending inventory for both years. (5 marks) iii. Income statement under which approach should be used for intenal decision making? (2 marks) Puan Sari, the shareholder of the company, has asked you the following: Since absorption costing is accepted for financial reporting purposes, why should we be concerned about the difference between the net income under absorption costing and variable costing? Why it is important? Explain to Puan Sari the difference in net operating income under the two approaches and its implication to decision making processes. iv. (4 marks) ITOTAL: 25 MARKSI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started