Answered step by step

Verified Expert Solution

Question

1 Approved Answer

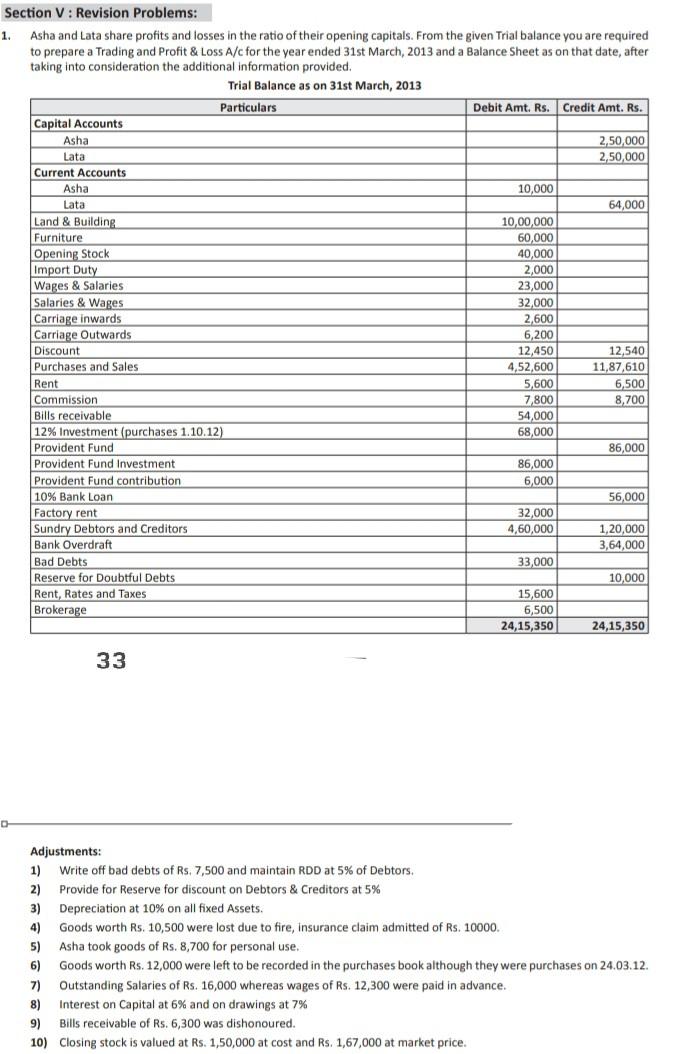

Section V: Revision Problems: 1. Asha and Lata share profits and losses in the ratio of their opening capitals. From the given Trial balance you

Section V: Revision Problems: 1. Asha and Lata share profits and losses in the ratio of their opening capitals. From the given Trial balance you are required to prepare a Trading and Profit & Loss A/c for the year ended 31st March, 2013 and a Balance Sheet as on that date, after taking into consideration the additional information provided. Trial Balance as on 31st March, 2013 Particulars Debit Amt. Rs. Credit Amt. Rs. Capital Accounts Asha 2,50,000 Lata 2,50,000 Current Accounts Asha 10,000 Lata 64,000 Land & Building 10,00,000 Furniture 60,000 Opening Stock 40,000 Import Duty 2,000 Wages & Salaries 23,000 Salaries & Wages solares 32,000 Carriage inwards 2.000 2,600 6,200 Discount tour 12,450 2014 12,540 Purchases and Sales SO 11,87,610 Rent Em 5,600 6,500 Commission 7,800 8,700 Bills receivable 54,000 12% Investment (purchases 1.10.12) 68,000 Provident Fund 86,000 Provident Fund Investment 86,000 Provident Fund contribution 6,000 10% Bank Loan % 56,000 Factory rent 32,000 Sundry Debtors and Creditors 4,60,000 1,20,000 Bank Overdraft 3,64,000 Bad Debts 33,000 Reserve for Doubtful Debts 10,000 Rent, Rates and Taxes 15,600 Brokerage 6,500 24,15,350 24,15,350 Carriage Outwards 4,52,600 33 D Adjustments: 1) Write off bad debts of Rs. 7,500 and maintain RDD at 5% of Debtors, 2) Provide for Reserve for discount on Debtors & Creditors at 5% 3) Depreciation at 10% on all fixed Assets. 4) Goods worth Rs. 10,500 were lost due to fire, insurance claim admitted of Rs. 10000 5) Asha took goods of Rs. 8,700 for personal use. 6) Goods worth Rs. 12,000 were left to be recorded in the purchases book although they were purchases on 24.03.12. 7) Outstanding Salaries of Rs. 16,000 whereas wages of Rs. 12,300 were paid in advance. 8) Interest on Capital at 6% and on drawings at 7% 9) Bills receivable of Rs. 6,300 was dishonoured. 10) Closing stock is valued at Rs. 1,50,000 at cost and Rs. 1,67,000 at market price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started