Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Section B Question 1 The executor of your father's Will has offered you the following options i. GH 50 million now ii. GH 120 million

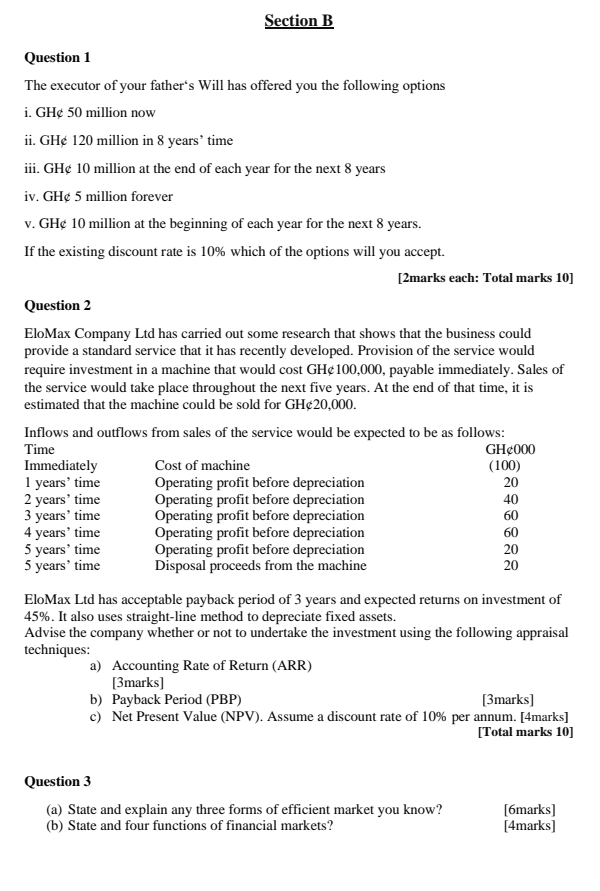

Section B Question 1 The executor of your father's Will has offered you the following options i. GH 50 million now ii. GH 120 million in 8 years' time iii. GH 10 million at the end of each year for the next 8 years iv. GH 5 million forever v. GH 10 million at the beginning of each year for the next 8 years. If the existing discount rate is 10% which of the options will you accept. [2marks each: Total marks 10] Question 2 EloMax Company Ltd has carried out some research that shows that the business could provide a standard service that it has recently developed. Provision of the service would require investment in a machine that would cost GH100,000, payable immediately. Sales of the service would take place throughout the next five years. At the end of that time, it is estimated that the machine could be sold for GH20,000. Inflows and outflows from sales of the service would be expected to be as follows: Time GH000 Immediately Cost of machine (100) 1 years' time Operating profit before depreciation 20 2 years' time Operating profit before depreciation 40 3 years' time Operating profit before depreciation 60 4 years' time Operating profit before depreciation 60 5 years' time Operating profit before depreciation 20 5 years' time Disposal proceeds from the machine 20 EloMax Ltd has acceptable payback period of 3 years and expected returns on investment of 45%. It also uses straight-line method to depreciate fixed assets. Advise the company whether or not to undertake the investment using the following appraisal techniques: a) Accounting Rate of Return (ARR) [3marks) b) Payback Period (PBP) [3marks) c) Net Present Value (NPV). Assume a discount rate of 10% per annum. [4marks] [Total marks 10] Question 3 (a) State and explain any three forms of efficient market you know? (b) State and four functions of financial markets? [6marks) [4marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started