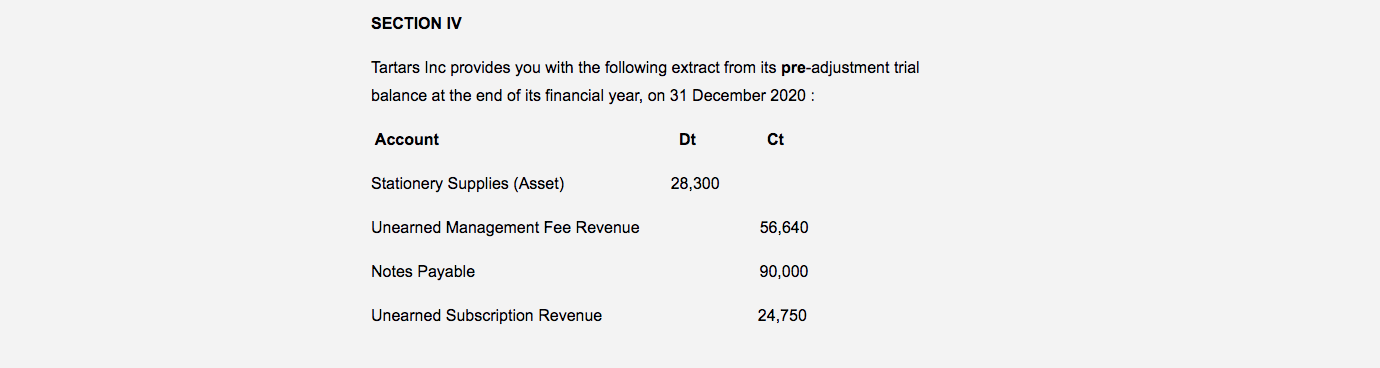

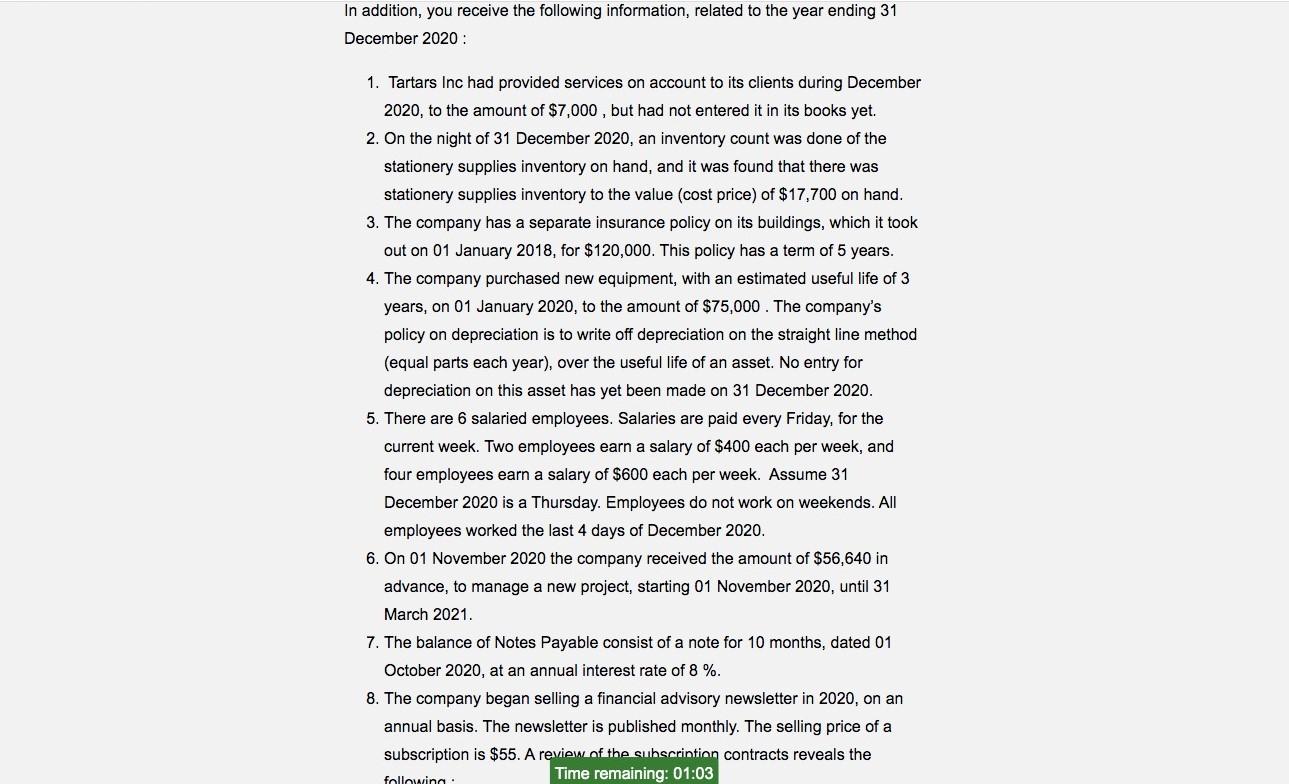

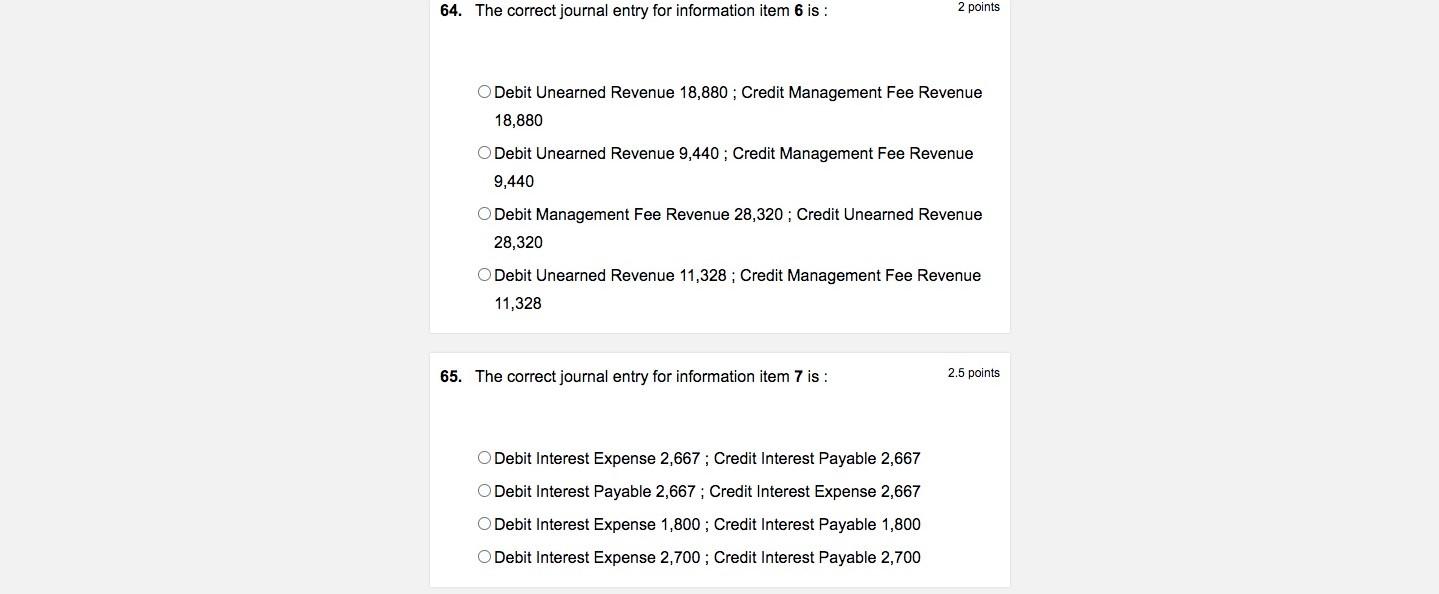

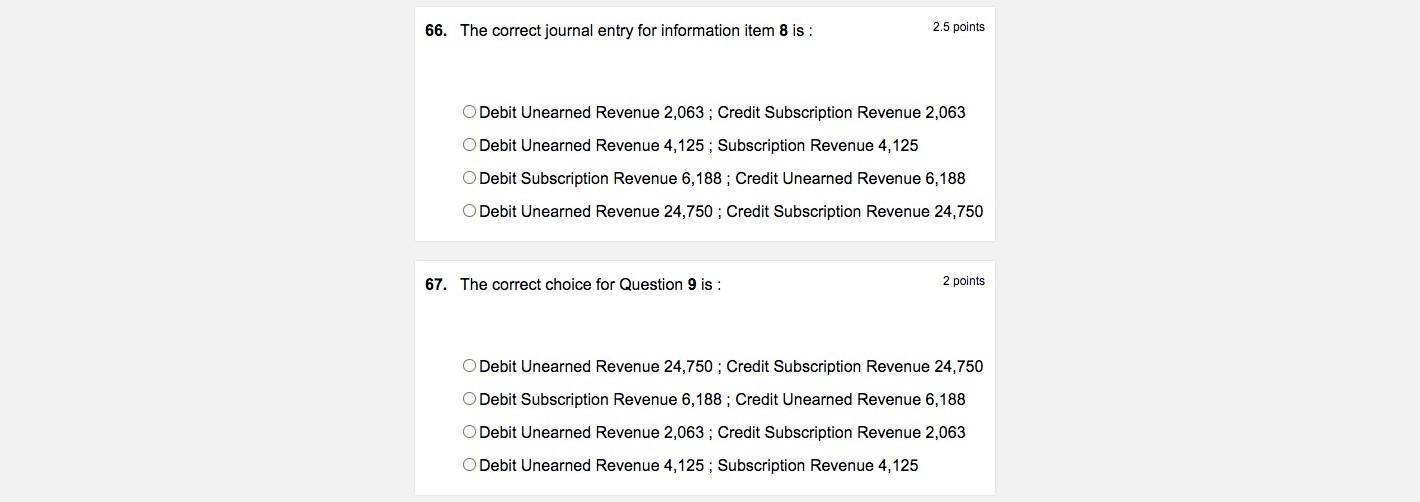

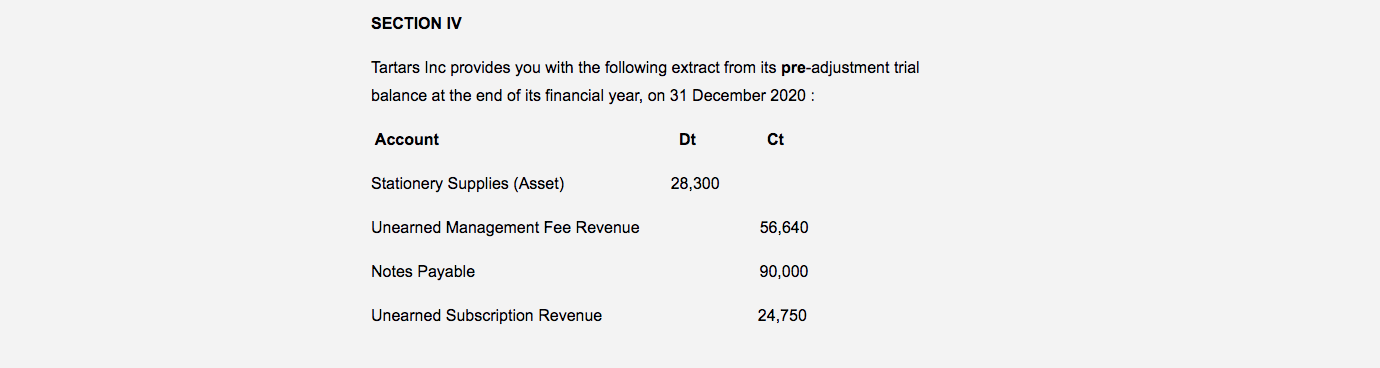

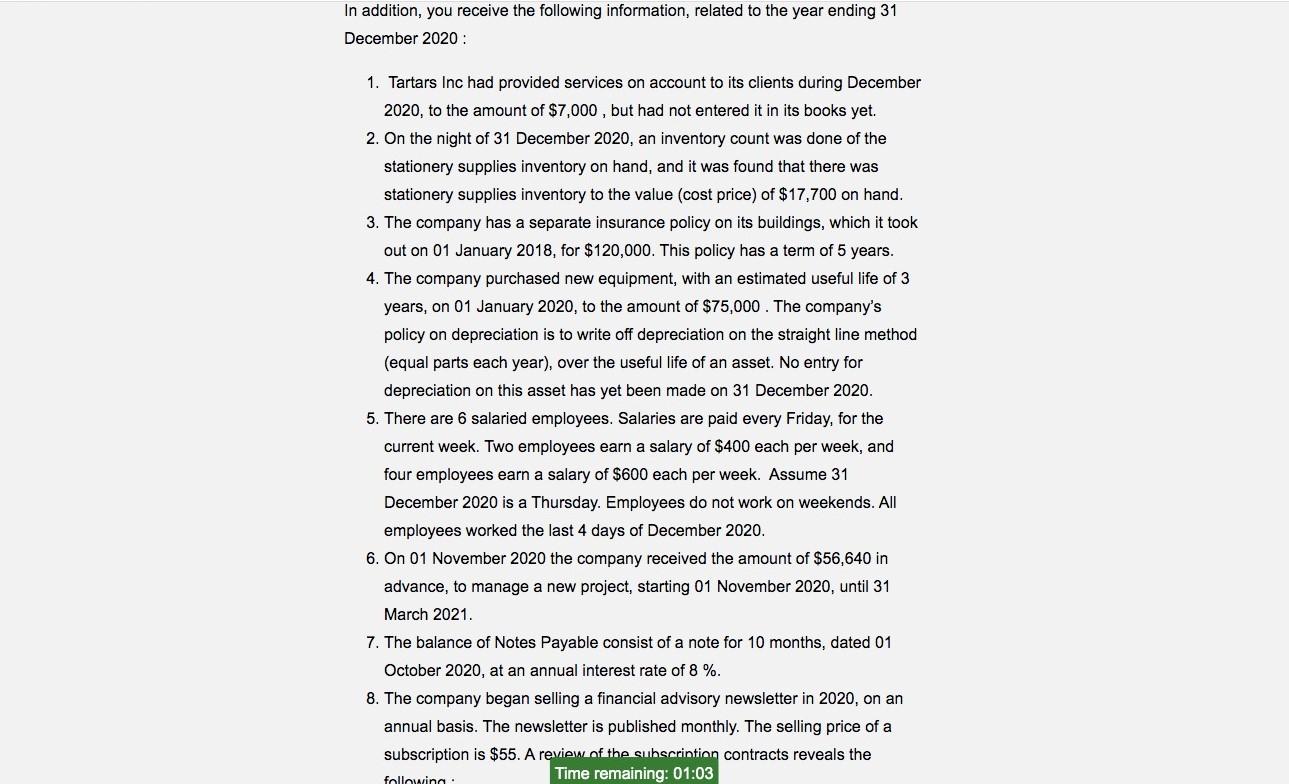

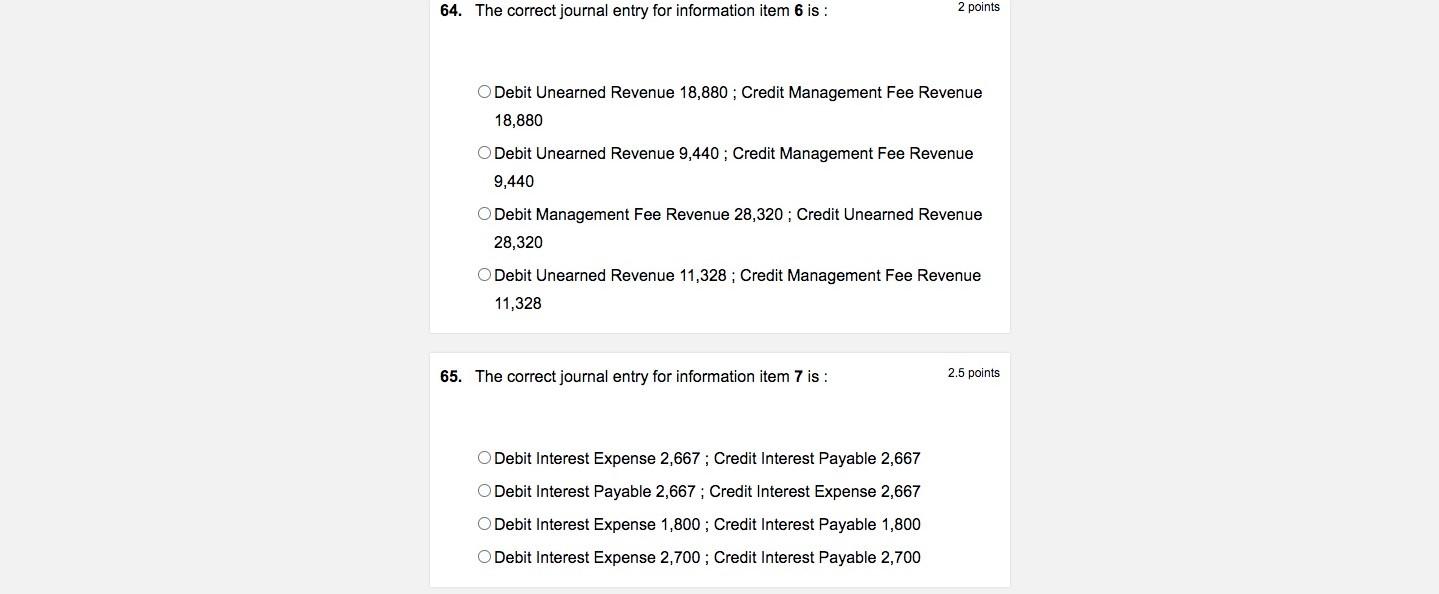

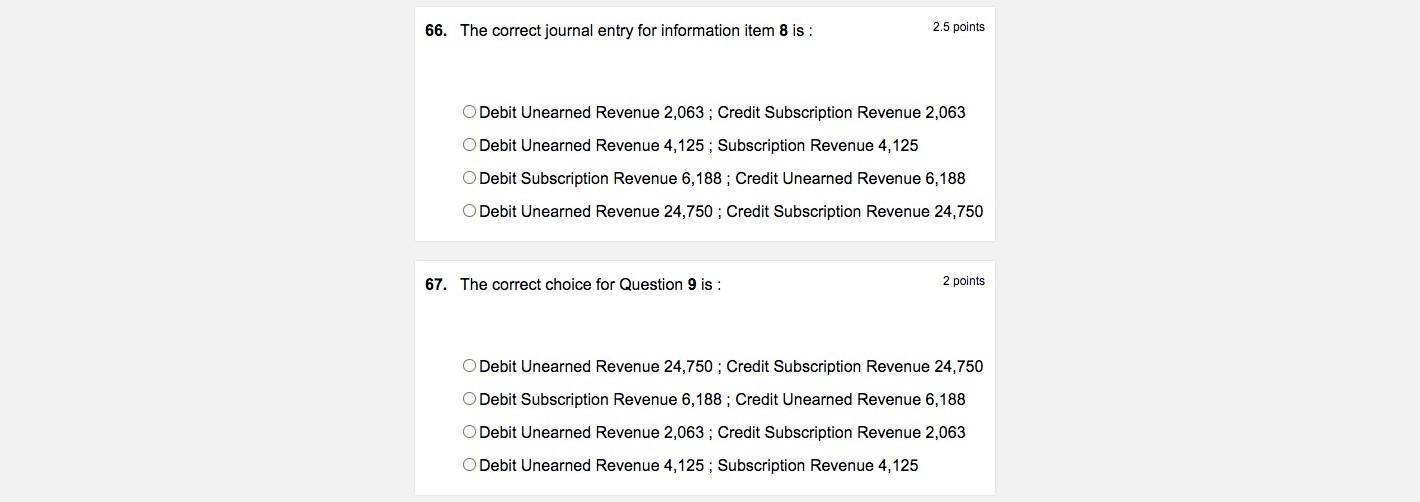

SECTION IV Tartars Inc provides you with the following extract from its pre-adjustment trial balance at the end of its financial year, on 31 December 2020 : Account Dt Ct Stationery Supplies (Asset) 28,300 Unearned Management Fee Revenue 56,640 Notes Payable 90,000 Unearned Subscription