Answered step by step

Verified Expert Solution

Question

1 Approved Answer

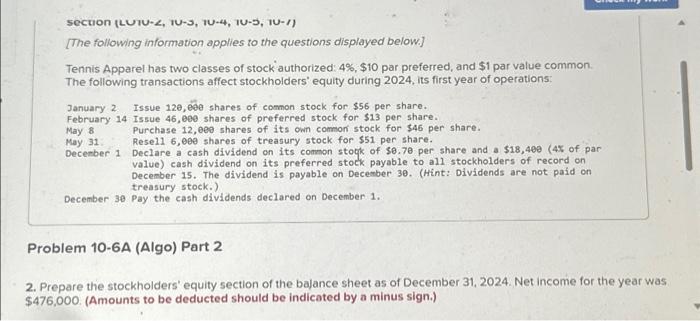

section (LUTU-2, 10-3, 10-4, 10-5, 1-7) [The following information applies to the questions displayed below.] Tennis Apparel has two classes of stock authorized: 4%, $10

section (LUTU-2, 10-3, 10-4, 10-5, 1-7) [The following information applies to the questions displayed below.] Tennis Apparel has two classes of stock authorized: 4%, $10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2024, its first year of operations: January 2 Issue 120,000 shares of common stock for $56 per share. Issue 46,000 shares of preferred stock for $13 per share. February 14 May 8 May 31 December 1 Purchase 12,000 shares of its own common stock for $46 per share. Resell 6,000 shares of treasury stock for $51 per share. Declare a cash dividend on its common stock of $0.70 per share and a $18,400 (4% of par value) cash dividend on its preferred stock payable to all stockholders of record on December 15. The dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.) December 30 Pay the cash dividends declared on December 1. Problem 10-6A (Algo) Part 2 2. Prepare the stockholders' equity section of the balance sheet as of December 31, 2024. Net income for the year was $476,000. (Amounts to be deducted should be indicated by a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started