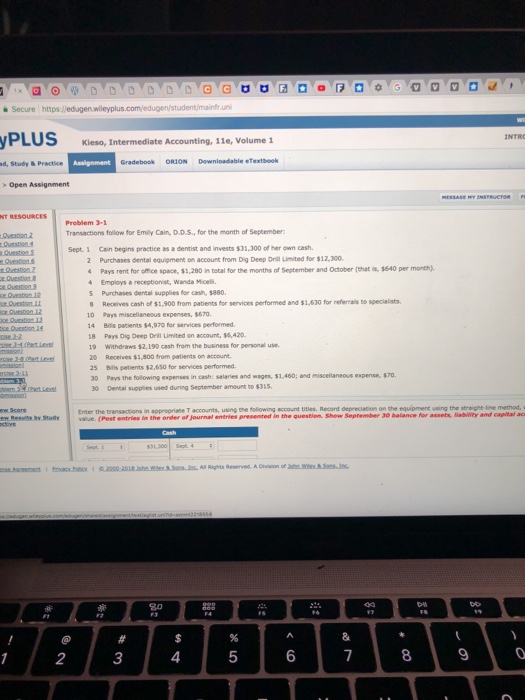

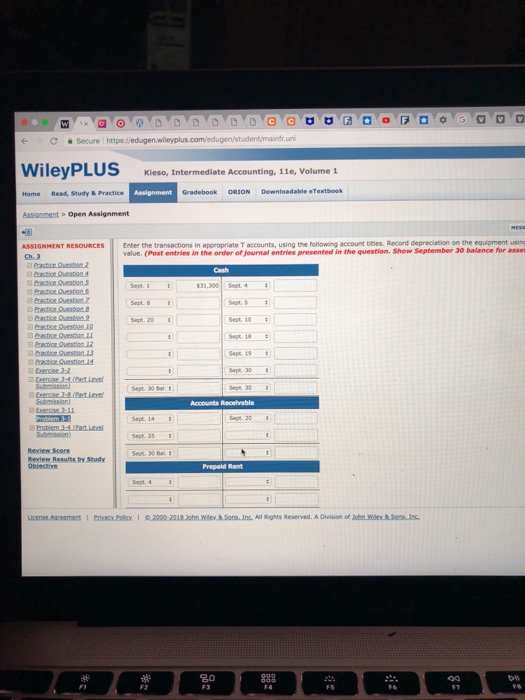

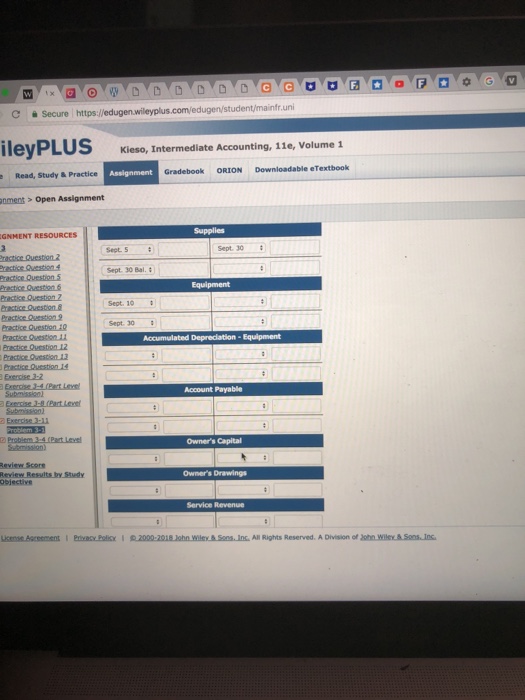

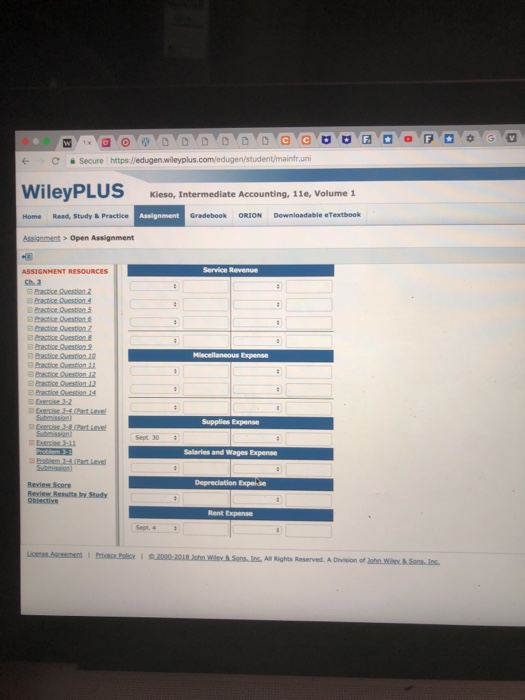

Secure https yPLUS INTR Kieso, Intermediate Accounting, 11e, Volume 1 d, Study & Practice >Open Assignment Transactions follow for Emily Cain, D.D.S, for the month of September Cain begins practice as a dentist and invests $31,300 of her own cash. 2 Purchases dental equiement on account from Dig Deep Drill Limited for $12,300 Sept. 1 4 Pays rent for office space, $,280 in total for the months of September and October (Chat is, 5640 per moneh). Employs a receptionist, Wanda Micelli 5 Purchases dental supplies for cash, $880 6 Receives cash of $1,900 from patients for services performed and $1,630 for referrals to specialists 10 Pays miscelianeous expenses, $670 14 Bils patients $4,970 for services performed 18 Pays Dig Deep Dril Limited on account, $6,420 19 Withdraws $2,190 cash from the business for personal use. 20 Receives $,800 from patients on account 25 Bills petients $2,650 for services performed 00 Pays the following expenses in cash: salaries and mages, $1,460; and miscellaneous expense, $,70 30 Dental supplies used during September amount so $385 ce Question. Utles. Record depreciation o the equipment using the ew Beslts hy Stud Enter the transactions in appropriate T accounts, using value. (Post entries in the onder of journal entries presented in the question. Shew September 30 baiance for assets abiiWey and capital ac 80 2 3 4 9 Secure https yPLUS INTR Kieso, Intermediate Accounting, 11e, Volume 1 d, Study & Practice >Open Assignment Transactions follow for Emily Cain, D.D.S, for the month of September Cain begins practice as a dentist and invests $31,300 of her own cash. 2 Purchases dental equiement on account from Dig Deep Drill Limited for $12,300 Sept. 1 4 Pays rent for office space, $,280 in total for the months of September and October (Chat is, 5640 per moneh). Employs a receptionist, Wanda Micelli 5 Purchases dental supplies for cash, $880 6 Receives cash of $1,900 from patients for services performed and $1,630 for referrals to specialists 10 Pays miscelianeous expenses, $670 14 Bils patients $4,970 for services performed 18 Pays Dig Deep Dril Limited on account, $6,420 19 Withdraws $2,190 cash from the business for personal use. 20 Receives $,800 from patients on account 25 Bills petients $2,650 for services performed 00 Pays the following expenses in cash: salaries and mages, $1,460; and miscellaneous expense, $,70 30 Dental supplies used during September amount so $385 ce Question. Utles. Record depreciation o the equipment using the ew Beslts hy Stud Enter the transactions in appropriate T accounts, using value. (Post entries in the onder of journal entries presented in the question. Shew September 30 baiance for assets abiiWey and capital ac 80 2 3 4 9