Revenue 24,750 In addition, you receive the following information, related to the year ending 31 December 2020: 1. Tartars Inc had provided services on account to its clients during December 2020, to the amount of $7,000, but had not entered it in its books yet. 2. On the night of 31 December 2020, an inventory count was done of the stationery supplies inventory on hand, and it was found that there was stationery supplies inventory to the value (cost price) of $17,700 on hand. 3. The company has a separate insurance policy on its buildings, which it took out on 01 January 2018, for $120,000. This policy has a term of 5 years. 4. The company purchased new equipment, with an estimated useful life of 3 years, on 01 January 2020, to the amount of $75,000. The company's policy on depreciation is to write off depreciation on the straight line method (equal parts each year), over the useful life of an asset. No entry for depreciation on this asset has yet been made on 31 December 2020. 5. There are salaried employees. Salaries are paid every Friday, for the current week. Two employees earn a salary of $400 each per week, and four employees earn a salary of $600 each per week. Assume 31 December 2020 is a Thursday. Employees do not work on weekends. All employees worked the last 4 days of December 2020. 6. On 01 November 2020 the company received the amount of $56,640 in advance, to manage a new project, starting 01 November 2020, until 31 March 2021. 7. The balance of Notes Payable consist of a note for 10 months, dated 01 October 2020, at an annual interest rate of 8 %. 8. The company began selling a financial advisory newsletter in 2020, on an annual basis. The newsletter is published monthly. The selling price of a subscription is $55. A review of the subscrintion contracts reveals the following: Time remaining: 01:03 64. The correct journal entry for information