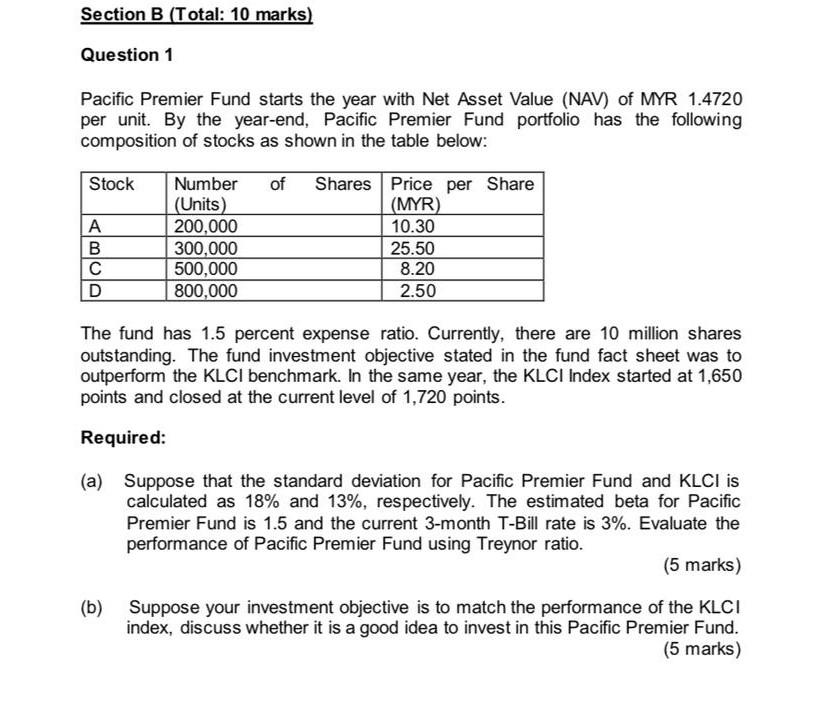

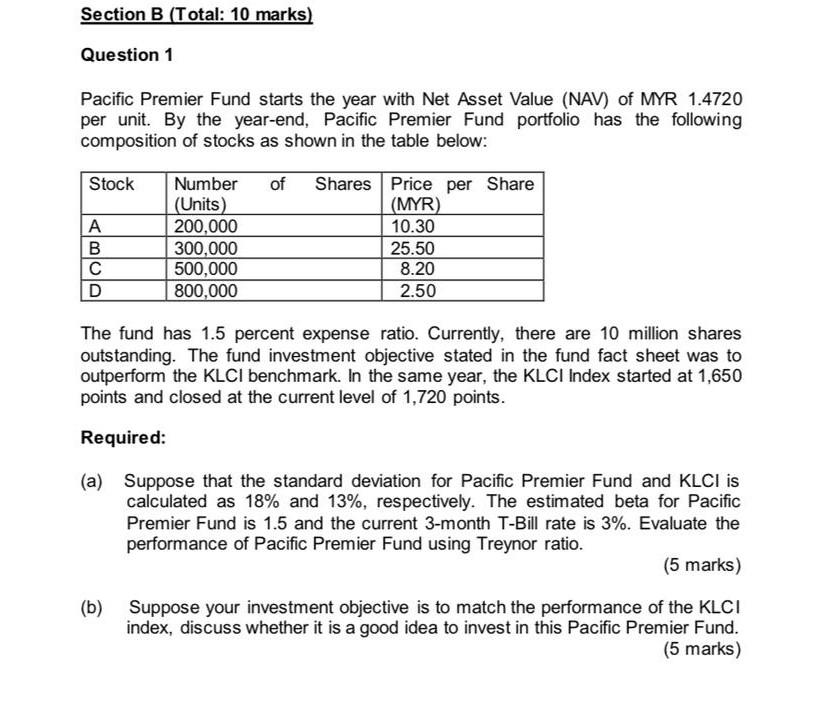

Section B (Total: 10 marks) Question 1 Pacific Premier Fund starts the year with Net Asset Value (NAV) of MYR 1.4720 per unit. By the year-end, Pacific Premier Fund portfolio has the following composition of stocks as shown in the table below: Stock of A B D Number (Units) 200,000 300,000 500,000 800,000 Shares Price per Share (MYR) 10.30 25.50 8.20 2.50 The fund has 1.5 percent expense ratio. Currently, there are 10 million shares outstanding. The fund investment objective stated in the fund fact sheet was to outperform the KLCI benchmark. In the same year, the KLCI Index started at 1,650 points and closed at the current level of 1,720 points. Required: (a) Suppose that the standard deviation for Pacific Premier Fund and KLCI is calculated as 18% and 13%, respectively. The estimated beta for Pacific Premier Fund is 1.5 and the current 3-month T-Bill rate is 3%. Evaluate the performance of Pacific Premier Fund using Treynor ratio. (5 marks) (b) Suppose your investment objective is to match the performance of the KLCI index, discuss whether it is a good idea to invest in this Pacific Premier Fund. (5 marks) Section B (Total: 10 marks) Question 1 Pacific Premier Fund starts the year with Net Asset Value (NAV) of MYR 1.4720 per unit. By the year-end, Pacific Premier Fund portfolio has the following composition of stocks as shown in the table below: Stock of A B D Number (Units) 200,000 300,000 500,000 800,000 Shares Price per Share (MYR) 10.30 25.50 8.20 2.50 The fund has 1.5 percent expense ratio. Currently, there are 10 million shares outstanding. The fund investment objective stated in the fund fact sheet was to outperform the KLCI benchmark. In the same year, the KLCI Index started at 1,650 points and closed at the current level of 1,720 points. Required: (a) Suppose that the standard deviation for Pacific Premier Fund and KLCI is calculated as 18% and 13%, respectively. The estimated beta for Pacific Premier Fund is 1.5 and the current 3-month T-Bill rate is 3%. Evaluate the performance of Pacific Premier Fund using Treynor ratio. (5 marks) (b) Suppose your investment objective is to match the performance of the KLCI index, discuss whether it is a good idea to invest in this Pacific Premier Fund