item 6 is : 2 points O Debit Unearned Revenue 18,880 ; Credit Management Fee Revenue 18,880 O Debit Unearned Revenue 9,440 ; Credit Management Fee Revenue 9,440 O Debit Management Fee Revenue 28,320 ; Credit Unearned Revenue 28,320 Debit Unearned Revenue 11,328; Credit Management Fee Revenue 11,328 65. The correct journal entry for information item 7 is: 2.5 points O Debit Interest Expense 2,667; Credit Interest Payable 2,667 Debit Interest Payable 2,667; Credit Interest Expense 2,667 O Debit Interest Expense 1,800 ; Credit Interest Payable 1,800 O Debit Interest Expense 2,700 ; Credit Interest Payable 2,700 66. The correct journal entry for information item 8 is : 2.5 points Debit Unearned Revenue 2,063 ; Credit Subscription Revenue 2,063 O Debit Unearned Revenue 4,125; Subscription Revenue 4,125 O Debit Subscription Revenue 6,188 ; Credit Unearned Revenue 6,188 Debit Unearned Revenue 24,750 ; Credit Subscription Revenue 24,750 67. The correct choice for Question 9 is : 2 points Debit Unearned Revenue 24,750 ; Credit Subscription Revenue 24,750 O Debit Subscription Revenue 6,188; Credit Unearned Revenue 6,188 O Debit Unearned Revenue 2,063; Credit Subscription Revenue 2,063 O Debit Unearned Revenue 4,125; Subscription Revenue 4,125